Podcast

Questions and Answers

Which company is most likely to use job-order costing?

Which company is most likely to use job-order costing?

- Bechtel International

- Caterer for a wedding reception (correct)

- Heinz for ketchup

- Scott Paper Company for Kleenex

Heinz for ketchup would typically use process costing.

Heinz for ketchup would typically use process costing.

True (A)

Name one industry that likely uses job-order costing.

Name one industry that likely uses job-order costing.

Architects

Job-order costing allocates direct materials and direct labour costs to each job as work is performed, focusing on individual ______.

Job-order costing allocates direct materials and direct labour costs to each job as work is performed, focusing on individual ______.

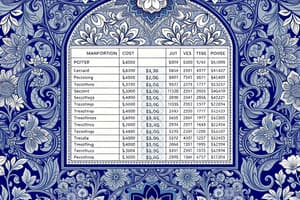

Match the following companies with their costing method:

Match the following companies with their costing method:

What happens to Raw Materials when direct materials are issued to a job?

What happens to Raw Materials when direct materials are issued to a job?

Indirect materials used increase the Raw Materials account.

Indirect materials used increase the Raw Materials account.

What account is debited when raw materials are purchased?

What account is debited when raw materials are purchased?

When direct materials are issued, they decrease the Raw Materials and increase __________.

When direct materials are issued, they decrease the Raw Materials and increase __________.

Match the following terms with their descriptions:

Match the following terms with their descriptions:

Which of the following accounts is credited when recording actual manufacturing overhead costs?

Which of the following accounts is credited when recording actual manufacturing overhead costs?

Indirect materials are included in actual manufacturing overhead.

Indirect materials are included in actual manufacturing overhead.

What account is debited for direct labor costs?

What account is debited for direct labor costs?

Other manufacturing overhead costs are charged to the __________ account as they are incurred.

Other manufacturing overhead costs are charged to the __________ account as they are incurred.

Match the following components of manufacturing overhead with their descriptions:

Match the following components of manufacturing overhead with their descriptions:

What is the primary purpose of a Materials Requisition form?

What is the primary purpose of a Materials Requisition form?

Direct labour costs are included in the job cost sheet.

Direct labour costs are included in the job cost sheet.

What records are maintained in a job cost sheet?

What records are maintained in a job cost sheet?

___ materials and indirect labour are allocated to all jobs as part of manufacturing overhead.

___ materials and indirect labour are allocated to all jobs as part of manufacturing overhead.

Which of the following is NOT directly charged to the job cost sheet?

Which of the following is NOT directly charged to the job cost sheet?

Match the terms with their descriptions:

Match the terms with their descriptions:

All manufacturing overhead costs can be directly traced to specific jobs.

All manufacturing overhead costs can be directly traced to specific jobs.

What do many companies use to maintain records of direct labour costs?

What do many companies use to maintain records of direct labour costs?

What happens to the predetermined overhead rate when estimated activity decreases?

What happens to the predetermined overhead rate when estimated activity decreases?

The IAS 2 allows for predetermined overhead rates based on capacity for external reporting.

The IAS 2 allows for predetermined overhead rates based on capacity for external reporting.

What is one reason managers may choose to use predetermined overhead rates based on capacity for internal reporting?

What is one reason managers may choose to use predetermined overhead rates based on capacity for internal reporting?

When estimated activity decreases, the predetermined overhead rate __________.

When estimated activity decreases, the predetermined overhead rate __________.

Match the following items related to predetermined overhead rates:

Match the following items related to predetermined overhead rates:

What was Tiger, Inc.'s predetermined overhead rate per machine hour?

What was Tiger, Inc.'s predetermined overhead rate per machine hour?

Tiger, Inc. had actual manufacturing overhead costs of $1,210,000 and applied overhead of $1,160,000, leading to overapplied overhead.

Tiger, Inc. had actual manufacturing overhead costs of $1,210,000 and applied overhead of $1,160,000, leading to overapplied overhead.

If Tiger, Inc. worked 290,000 machine hours, what is the total overhead applied?

If Tiger, Inc. worked 290,000 machine hours, what is the total overhead applied?

Tiger's manufacturing overhead was $___ underapplied.

Tiger's manufacturing overhead was $___ underapplied.

Why might large companies use multiple predetermined overhead rates?

Why might large companies use multiple predetermined overhead rates?

Job-order costing is used exclusively in manufacturing companies.

Job-order costing is used exclusively in manufacturing companies.

What type of organizations commonly use job-order costing?

What type of organizations commonly use job-order costing?

Match the following overhead results with their outcomes:

Match the following overhead results with their outcomes:

Flashcards

Raw Material Purchase

Raw Material Purchase

The process of acquiring raw materials needed for production.

Direct Materials

Direct Materials

Direct materials are materials that become an integral part of the finished product, directly traceable to the product. Examples include wood for a table, fabric for a shirt, or steel for a car.

Indirect Materials

Indirect Materials

Indirect materials are materials used in the production process but not directly traceable to the finished product. Examples include glue, paint, or cleaning supplies.

Materials Inventory

Materials Inventory

Signup and view all the flashcards

Material Usage

Material Usage

Signup and view all the flashcards

Job-Order Costing

Job-Order Costing

Signup and view all the flashcards

Direct Costs

Direct Costs

Signup and view all the flashcards

Manufacturing Overhead

Manufacturing Overhead

Signup and view all the flashcards

Materials Requisition Form

Materials Requisition Form

Signup and view all the flashcards

Job Cost Sheet

Job Cost Sheet

Signup and view all the flashcards

Direct Labor Cost

Direct Labor Cost

Signup and view all the flashcards

Indirect Labor

Indirect Labor

Signup and view all the flashcards

Allocating Overhead

Allocating Overhead

Signup and view all the flashcards

How does Job-Order Costing work?

How does Job-Order Costing work?

Signup and view all the flashcards

Predetermined Overhead Rate

Predetermined Overhead Rate

Signup and view all the flashcards

When is Job-Order Costing used?

When is Job-Order Costing used?

Signup and view all the flashcards

Manufacturing Overhead Account

Manufacturing Overhead Account

Signup and view all the flashcards

Direct Manufacturing Costs

Direct Manufacturing Costs

Signup and view all the flashcards

Indirect Manufacturing Costs

Indirect Manufacturing Costs

Signup and view all the flashcards

Applying Manufacturing Overhead

Applying Manufacturing Overhead

Signup and view all the flashcards

Manufacturing Overhead Variance

Manufacturing Overhead Variance

Signup and view all the flashcards

Predetermined Overhead Rate Based on Capacity

Predetermined Overhead Rate Based on Capacity

Signup and view all the flashcards

Predetermined Overhead Rate and Capacity Decrease

Predetermined Overhead Rate and Capacity Decrease

Signup and view all the flashcards

Limitations of Predetermined Overhead Rate Based on Capacity

Limitations of Predetermined Overhead Rate Based on Capacity

Signup and view all the flashcards

IAS 2 and Predetermined Overhead Rate Based on Capacity

IAS 2 and Predetermined Overhead Rate Based on Capacity

Signup and view all the flashcards

Internal Use of Predetermined Overhead Rate Based on Capacity

Internal Use of Predetermined Overhead Rate Based on Capacity

Signup and view all the flashcards

Underapplied Overhead

Underapplied Overhead

Signup and view all the flashcards

Overapplied Overhead

Overapplied Overhead

Signup and view all the flashcards

Plantwide Overhead Rate

Plantwide Overhead Rate

Signup and view all the flashcards

Multiple Predetermined Overhead Rates

Multiple Predetermined Overhead Rates

Signup and view all the flashcards

General Model of Cost Flow

General Model of Cost Flow

Signup and view all the flashcards

Study Notes

Chapter 5: Systems Design: Job-Order Costing

- This chapter focuses on job-order costing, a method used to track costs for individual projects or jobs.

- Distinguishes between process costing and job-order costing. Process costing is used for repetitive, homogeneous products; job-order costing is used for unique, customized products.

- Different production or service processes fit with each costing method.

- Recognizes the flow of costs through a job-order costing system, highlighting the steps materials, labor, and overhead take.

- Explains why estimated overhead costs, rather than actual costs, are used in the short-run job-order costing process.

- Records journal entries reflecting the flow of costs in a job-order costing system.

Learning Objectives Part 1

- Distinguishes between process costing and job-order costing, identifying the type of businesses or products those methods apply to.

- Recognizes the flow of costs through a job-order costing system.

- Calculates predetermined overhead rates, explaining why estimated overhead costs are used before actual costs are available.

- Records journal entries representing the flow of costs in a job-order costing system.

Learning Objectives Part 2

- Applies overhead cost to work-in-process inventory using a predetermined overhead rate.

- Creates schedules for the costs of goods manufactured and the costs of goods sold.

- Calculates and records journal entries for underapplied or overapplied overhead. -Explains why predetermined overhead rate calculations are often based on full capacity rather than expected capacity.

Types of Product Costing Systems

-

Process costing: Used for producing many identical units of a single product where one unit is indistinguishable from the others – average cost per unit is applied.

- Example companies: Cement mixing, refining oil, and beverage mixing/bottling operations.

-

Job-order costing: Used for producing many different products each period that are produced to order. Tracking costs for each job, unique products, and custom work requires careful cost allocation to each order.

- Example companies: Aircraft manufacturing, large-scale construction, greeting card design and printing.

Job-Order Costing - An Overview

- Direct Materials and direct labor are tracked to specific jobs.

- Manufacturing overhead is allocated to all jobs.

Measuring Direct Material Costs

- Materials requisition forms are documents used to request materials from the storeroom, specifying the type and quantity needed and the job the materials are to be charged to.

- These forms help allocate material to specific products.

Measuring Direct Labour Costs

- Direct labor is tracked in a similar way as direct materials—only direct labor costs are recorded on the job cost sheet.

- Indirect labor is part of Manufacturing Overhead

- Many companies use computerized systems to track employee time tickets for job-order costing.

Computing Predetermined Overhead Rates

- An allocation base (like direct labor hours, direct labor dollars, or machine hours) is used to assign manufacturing overhead to individual jobs. This is done because overhead is not easily traceable to specific jobs.

- Estimated overhead costs are used to calculate a predetermined overhead rate. Estimated overhead cost divided by expected level of activity.

Overhead Application

- The predetermined overhead rate (POHR) is applied to the estimated activity during the accounting period by multiplying the rate by the actual activity for the specific job.

Predetermined Overhead Rate

- The predetermined overhead rate is calculated based on (estimated total manufacturing overhead cost) / (estimated total units in the allocation base).

- Example usage: If estimated total manufacturing overhead cost = $320,000 and estimated total units in the allocation base (e.g., direct labor hours) = 40,000, the predetermined overhead rate is $8.00 per direct labor hour.

Job Cost Sheet

- A job cost sheet is a form to track material, labor, and overhead costs for each specific job.

- The Job Cost Sheet is used to compute a job's total costs.

The Need for a POHR

- A predetermined rate allows for earlier estimates of total job costs.

- The actual overhead costs for a period are often not known until the period ends, which necessitates basing cost allocation on estimates.

Choice of an Allocation Base

- The allocation base used in calculating the POHR should be a cost driver because the cost driver is the factor that causes overhead cost.

- If the base doesn't drive the costs, overhead rates will be inaccurate. Direct labor is a common allocation base.

Computation of Unit Cost

- The average unit cost isn't the cost that will be incurred if an additional unit were produced because fixed overhead doesn't change.

Summary of Document Flows

- Sales Order → Production Order → Materials Requisition form → Direct Labour Time Ticket → Job Cost Sheet

Job-Order Costing: The Flow of Costs

- Detailed look at the flow of costs, using T-accounts and journal entries.

The Purchase and Issue of Raw Materials

- Raw materials are initially recorded in the Raw Materials Inventory Account.

- When raw materials are used in a job, they are transferred from the Raw Materials inventory account to the Work-in-Process inventory account.

Cost Flows - Material Purchases

- Raw material purchases are recorded in the Raw Materials Inventory account.

- Example journal entries: Debit Raw Materials Inventory; Credit Accounts Payable

Cost Flows - Material Usage

- Direct materials issued to a job increase Work in Process Inventory, and decrease Raw Materials Inventory.

The Recording of Labour Costs

- Direct labor costs increase the Work-in-Process Inventory account and reduce the Salaries and Wages Payable account.

- Indirect labor costs increase the Manufacturing Overhead account and reduce the Salaries and Wages Payable account.

Recording Actual Manufacturing Overhead

- Indirect materials, indirect labor costs, and other manufacturing overhead costs increase the Manufacturing Overhead account, and reduce expense accounts like Accounts Payable.

Applying Manufacturing Overhead

- If actual and applied manufacturing overhead are equal, no further action is required in general.

- If they are not equal, a year-end adjustment is needed.

The Concept of a Clearing Account

- The Manufacturing Overhead account is a clearing account that tracks the actual incurrence of overhead costs.

- Overhead is applied to the Work-in-Process Inventory during the accounting period.

Non-Manufacturing Cost

- Non-manufacturing costs aren't assigned to individual jobs but are charged to expense in the period they are incurred rather than accumulated on job cost sheets (e.g. salaries, advertising).

Cost of Goods Manufactured

- The costs of goods manufactured are a sum of the beginning WIP, direct materials, direct labor, and manufacturing overhead costs.

Cost of Goods Sold

- When finished goods are sold, two entries are recorded: one for the sales revenue and another for the cost of goods sold and reduction to Finished Goods Inventory.

Complications of Overhead Application

- Underapplied overhead occurs when applied overhead costs are less than the actual overhead costs.

- Overapplied overhead occurs when applied overhead is greater than the actual overhead costs.

Overhead Application Example

- Calculation of applied overhead using a predetermined rate and actual activity.

- Determination of under or overapplied overhead given actual and applied amounts.

Disposition of Under or Overapplied Overhead

- Underapplied overhead is debited to the Cost of Goods Sold account.

- Overapplied overhead is credited to the Cost of Goods Sold account.

- Allocation of under or overapplied overhead among WIP, Finished Goods, and COGS.

Allocate Overapplied Overhead

- Allocating the balance of overapplied or underapplied overhead based on the percentage of each inventory amount (WIP, FG, COGS) within the total inventory balance.

Multiple Predetermined Overhead Rates

- Large companies often use multiple predetermined overhead rates, one for each department or activity area.

Job-Order Costing in Service Companies

- Service businesses, such as accounting firms, hospitals, and airlines, also use job-order costing.

- Costs are accumulated on a job cost sheet as each job is performed.

- Costs typically include direct labor and manufacturing overhead.

The Use of Information Technology

- Technology (EDI, XML, bar coding) simplifies job-order costing in service/production companies by eliminating inefficiencies and inaccuracies of manual recording.

End of Chapter Summary

- Job-order costing is used for various production or service processes (individual / customized work).

- Process costing is used for repetitive, homogeneous products.

- Predetermined overhead rates are commonly used to estimate overhead for a job-order costing system.

- Schedules of Cost of Goods Manufactured and Cost of Goods Sold summarize the flow of costs through the job order process.

The Predetermined Overhead Rate & Capacity (Appendix 5A)

- IAS 2 prohibits using capacity-based rates for external reporting, but they can still be used for internal reporting.

Predetermined Overhead Rate and Capacity

- Criticisms of using estimated allocation bases in calculating predetermined overhead rates include fluctuations in product costs based on activity levels and the inclusion of costs for activities the products do not use.

Capacity-Based Overhead Rates

- Using capacity in the calculation (number of units at full capacity), rather than expected activity, overcomes the deficiencies of using estimated activities.

An Example 1 and 2 (Capacity-Based Overhead Rates)

- Calculation of predetermined overhead rates using capacity-based and traditional costing methods. The key difference is what denominator is used to compute the overhead rate.

Quick Check Questions (various)

- Various examples of questions on job-order costing calculations and concepts.

Explanation of Quick Check Answers (when applicable)

- Explanation of typical answers for the quick check questions.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.