Podcast

Questions and Answers

Cash flow from financing activities is the second component of a company's cash flow statement.

Cash flow from financing activities is the second component of a company's cash flow statement.

False (B)

When a company takes on debt, it compensates bondholders or creditors with dividend payments.

When a company takes on debt, it compensates bondholders or creditors with dividend payments.

False (B)

The formula to calculate cash flow from financing activities includes components like cash inflows from issuing equity or debt.

The formula to calculate cash flow from financing activities includes components like cash inflows from issuing equity or debt.

True (A)

Cash paid as dividends is subtracted in the calculation of cash flow from financing activities.

Cash paid as dividends is subtracted in the calculation of cash flow from financing activities.

Signup and view all the answers

Issuing stock to investors does not impact the cash flow from financing activities.

Issuing stock to investors does not impact the cash flow from financing activities.

Signup and view all the answers

Cash flow from financing activities provides insight into a company's ability to generate revenue.

Cash flow from financing activities provides insight into a company's ability to generate revenue.

Signup and view all the answers

A positive cash flow from financing activities means more money is flowing out of the company than flowing in.

A positive cash flow from financing activities means more money is flowing out of the company than flowing in.

Signup and view all the answers

Cash flow from financing activities only includes transactions involving debt, not equity or dividends.

Cash flow from financing activities only includes transactions involving debt, not equity or dividends.

Signup and view all the answers

The cash flow from financing section varies with different capital structures, dividend policies, and debt terms a company may have.

The cash flow from financing section varies with different capital structures, dividend policies, and debt terms a company may have.

Signup and view all the answers

The cash flow statement is not one of the main three financial statements that show a company's financial health.

The cash flow statement is not one of the main three financial statements that show a company's financial health.

Signup and view all the answers

A negative cash flow from financing activities indicates that the company is accumulating debt.

A negative cash flow from financing activities indicates that the company is accumulating debt.

Signup and view all the answers

Cash flow from financing activities provides investors with insight into how well a company is generating revenue.

Cash flow from financing activities provides investors with insight into how well a company is generating revenue.

Signup and view all the answers

Study Notes

Financing Activities in a Cash Flow Statement

Cash flow from financing activities is the third component of a company's cash flow statement, which outlines the inflows and outflows of cash used to fund the business during a given period. These activities include transactions involving debt, equity, and dividends. They provide investors with insight into a company's financial strength and its ability to generate cash.

Debt and Equity Financing

A company can raise capital to maintain or grow its operations by issuing debt or equity. When a company takes on debt, it typically does so by issuing bonds or taking a loan from a bank. In either case, the company must make interest payments to its bondholders or creditors to compensate them for loaning their money. On the other hand, when a company goes through the equity route, it issues stock to investors who purchase the stock for a share in the company. Some companies also make dividend payments to shareholders, which represents a cost of equity for the firm.

Cash Flow from Financing Activities Calculation

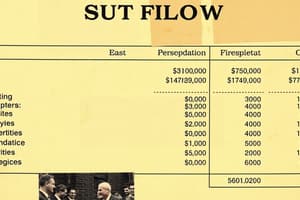

Investors and analysts can determine the net flow of funds used to run the company by using the following formula:

CFF = CED - (CD + RP)

where:

- CED = Cash in flows from issuing equity or debt

- CD = Cash paid as dividends

- RP = Repurchase of debt - Add cash inflows from the issuing of debt or equity.

The result of this calculation is the cash flow from financing activities for the period.

Positive and Negative Cash Flow from Financing Activities

A positive number for cash flow from financing activities means more money is flowing into the company than flowing out, which increases the company's assets. Conversely, a negative number indicates that the company is servicing debt.

Key Takeaways

- Cash flow from financing activities is a section of a company's cash flow statement, which shows the net flows of cash that are used to fund the company.

- Financing activities include transactions involving debt, equity, and dividends.

- Debt and equity financing are reflected in the cash flow from financing section, which varies with the different capital structures, dividend policies, or debt terms that companies may have.

- Cash flow from financing activities provides investors with insight into a company's financial strength and how well it is funded.

- The cash flow statement is one of the three main financial statements that show the state of a company's financial health, along with the balance sheet and income statement.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.

Description

Test your knowledge about cash flow from financing activities, which is a component of a company's cash flow statement reflecting the inflows and outflows of cash related to funding the business through debt, equity, and dividends. Learn about how to calculate cash flow from financing activities and its significance for investors.