Podcast

Questions and Answers

What does Free Cash Flow indicate?

What does Free Cash Flow indicate?

- Cash available for financing activities

- Operating income minus interest expenses

- Available funds after capital purchases and payments of cash dividends (correct)

- Net cash provided by operating activities

Which method does not require the disclosure of activities that do not affect cash?

Which method does not require the disclosure of activities that do not affect cash?

- Financial Reporting Method

- Cash Flow Analysis Method

- Direct Method (correct)

- Indirect Method

What does the Current Cash Debt Coverage ratio indicate?

What does the Current Cash Debt Coverage ratio indicate?

- Ability to repay total liabilities from net cash provided by operations

- Capacity to pay off current liabilities from operating activities (correct)

- Company's liquidity position based on cash flows

- Proportion of current assets to current liabilities

Which of the following is considered a financing activity?

Which of the following is considered a financing activity?

What is used to calculate the ratio to indicate a company's ability to meet current obligations?

What is used to calculate the ratio to indicate a company's ability to meet current obligations?

What does the change in cash for a period represent?

What does the change in cash for a period represent?

What is the formula for calculating Free Cash Flow?

What is the formula for calculating Free Cash Flow?

Which of the following activities is considered as a financing activity?

Which of the following activities is considered as a financing activity?

What do we understand by the Current Cash Debt Coverage ratio?

What do we understand by the Current Cash Debt Coverage ratio?

Which of the following is NOT classified as an investing activity?

Which of the following is NOT classified as an investing activity?

Flashcards are hidden until you start studying

Study Notes

Cash Flow Statement

- Provides information about cash recipients and cash payments

- Includes operating, investing, and financing activities

Investing Activities

- Change in cash for the period is found on the comparative balance sheet

- The difference between the beginning and end of cash on the balance sheet reflects the change in cash

Financing Activities

- The indirect method is used to prepare the statement of cash flows

- Direct method is an alternative

- The direct method does not require a reconciliation of net income to net cash provided by operating activities

Material Financing and Investing Activities

- Material financing and investing activities that do not affect cash include the issuance of common stock for property, plant, and equipment (PPE), issuance of debt to purchase PPE, and conversion of bonds into common stock

- Examples:

- Purchasing land with a down payment and a note. The portion of the purchase price that is reflected in the note does not affect cash

Disclosure

- Information about non-cash financing and investing activities is disclosed at the bottom of the statement of cash flows or in the notes to the financial statements

Financial Ratios

- Current cash debt coverage ratio (ON EXAM): Net cash provided by operating activities divided by average current liabilities

- Indicates a company's ability to repay its liabilities from net cash provided by operating activities without having to liquidate the assets employed in its operations

- Whether the company can pay off its current liabilities from its operations in a given year

- Cash debt coverage ratio: Net cash provided by operating activities divided by average total liabilities

- Indicates that the company can meet all of its current obligations from internally generated cash flow

- Free cash flow: Net cash provided by operating activities minus capital expenditures minus cash dividends

- Indicates available funds after capital purchases and payments of cash dividends

Cash Flows from Operating Activities

- Provides information about the cash inflows and outflows of an entity during a period

Cash Flows from Investing Activities

- Represents the change in cash over the period, which is determined by comparing the beginning and ending cash balances on the comparative balance sheet.

Cash Flows from Financing Activities

- There are two methods to calculate cash flows from financing activities:

- Indirect Method

- Direct Method

Material Financing and Investing Activities that do not affect cash

- Issuance of common stock to acquire Property, Plant, and Equipment (PPE)

- Issuance of debt to purchase PPE

- Conversion of bonds into common stock

- When purchasing land with a down payment and note payable, the portion financed by the note does not affect cash flow this period.

- This information is typically presented at the bottom of the statement of cash flows or within the notes of the financial statement.

Key Financial Ratios

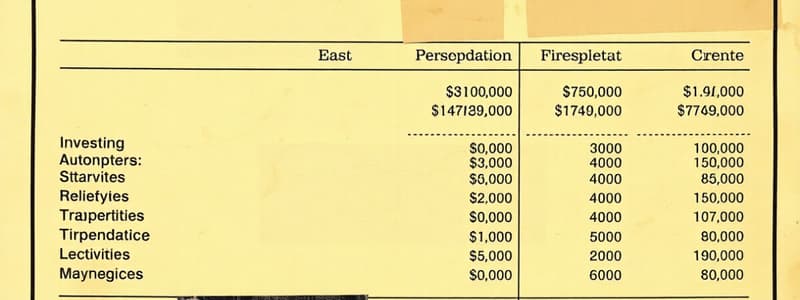

-

Current Cash Debt Coverage:

- Formula: Net cash provided by operating activities / Average current liabilities

- Indicates a company's ability to repay current liabilities using cash generated from operations.

- This ratio suggests whether a company can meet its current obligations from its operating activities within a year.

-

Cash Debt Coverage:

- Formula: Net cash provided by operating activities / Average total liabilities

- Indicates a company's ability to repay all its liabilities using internally generated cash flow.

-

Free Cash Flow:

- Formula: Net cash provided by operating activities - capital expenditures - cash dividends

- Measures the funds available for capital purchases and dividend payments after accounting for operating activities, investing activities, and financing activities.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.