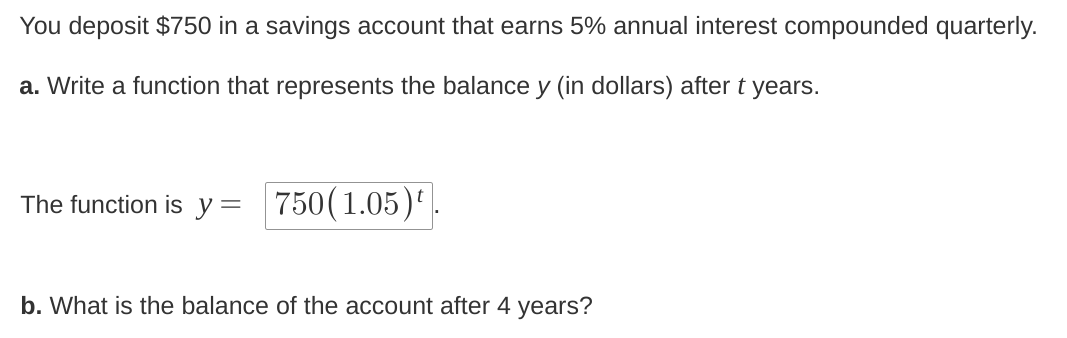

You deposit $750 in a savings account that earns 5% annual interest compounded quarterly. a. Write a function that represents the balance y (in dollars) after t years. b. What is t... You deposit $750 in a savings account that earns 5% annual interest compounded quarterly. a. Write a function that represents the balance y (in dollars) after t years. b. What is the balance of the account after 4 years?

Understand the Problem

The question involves calculating the balance of a savings account that earns interest compounded quarterly. It asks for a function representing the balance over time and then specifically for the balance after 4 years.

Answer

The balance after 4 years is approximately $915.99.

Answer for screen readers

The balance of the account after 4 years is approximately $915.99.

Steps to Solve

- Identify the Compounding Interest Formula

To find the balance in a savings account that compounds interest, we use the formula:

$$ A = P \left(1 + \frac{r}{n}\right)^{nt} $$

where:

- ( A ) = the amount of money accumulated after n years, including interest.

- ( P ) = the principal amount (the initial amount of money).

- ( r ) = annual interest rate (decimal).

- ( n ) = number of times that interest is compounded per year.

- ( t ) = the number of years the money is invested or borrowed.

- Substitute Known Values into the Formula

Given:

- ( P = 750 )

- ( r = 0.05 )

- ( n = 4 ) (quarterly compounding)

- ( t = 4 )

Substituting these values in, we have:

$$ A = 750 \left(1 + \frac{0.05}{4}\right)^{4 \cdot t} $$

- Simplify the Equation

Calculate the term inside the parentheses:

$$ A = 750 \left(1 + \frac{0.05}{4}\right)^{4t} = 750 \left(1 + 0.0125\right)^{4t} = 750 (1.0125)^{4t} $$

Now, substituting ( t ) with 4:

$$ A = 750 (1.0125)^{16} $$

- Calculate the Final Balance

Now, we calculate ( (1.0125)^{16} ):

Using a calculator,

$$ (1.0125)^{16} \approx 1.221386025 $$

Therefore, we compute:

$$ A \approx 750 \times 1.221386025 \approx 915.99 $$

The balance of the account after 4 years is approximately $915.99.

More Information

This problem demonstrates how compound interest can significantly increase savings over time, especially with more frequent compounding periods. Understanding this can help in making informed savings decisions.

Tips

- Mistaking the formula for simple interest when compounding is involved.

- Not converting the interest rate to the correct form for compounding (decimals).

- Forgetting to correctly adjust the number of compounding periods when changing the time variable.

AI-generated content may contain errors. Please verify critical information