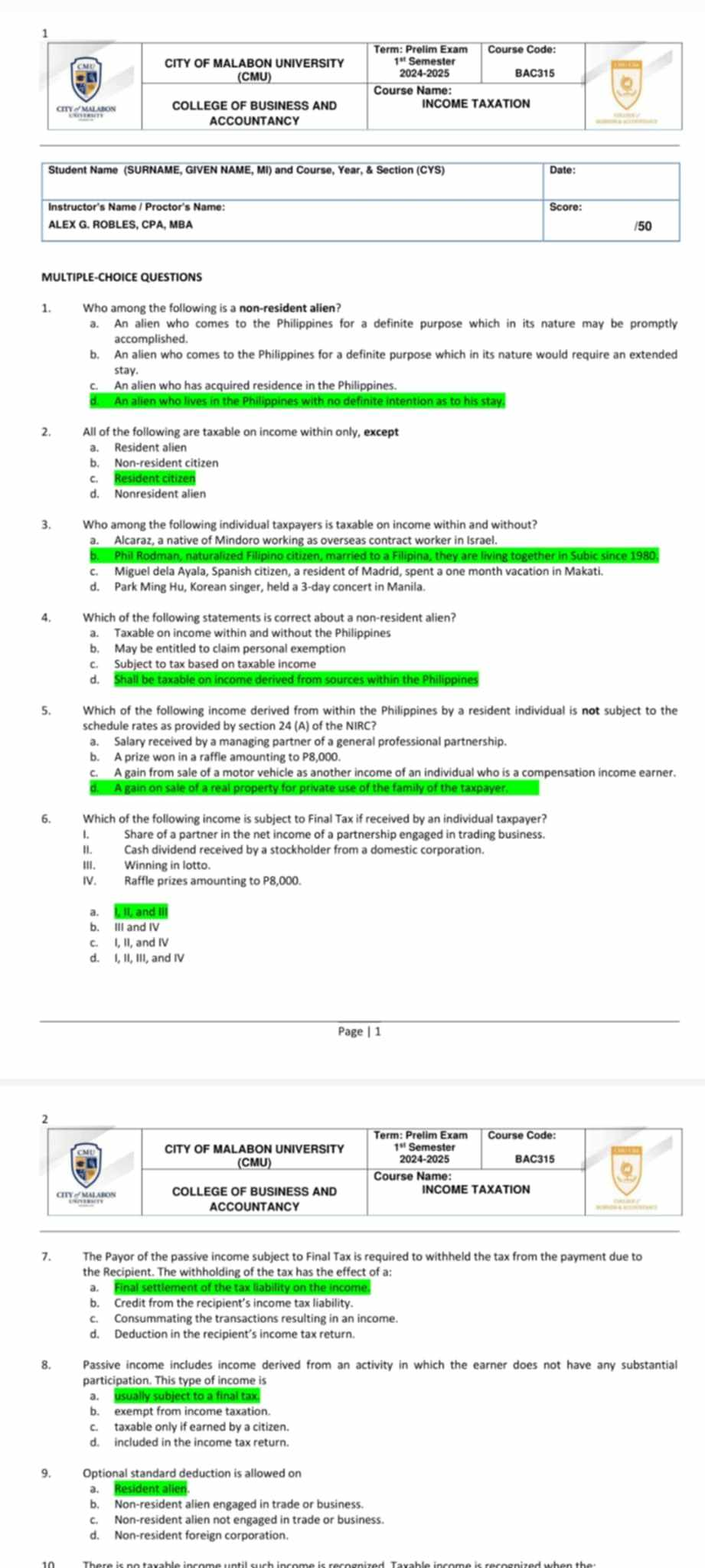

Who among the following is a non-resident alien? All of the following are taxable on income within only, except? Who among the following individual taxpayers is taxable on income w... Who among the following is a non-resident alien? All of the following are taxable on income within only, except? Who among the following individual taxpayers is taxable on income within and without? Which of the following statements is correct about a non-resident alien? Which of the following income derived from within the Philippines by a resident individual is not subject to the schedule rates as provided by section 24 (A) of the NIRC? Which of the following income is subject to Final Tax if received by an individual taxpayer? Passive income includes income derived from an activity in which the earner does not have any substantial participation. This type of income is usually subject to a final tax, exempt from income taxation, taxable only if earned by a citizen, or included in the income tax return? Optional standard deduction is allowed on?

Understand the Problem

The question is asking about concepts related to income taxation, particularly focusing on classifications of individuals (like resident and non-resident aliens) and their tax liabilities. It seems to be part of a multiple-choice exam concerning taxation rules in the Philippines.

Answer

1. d, 2. c, 3. b, 4. d, 5. c, 6. a, 7. a, 8. a, 9. a

- d

- c

- b

- d

- c

- a

- a

- a

- a

Answer for screen readers

- d

- c

- b

- d

- c

- a

- a

- a

- a

More Information

These answers are based on typical interpretations of residency and taxation rules.

Tips

Confusing non-resident alien status with resident status is common. Ensure you understand the distinction between different types of taxpayer statuses.

AI-generated content may contain errors. Please verify critical information