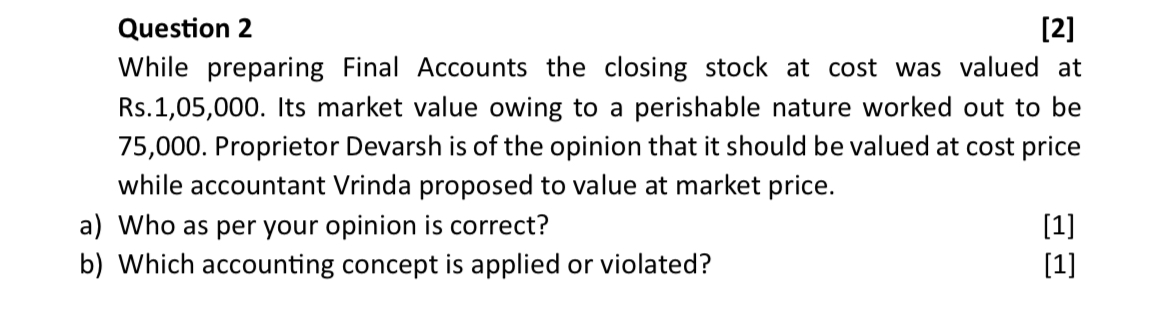

While preparing Final Accounts the closing stock at cost was valued at Rs.1,05,000. Its market value owing to a perishable nature worked out to be 75,000. Proprietor Devansh is of... While preparing Final Accounts the closing stock at cost was valued at Rs.1,05,000. Its market value owing to a perishable nature worked out to be 75,000. Proprietor Devansh is of the opinion that it should be valued at cost price while accountant Vrinda proposed to value at market price. Who as per your opinion is correct? Which accounting concept is applied or violated?

Understand the Problem

The question asks for an opinion on who is correct between the proprietor and the accountant regarding the valuation of closing stock, and it also inquires about the accounting concept that applies or is violated in this scenario.

Answer

Vrinda is correct; lower of cost or market value concept applies.

The final answer is Vrinda is correct; it should be valued at market price due to the lower of cost or net realizable value principle.

Answer for screen readers

The final answer is Vrinda is correct; it should be valued at market price due to the lower of cost or net realizable value principle.

More Information

According to the 'lower of cost or market value' principle (conservatism), inventory should be recorded at whichever is lower between the cost and its current market price. This ensures that assets are not overstated.

Tips

A common mistake is valuing inventory at historical cost without considering changes in market conditions that could reduce its realizable value.

AI-generated content may contain errors. Please verify critical information