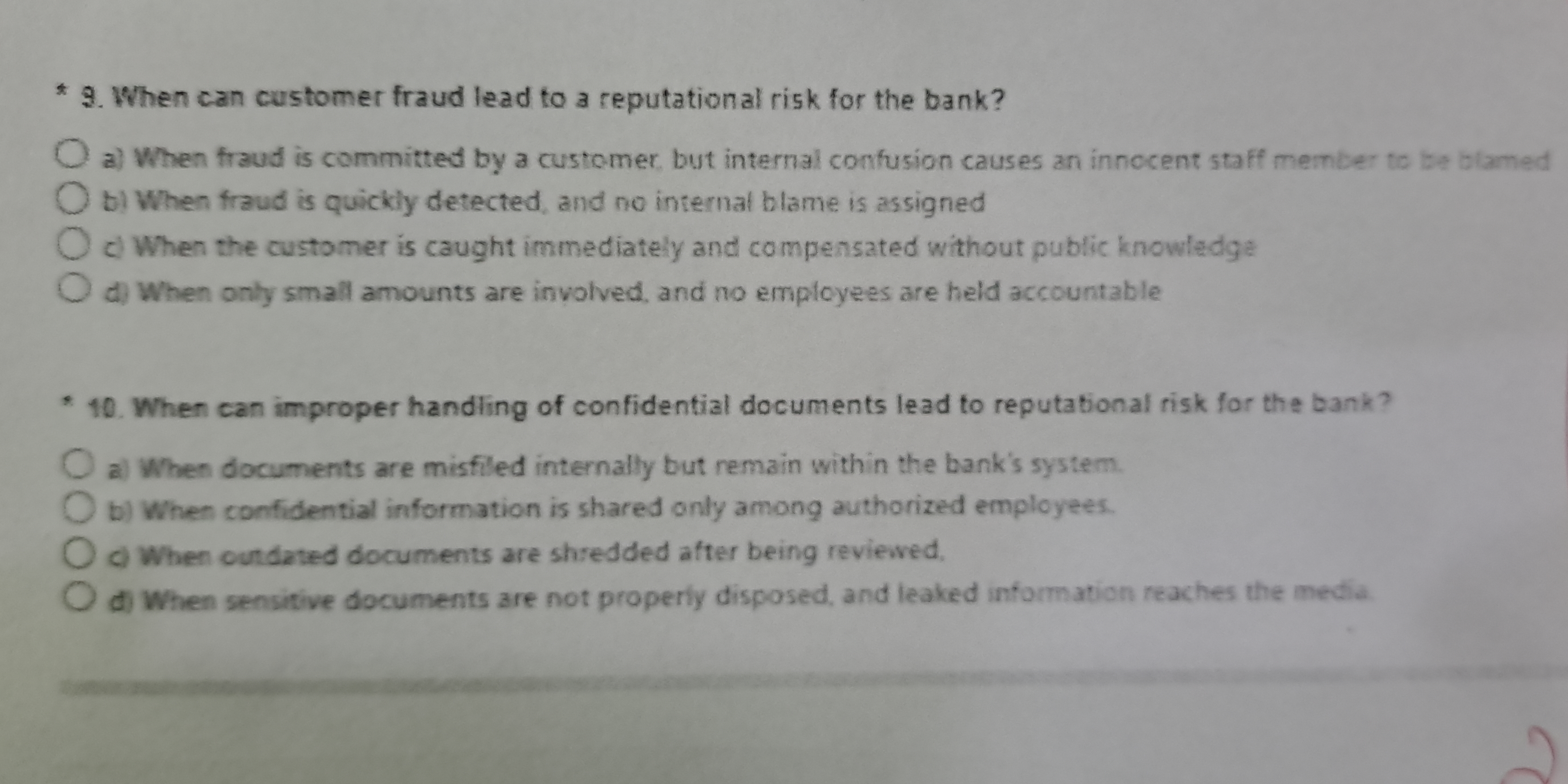

When can customer fraud lead to a reputational risk for the bank? When can improper handling of confidential documents lead to reputational risk for the bank?

Understand the Problem

The question is asking about the conditions under which customer fraud or improper handling of confidential documents can lead to reputational risk for a bank. It presents specific scenarios for consideration.

Answer

9. a; 10. d

The final answer is: 9. a) When fraud is committed by a customer, but internal confusion causes an innocent staff member to be blamed; 10. d) When sensitive documents are not properly disposed, and leaked information reaches the media.

Answer for screen readers

The final answer is: 9. a) When fraud is committed by a customer, but internal confusion causes an innocent staff member to be blamed; 10. d) When sensitive documents are not properly disposed, and leaked information reaches the media.

More Information

Reputational risks arise when banks handle fraud and sensitive information poorly. Particularly, blame misallocation and information leaks can severely damage credibility.

Tips

A common mistake is underestimating the impact of leaks in sensitive situations. It's crucial to manage both internal protocols and public perception.

Sources

- Reputational damage: when fraud causes more than financial loss - bankatfirst.com

- What Is Reputational Risk For Banks in 2023? - LogicManager - logicmanager.com

AI-generated content may contain errors. Please verify critical information