What is the effect of a tax on buyers on the demand curve and market equilibrium for ice-cream cones?

Understand the Problem

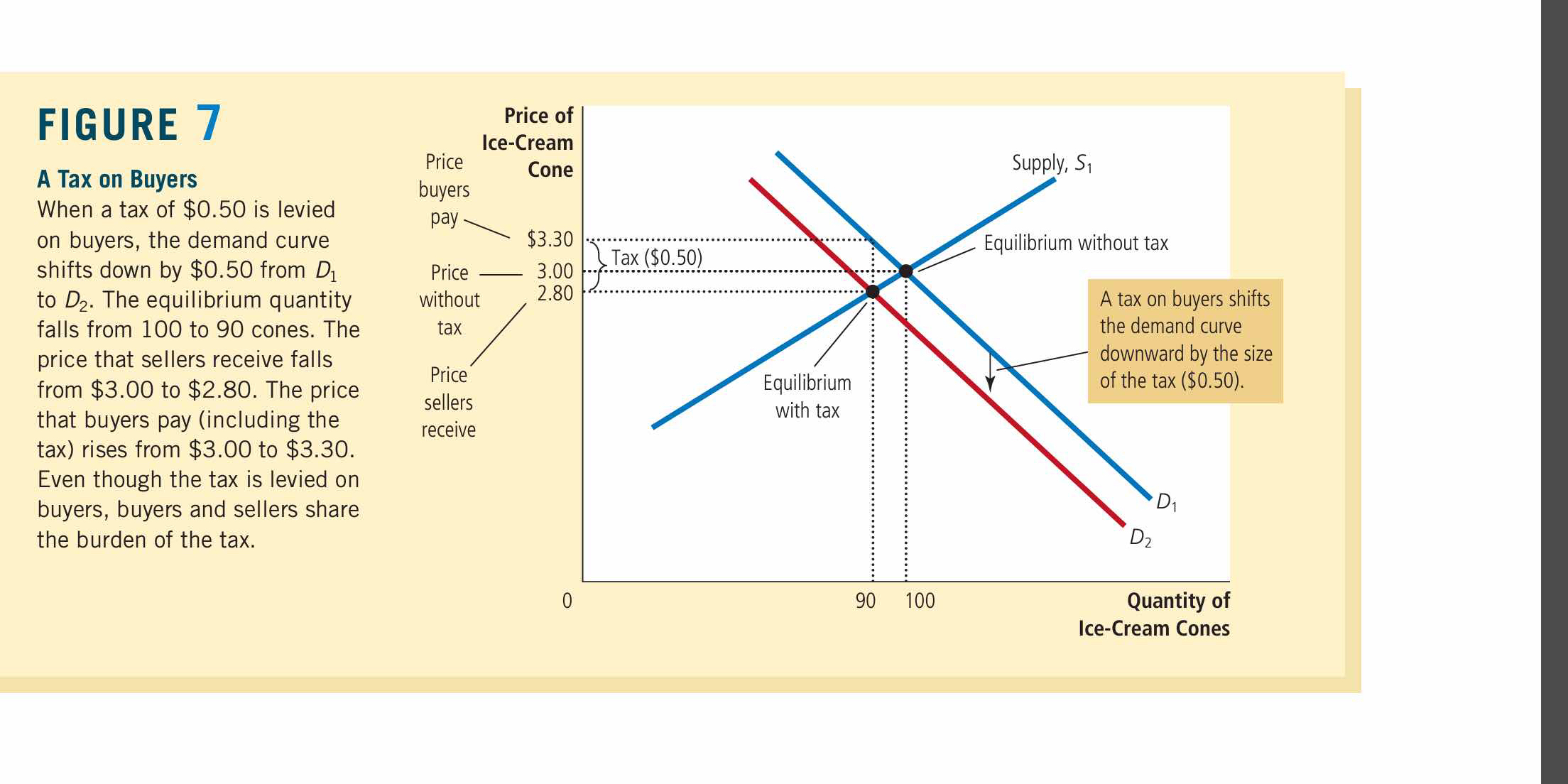

The question is summarizing the economic concept of how a tax on buyers affects the demand curve, equilibrium quantity, and prices paid by buyers and received by sellers in a market for ice-cream cones.

Answer

The demand curve shifts down; equilibrium quantity decreases, and prices change.

The tax on buyers shifts the demand curve downward by $0.50, decreasing the equilibrium quantity from 100 to 90 cones. The price sellers receive falls from $3.00 to $2.80, while the price buyers pay rises to $3.30.

Answer for screen readers

The tax on buyers shifts the demand curve downward by $0.50, decreasing the equilibrium quantity from 100 to 90 cones. The price sellers receive falls from $3.00 to $2.80, while the price buyers pay rises to $3.30.

More Information

Even though the tax is imposed on buyers, both buyers and sellers share the burden because of changes in equilibrium prices.

Tips

A common mistake is thinking only the buyer or seller bears the entire tax burden.

Sources

AI-generated content may contain errors. Please verify critical information