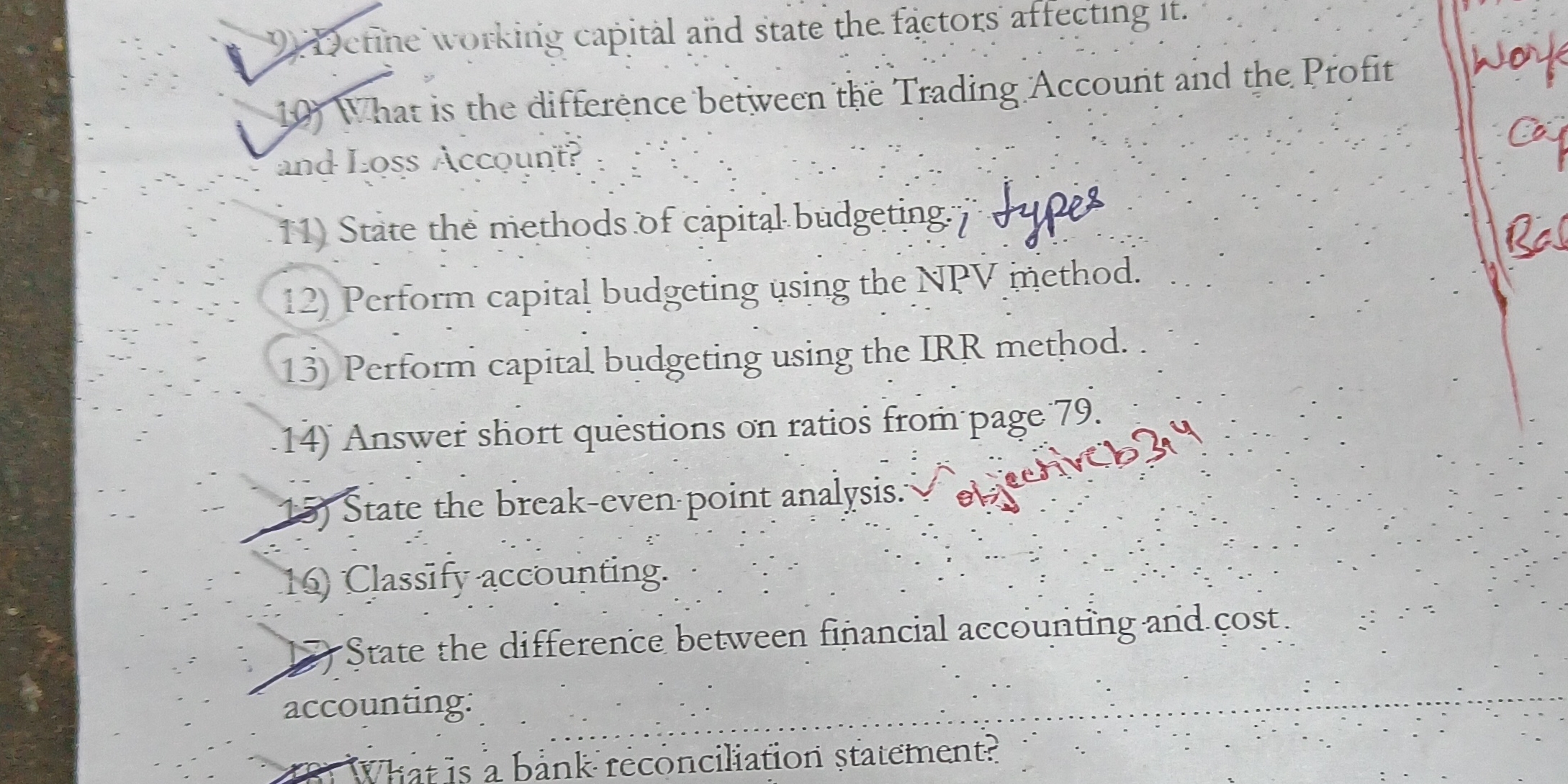

What is the difference between the Trading Account and the Profit and Loss Account? State the methods of capital budgeting. Perform capital budgeting using the NPV method. Perform... What is the difference between the Trading Account and the Profit and Loss Account? State the methods of capital budgeting. Perform capital budgeting using the NPV method. Perform capital budgeting using the IRR method. State the break-even point analysis. Classify accounting. State the difference between financial accounting and cost accounting. What is a bank reconciliation statement?

Understand the Problem

The question is asking for explanations of various accounting concepts and methods related to capital budgeting, ratios, break-even analysis, and the differences between types of accounting. It aims to understand the principles and applications of these concepts.

Answer

Trading Account shows gross profit; Profit and Loss shows net profit. Capital budgeting methods: NPV, IRR, Payback Period. Break-even point: revenue equals costs. Financial vs cost accounting: external vs internal use. Bank reconciliation matches records with statement.

The Trading Account shows the gross profit or loss from buying and selling goods. The Profit and Loss Account calculates the net profit or loss of a company. The methods of capital budgeting include Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period. The NPV method finds the present value of cash inflows minus outflows. The IRR method determines the discount rate that causes the NPV to be zero. The break-even point is where total costs equal total revenue. Accounting can be classified into financial, cost, and management accounting. Financial accounting focuses on external financial reporting while cost accounting focuses on internal cost management. A bank reconciliation statement ensures that an organization's accounting records match the bank statement.

Answer for screen readers

The Trading Account shows the gross profit or loss from buying and selling goods. The Profit and Loss Account calculates the net profit or loss of a company. The methods of capital budgeting include Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period. The NPV method finds the present value of cash inflows minus outflows. The IRR method determines the discount rate that causes the NPV to be zero. The break-even point is where total costs equal total revenue. Accounting can be classified into financial, cost, and management accounting. Financial accounting focuses on external financial reporting while cost accounting focuses on internal cost management. A bank reconciliation statement ensures that an organization's accounting records match the bank statement.

More Information

The Trading Account focuses on the core business of buying and selling goods, while the Profit and Loss Account includes all income and expenses. NPV provides a dollar value on profitability, whereas IRR gives a percentage return expected from a project.

Tips

A common mistake is confusing gross profit with net profit while evaluating accounts. Also, ensure correct cash flow estimation in NPV and IRR calculations.

Sources

- Capital Budgeting: What It Is and How It Works - Investopedia - investopedia.com

- Capital Budgeting Basics | Ag Decision Maker - extension.iastate.edu

AI-generated content may contain errors. Please verify critical information