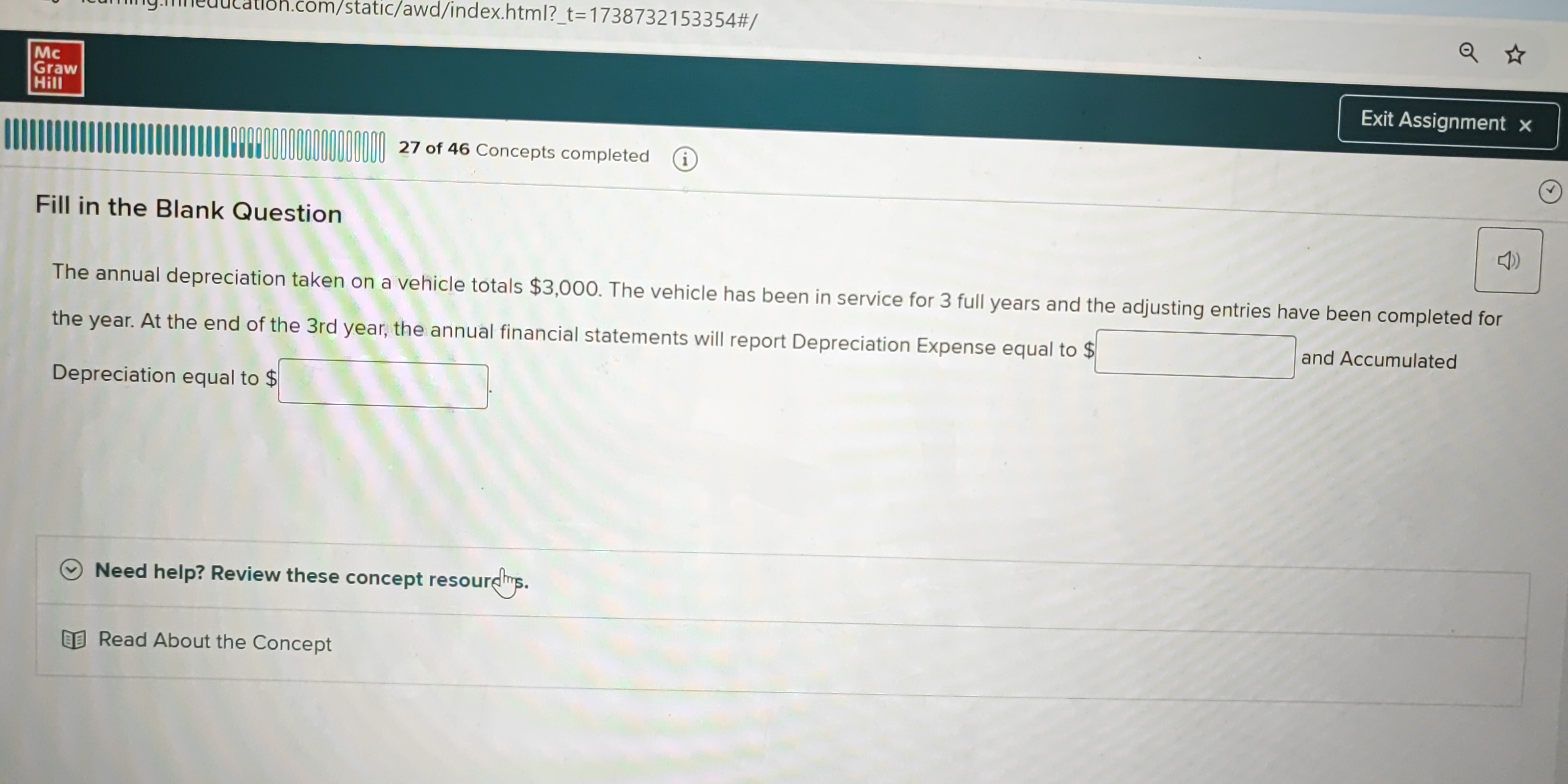

What is the depreciation expense and accumulated depreciation at the end of the 3rd year for a vehicle with an annual depreciation of $3,000?

Understand the Problem

The question is asking for the calculation of depreciation expense and accumulated depreciation for a vehicle over a three-year period, given an annual depreciation amount.

Answer

Depreciation Expense equal to $3,000 and Accumulated Depreciation equal to $9,000.

Answer for screen readers

Depreciation Expense equal to $3,000 and Accumulated Depreciation equal to $9,000.

Steps to Solve

-

Understand Annual Depreciation The annual depreciation amount is given as $3,000. This means for each year, the vehicle's value decreases by this amount.

-

Calculate Total Depreciation Over 3 Years To find the total depreciation after 3 years, multiply the annual depreciation by the number of years: $$ \text{Total Depreciation} = \text{Annual Depreciation} \times \text{Number of Years} $$ Substituting the values: $$ \text{Total Depreciation} = 3000 \times 3 $$

-

Perform the Calculation Now, calculate: $$ \text{Total Depreciation} = 3000 \times 3 = 9000 $$ So, the total depreciation at the end of 3 years is $9,000.

-

Fill in the Blanks

- Depreciation Expense for each year is $3,000.

- Accumulated Depreciation at the end of 3 years is $9,000.

Depreciation Expense equal to $3,000 and Accumulated Depreciation equal to $9,000.

More Information

Depreciation expense reflects the cost of using an asset over time. In accounting, accumulated depreciation shows the total amount that has been depreciated from the original value of the asset over its useful life.

Tips

- Forgetting to multiply by the number of years: Ensure to account for the entire period the vehicle has been in service.

- Mixing up depreciation expense with accumulated depreciation: Remember that "depreciation expense" is reported each year, while "accumulated depreciation" is the total over the years.

AI-generated content may contain errors. Please verify critical information