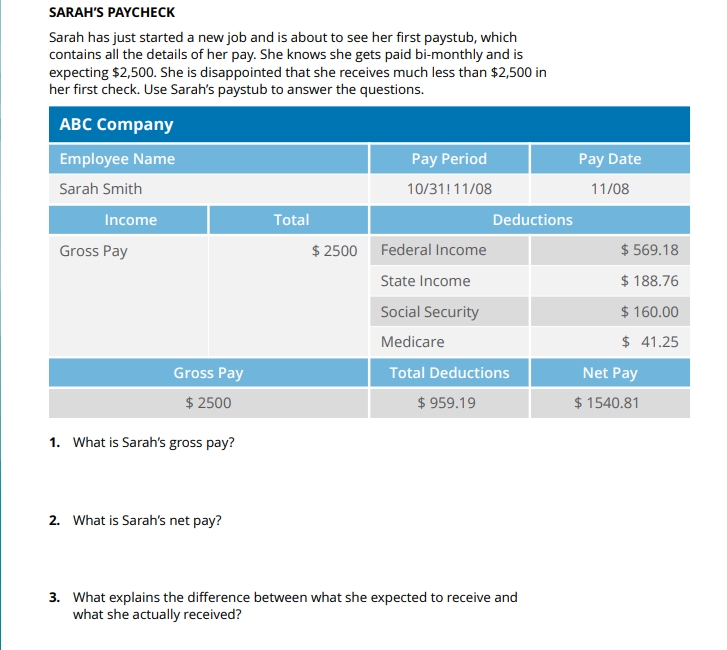

What is Sarah's gross pay? What is Sarah's net pay? What explains the difference between what she expected to receive and what she actually received?

Understand the Problem

The question is asking about Sarah's paycheck details, specifically her gross pay, net pay, and the reasons for the difference between her expected and actual pay.

Answer

Sarah's gross pay is $2500, her net pay is $1540.81, and the deductions total $959.19, explaining the difference between expected and actual pay.

Answer for screen readers

-

Sarah's gross pay is $2500.

-

Sarah's net pay is $1540.81.

-

The difference between what she expected ($2500) and what she actually received ($1540.81) is caused by the deductions totaling $959.19.

Steps to Solve

-

Identify Gross Pay Gross pay is the total earnings before any deductions. According to the paystub, Sarah's gross pay is given as $2500.

-

Calculate Net Pay Net pay is the amount leftover after all deductions. To find net pay, subtract the total deductions from the gross pay.

The total deductions are:

- Federal Income: $569.18

- State Income: $188.76

- Social Security: $160.00

- Medicare: $41.25

The total deductions can be calculated as: $$ \text{Total Deductions} = 569.18 + 188.76 + 160.00 + 41.25 $$

Calculating this gives: $$ \text{Total Deductions} = 959.19 $$

Now subtract the total deductions from the gross pay to find the net pay: $$ \text{Net Pay} = 2500 - 959.19 = 1540.81 $$

- Explain the Difference in Expected vs Actual Pay Sarah expected to receive $2500, which is her gross pay. However, due to the deductions totaling $959.19, her actual net pay of $1540.81 is what she took home.

-

Sarah's gross pay is $2500.

-

Sarah's net pay is $1540.81.

-

The difference between what she expected ($2500) and what she actually received ($1540.81) is caused by the deductions totaling $959.19.

More Information

Sarah's paycheck reflects standard deductions such as federal and state income taxes, Social Security, and Medicare. These deductions account for nearly 40% of her gross pay, which is why her net pay is significantly less than her expected gross pay.

Tips

- Forgetting to include all deductions when calculating net pay. Be sure to sum all deductions before subtracting from the gross pay.

- Misinterpreting gross pay as net pay; it's essential to differentiate between the two terms.

AI-generated content may contain errors. Please verify critical information