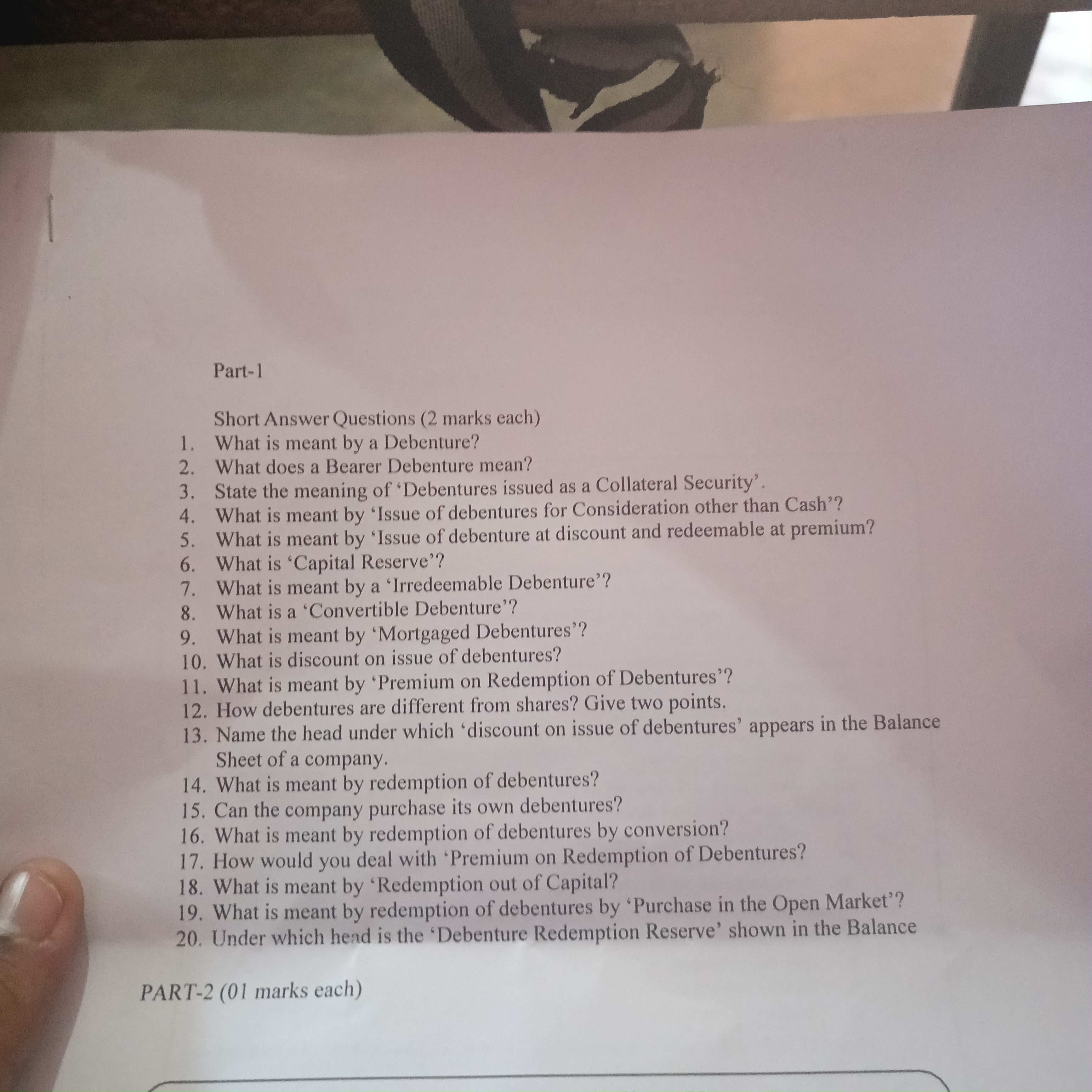

What is meant by a Debenture? What does a Bearer Debenture mean? State the meaning of 'Debentures issued as a Collateral Security'. What is meant by 'Issue of debentures for Consid... What is meant by a Debenture? What does a Bearer Debenture mean? State the meaning of 'Debentures issued as a Collateral Security'. What is meant by 'Issue of debentures for Consideration other than Cash'? What is meant by 'Issue of debenture at discount and redeemable at premium'? What is 'Capital Reserve'? What is meant by a 'Irredeemable Debenture'? What is a 'Convertible Debenture'? What is meant by 'Mortgaged Debentures'? What is discount on issue of debentures? What is meant by 'Premium on Redemption of Debentures'? How debentures are different from shares? Give two points. Name the head under which 'discount on issue of debentures' appears in the Balance Sheet of a company. What is meant by redemption of debentures? Can the company purchase its own debentures? What is meant by redemption of debentures by conversion? How would you deal with 'Premium on Redemption of Debentures'? What is meant by 'Redemption out of Capital'? Under which head is the 'Debenture Redemption Reserve' shown in the Balance?

Understand the Problem

The question consists of various queries related to debentures, their types, meanings, and accounting aspects. It seeks short answer explanations for each topic listed.

Answer

A debenture is a long-term unsecured debt instrument. Bearer debentures are unregistered and transferable by delivery.

- A debenture is a type of long-term debt instrument used by corporations to borrow money without collateral.

- Bearer debentures are unregistered and can be transferred by delivery.

- Debentures issued as collateral security means issuing debentures in addition to a primary security for a loan.

- Issue of debentures for consideration other than cash involves exchanging debentures for assets or services.

- Debentures issued at a discount and redeemable at a premium are sold for less than face value but repaid above it.

- Capital reserve is a fund created for specific purposes like writing off capital losses.

- Irredeemable debentures have no fixed maturity date and are not paid back.

- Convertible debentures can be converted into equity shares at a specified time.

- Mortgaged debentures are backed by the issuer's assets as collateral.

- Discount on issue of debentures is the difference when debentures are issued below their face value.

- Premium on redemption of debentures is the excess amount paid over the face value at redemption.

- Debentures differ from shares as they represent debt (not ownership) and provide fixed returns.

- Discount on issue of debentures appears under 'Other current liabilities' or deferred revenue expenditure in the balance sheet.

- Redemption of debentures is returning the principal to debenture holders.

- A company can purchase its own debentures, subject to regulatory constraints.

- Redemption of debentures by conversion means exchanging debentures for shares.

- Premium on redemption of debentures is recorded as a liability until paid.

- Redemption out of capital means repaying debentures using the capital or retained earnings of the company.

- Redemption by purchase in the open market involves the company buying back its debentures from the market.

- Debenture Redemption Reserve is shown under 'Reserves & Surplus' in the liabilities section of the balance sheet.

Answer for screen readers

- A debenture is a type of long-term debt instrument used by corporations to borrow money without collateral.

- Bearer debentures are unregistered and can be transferred by delivery.

- Debentures issued as collateral security means issuing debentures in addition to a primary security for a loan.

- Issue of debentures for consideration other than cash involves exchanging debentures for assets or services.

- Debentures issued at a discount and redeemable at a premium are sold for less than face value but repaid above it.

- Capital reserve is a fund created for specific purposes like writing off capital losses.

- Irredeemable debentures have no fixed maturity date and are not paid back.

- Convertible debentures can be converted into equity shares at a specified time.

- Mortgaged debentures are backed by the issuer's assets as collateral.

- Discount on issue of debentures is the difference when debentures are issued below their face value.

- Premium on redemption of debentures is the excess amount paid over the face value at redemption.

- Debentures differ from shares as they represent debt (not ownership) and provide fixed returns.

- Discount on issue of debentures appears under 'Other current liabilities' or deferred revenue expenditure in the balance sheet.

- Redemption of debentures is returning the principal to debenture holders.

- A company can purchase its own debentures, subject to regulatory constraints.

- Redemption of debentures by conversion means exchanging debentures for shares.

- Premium on redemption of debentures is recorded as a liability until paid.

- Redemption out of capital means repaying debentures using the capital or retained earnings of the company.

- Redemption by purchase in the open market involves the company buying back its debentures from the market.

- Debenture Redemption Reserve is shown under 'Reserves & Surplus' in the liabilities section of the balance sheet.

More Information

Debentures are an important financial tool used by companies to raise funds without giving up equity, providing flexibility and access to capital.

Tips

Avoid confusing debentures with equity, as they do not confer ownership rights.

Sources

- Debenture Explained, With Types and Features - Investopedia - investopedia.com

- What does a Bearer Debenture mean? - BYJU'S - byjus.com

- Issue of Debenture as Collateral Security - GeeksforGeeks - geeksforgeeks.org

AI-generated content may contain errors. Please verify critical information