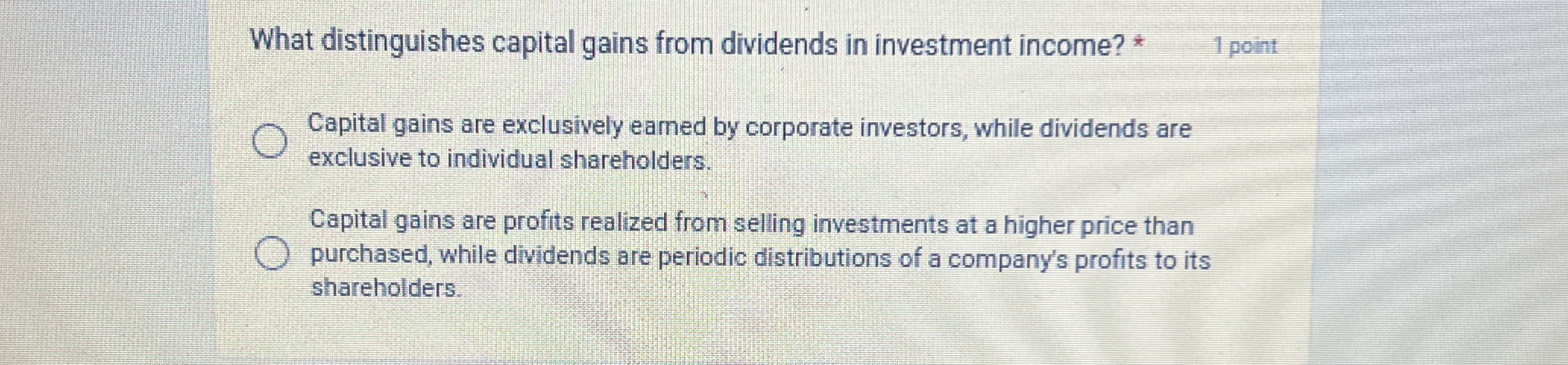

What distinguishes capital gains from dividends in investment income?

Understand the Problem

The question is asking about the differences between capital gains and dividends in the context of investment income, focusing on their definitions and implications for investors.

Answer

Capital gains are profits from sales; dividends are company profit distributions.

Capital gains are profits realized from selling investments at a higher price than purchased, while dividends are periodic distributions of a company's profits to its shareholders.

Answer for screen readers

Capital gains are profits realized from selling investments at a higher price than purchased, while dividends are periodic distributions of a company's profits to its shareholders.

More Information

Capital gains represent an increase in value after selling an asset. In contrast, dividends provide regular income without needing to sell the underlying investment.

Tips

A common mistake is confusing realized gains (sale profits) with income derived without selling an asset (dividends).

Sources

- What Is the Difference Between Dividends and Capital Gains? - investopedia.com

- Dividends vs Capital Gains: How Do They Differ? - SmartAsset - smartasset.com

AI-generated content may contain errors. Please verify critical information