Using your answer to (a) above, calculate the cash balance.

Understand the Problem

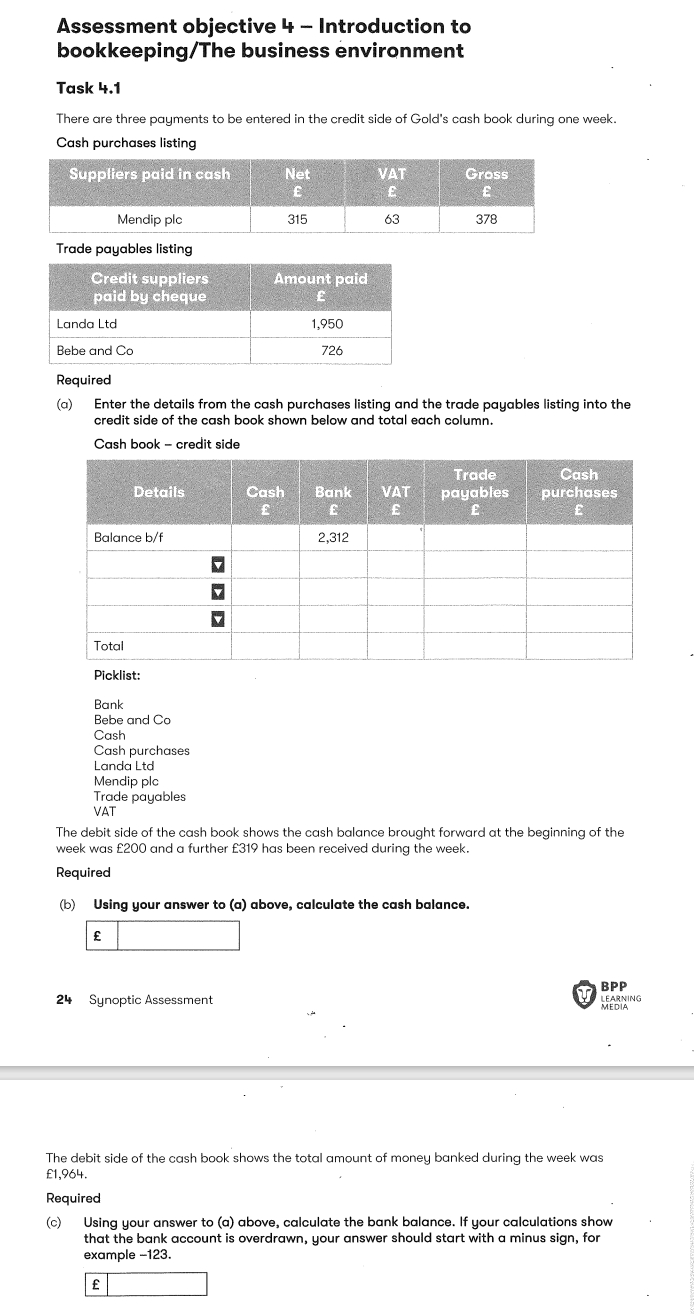

The question is asking for the entry of transactions into a cash book based on provided financial figures. It involves calculating totals for cash purchases, bank transactions, VAT, and trade payables, as well as determining cash and bank balances based on previous totals and new transactions.

Answer

The cash balance is £2,253.

Answer for screen readers

The cash balance is £2,253.

Steps to Solve

-

Enter the Cash Purchases List the cash purchases based on the data for Mendip plc. The net amount is £315, VAT is £63, and the gross amount is £378.

Cash Purchases Entry:

- Cash: £378 (the gross amount)

-

Enter the Trade Payables List the trade payables for the suppliers paid by cheque. Add the amounts for Landa Ltd (£1,950) and Bebe and Co (£726).

Trade Payables Entry:

- Bank: £1,950 (Landa Ltd)

- Bank: £726 (Bebe and Co)

-

Calculate Total for Each Column Now we will total each column in the credit side of the cash book:

-

Cash Total:

- Total Cash = £378

-

Bank Total:

- Total Bank = £1,950 + £726 = £2,676

-

VAT Total:

- Total VAT = £63

-

Trade Payables Total:

- Total Trade Payables = £1,950 + £726 = £2,676

-

Cash Purchases Total:

- Total Cash Purchases = £378

-

-

Balance Calculation Using the previously provided cash balance of £2,312 and calculating the net balance after the new entries:

Net Cash Calculation:

- New Cash Balance = Previous Cash Balance + Cash Received - Cash Paid

- Cash Received = £319

- Cash Paid = £378

So, the calculation will be: $$ \text{New Cash Balance} = 2312 + 319 - 378 $$ $$ \text{New Cash Balance} = 2312 + 319 - 378 = 2253 $$

The cash balance is £2,253.

More Information

This cash balance reflects the final amount available after accounting for the incoming and outgoing cash transactions during the week. It's important in bookkeeping to keep track of both cash inflows and outflows for accurate financial management.

Tips

- Confusing net amounts with gross amounts while entering transactions.

- Forgetting to include or correctly calculate VAT amounts when totaling.

- Miscalculating the total bank and cash balances due to incorrect entries in the cash book.

AI-generated content may contain errors. Please verify critical information