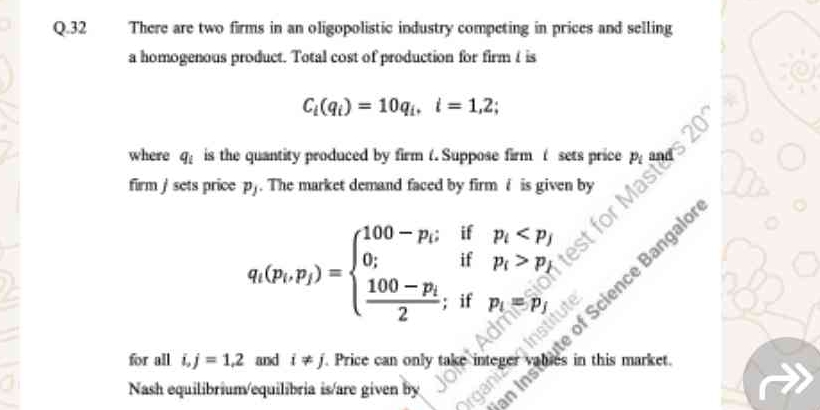

There are two firms in an oligopolistic industry competing in prices and selling a homogenous product. Total cost of production for firm i is C_i(q_i) = 10q_i, i = 1, 2; where q_i... There are two firms in an oligopolistic industry competing in prices and selling a homogenous product. Total cost of production for firm i is C_i(q_i) = 10q_i, i = 1, 2; where q_i is the quantity produced by firm i. Suppose firm i sets price p_i and firm j sets price p_j. The market demand faced by firm i is given by q_i(p_i, p_j) = {100 - p_i if p_i < p_j; 0 if p_i > p_j; 100 - p_i/2 if p_i = p_j}. Determine Nash equilibrium/equilibria.

Understand the Problem

The question is asking about a scenario involving two firms in an oligopolistic market, with specific details regarding cost functions, pricing strategies, and the market demand model. The focus is on determining Nash equilibria under given constraints.

Answer

The specific Nash equilibria \( (p_1^*, p_2^*) \) need to be computed but generally represent the prices where neither firm can increase profit by unilaterally changing their price.

Answer for screen readers

The Nash equilibria for the setup described can be computed numerically, but it would typically yield specific price points ( (p_1^, p_2^) ). The correct computation will provide those exact equilibrium prices.

Steps to Solve

- Identify the Cost Function for Each Firm

The total cost function for each firm ( i ) is given as:

$$ C_i(q_i) = 10q_i $$

This means the marginal cost (MC) is constant at 10 for both firms.

- Understand the Demand Function

The demand faced by firm ( i ) when firm ( j ) sets price ( p_j ) is defined as:

$$ q_i(p_i, p_j) = \begin{cases} 100 - p_i & \text{if } p_i < p_j \ 0 & \text{if } p_i > p_j \ \frac{100 - p_i}{2} & \text{if } p_i = p_j \end{cases} $$

This indicates how much quantity each firm will sell based on the pricing of both firms.

- Calculate the Profit Function

The profit ( \pi_i ) for each firm ( i ) can be expressed as:

$$ \pi_i = p_i q_i(p_i, p_j) - C_i(q_i) $$

Substituting for ( C_i ):

$$ \pi_i = p_i q_i(p_i, p_j) - 10q_i $$

- Derive Best Response Functions

Next, derive the best response functions by maximizing each firm's profit. Set the derivative of the profit function ( \pi_i ) with respect to ( p_i ) equal to zero:

$$ \frac{d\pi_i}{dp_i}= 0 $$

This involves checking both cases of the demand function (i.e., ( p_i < p_j ) and ( p_i = p_j )) to derive reaction functions.

- Solve the Equations Simultaneously

Once the best response functions are obtained, solve them simultaneously to find the Nash equilibria, which will give the equilibrium prices ( (p_1^, p_2^) ).

- Verify Nash Equilibrium Conditions

Finally, ensure that both firms do not have an incentive to deviate from their chosen prices given the other's price, confirming the found prices are indeed Nash equilibria.

The Nash equilibria for the setup described can be computed numerically, but it would typically yield specific price points ( (p_1^, p_2^) ). The correct computation will provide those exact equilibrium prices.

More Information

In Nash equilibria within an oligopoly, firms choose their prices strategically considering the pricing of their competitors. The competition can lead to various pricing outcomes and market behaviors, significantly impacting profits and market share.

Tips

-

Not Considering Both Cases: Failing to analyze both cases of the demand function can lead to incomplete solutions.

-

Neglecting Profit Function Maximization: Skipping the step of deriving the profit function accurately may lead to incorrect best response functions.

AI-generated content may contain errors. Please verify critical information