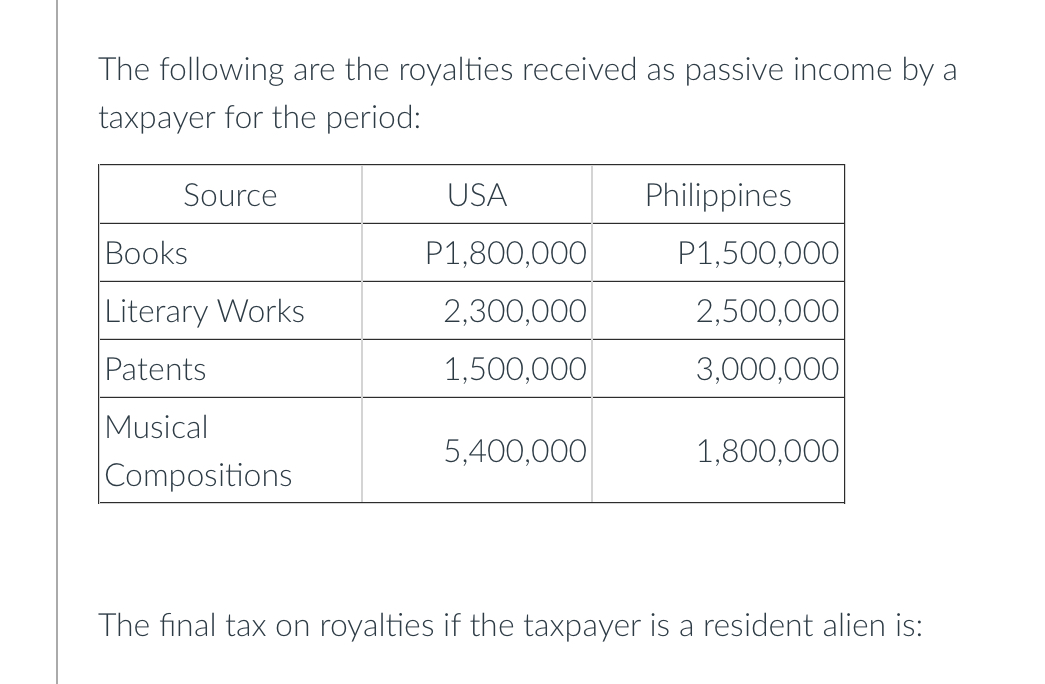

The following are the royalties received as passive income by a taxpayer for the period: | Source | USA | Philippines | | :----------------- | :--------- | :---... The following are the royalties received as passive income by a taxpayer for the period: | Source | USA | Philippines | | :----------------- | :--------- | :---------- | | Books | P1,800,000 | P1,500,000 | | Literary Works | 2,300,000 | 2,500,000 | | Patents | 1,500,000 | 3,000,000 | | Musical Compositions | 5,400,000 | 1,800,000 | What is the final tax on royalties if the taxpayer is a resident alien?

Understand the Problem

The question provides a table of royalties received by a taxpayer, broken down by source (books, literary works, patents, musical compositions) and country (USA, Philippines). The task is to determine the final tax on these royalties if the taxpayer is a resident alien. This will likely involve calculating total royalties and applying the relevant tax rate(s).

Answer

P1,760,000

Answer for screen readers

P1,760,000

Steps to Solve

-

Calculate the total royalties from sources within the Philippines. Add all the royalties received from the Philippines: $1,500,000 + 2,500,000 + 3,000,000 + 1,800,000 = 8,800,000$

-

Determine the applicable tax rate. For resident aliens, royalties from sources within the Philippines are subject to a final tax of 20%.

-

Calculate the final tax. Multiply the total royalties from the Philippines by the tax rate: $8,800,000 \times 0.20 = 1,760,000$

P1,760,000

More Information

Royalties earned by resident aliens are taxed at a final tax rate of 20% if they are sourced within the Philippines. Royalties from sources outside the Philippines are not subject to final tax.

Tips

A common mistake is to include royalties from sources outside the Philippines (USA) in the tax calculation for resident aliens.

AI-generated content may contain errors. Please verify critical information