Summarize the financial transactions described.

Understand the Problem

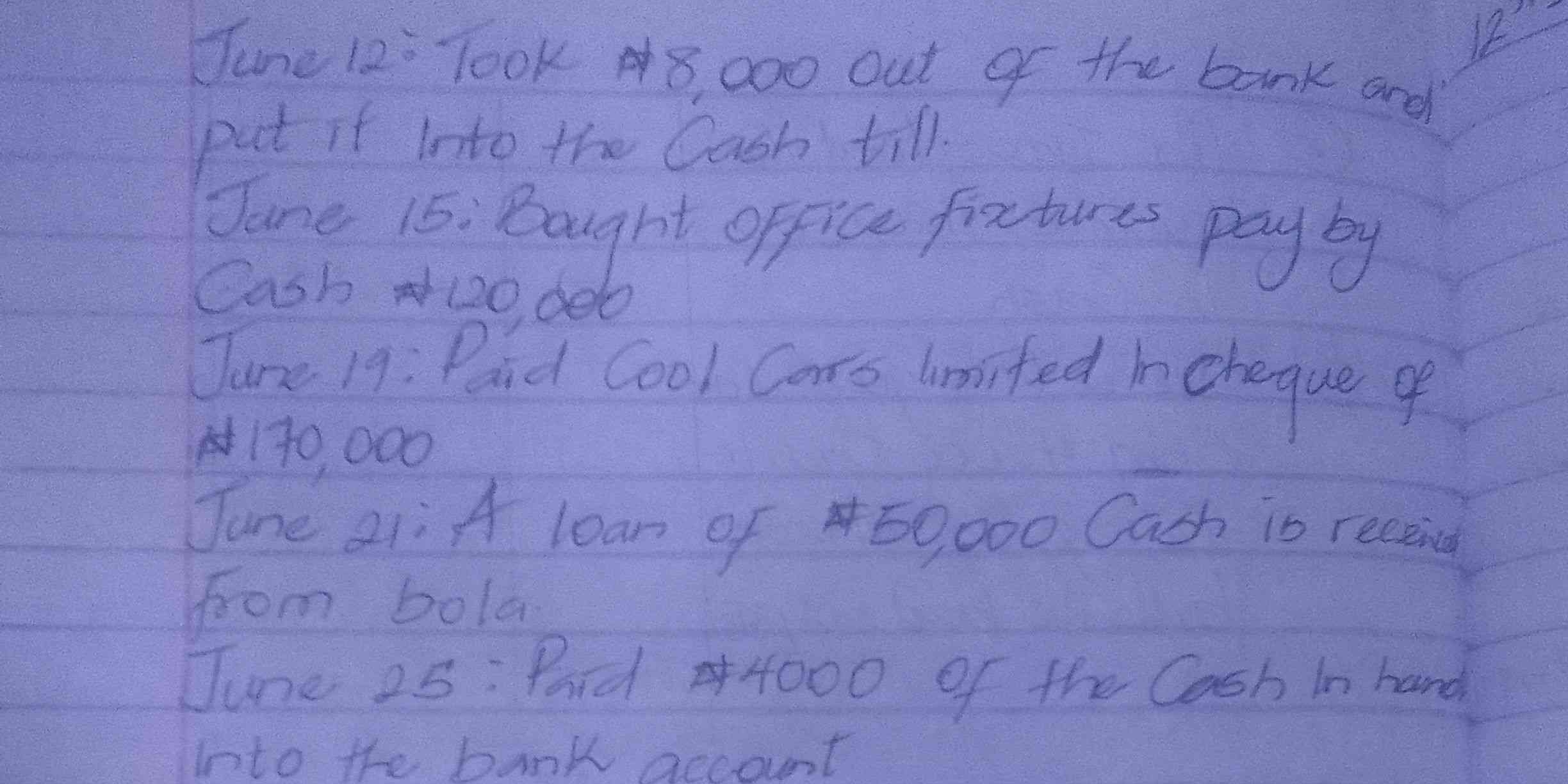

The image contains a series of financial transactions recorded with their respective dates. Understanding this involves recognizing the type of transaction (withdrawal, purchase, payment, loan) and the amounts involved. A question related to this might involve summarizing the transactions, calculating balances, or preparing a financial statement.

Answer

Financial transactions include cash transfer from bank to till, purchase of office fixtures, payment to Cool Cars Limited via cheque, receiving a loan from Bola, and cash deposited into bank account.

Here's a summary of the financial transactions:

- June 12: $8,000 was transferred from the bank to the cash till.

- June 15: Office fixtures were purchased for $120,000 in cash.

- June 19: Cool Cars Limited was paid $170,000 by cheque.

- June 21: A cash loan of $50,000 was received from Bola.

- June 25: $4,000 cash was deposited into the bank account.

Answer for screen readers

Here's a summary of the financial transactions:

- June 12: $8,000 was transferred from the bank to the cash till.

- June 15: Office fixtures were purchased for $120,000 in cash.

- June 19: Cool Cars Limited was paid $170,000 by cheque.

- June 21: A cash loan of $50,000 was received from Bola.

- June 25: $4,000 cash was deposited into the bank account.

More Information

A financial transaction is an agreement between a buyer and seller to exchange goods, services, or assets for payment. These transactions impact a business's assets, liabilities, or equity.

Tips

Pay close attention to the currency symbols and numerical values to ensure accurate documentation of the transactions.

Sources

- Financial Transaction Definition, Types & Examples - Lesson - study.com

- Transaction: Definition, Accounting, and Examples - Investopedia - investopedia.com

- What Is a Financial Transaction? A Comprehensive Guide - xactaccountants.co.uk

AI-generated content may contain errors. Please verify critical information