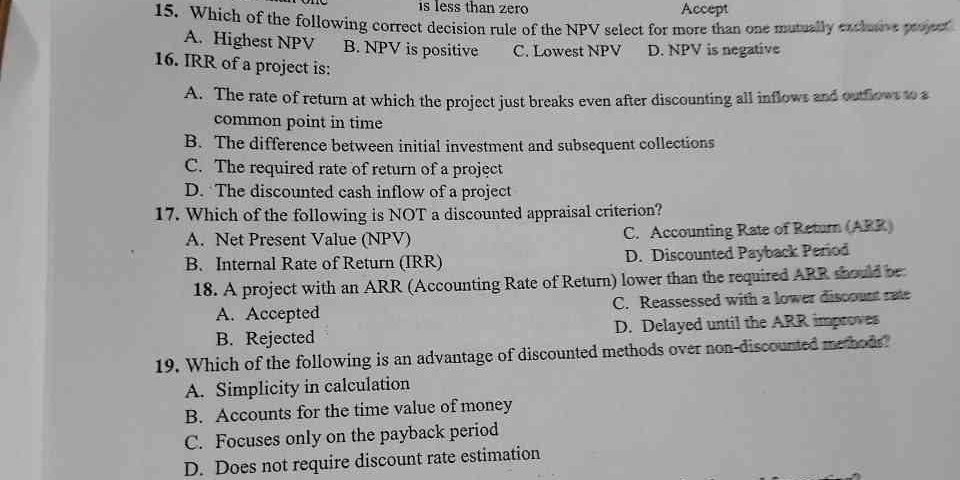

What is the IRR of a project? Which of the following is NOT a discounted appraisal criterion? What should be determined about a project with an ARR lower than the required APR?

Understand the Problem

The question seeks clarification on financial concepts related to investment appraisal, specifically concerning the Internal Rate of Return (IRR), Net Present Value (NPV), and discounted methods versus non-discounted methods.

Answer

IRR breaks even in NPV. ARR is not discounted. Reject project if ARR < APR.

IRR of a project is the rate at which the project breaks even in NPV. ARR is not a discounted appraisal criterion. A project with an ARR lower than the required APR should be rejected.

Answer for screen readers

IRR of a project is the rate at which the project breaks even in NPV. ARR is not a discounted appraisal criterion. A project with an ARR lower than the required APR should be rejected.

More Information

The IRR is a measure used to evaluate the profitability of an investment, while the ARR does not account for the time value of money.

Tips

Commonly people confuse ARR with discounted methods like IRR. Always check if methods account for the time value of money.

Sources

- Net Present Value vs. Internal Rate of Return - Investopedia - investopedia.com

- What Is Accounting Rate of Return (ARR)? - Investopedia - investopedia.com

- Internal Rate of Return (IRR) - Calculator & Formula - corporatefinanceinstitute.com

AI-generated content may contain errors. Please verify critical information