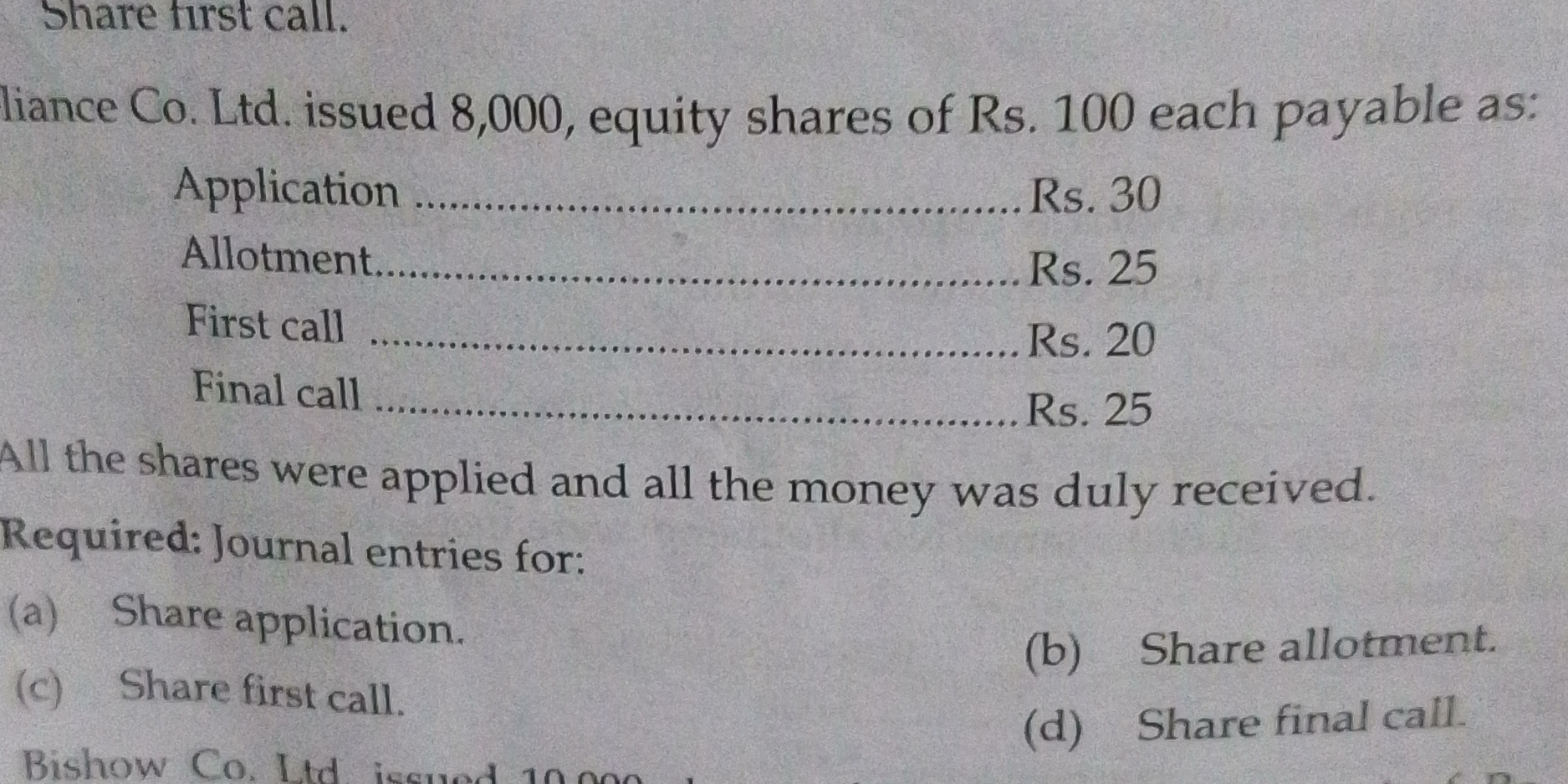

Required: Journal entries for: (a) Share application. (b) Share allotment. (c) Share first call.

Understand the Problem

The question is asking for the journal entries related to the share application, share allotment, and first call in the context of issuing equity shares of a company. It requires understanding the accounting principles related to equity financing and the specific amounts due at each stage.

Answer

The journal entries for Alliance Co. Ltd. are as follows: Share Application: ``` Bank Account Dr. 240,000 To Share Application Account 240,000 ``` Share Allotment: ``` Share Application Account Dr. 240,000 To Share Allotment Account 200,000 To Share Capital Account 40,000 ``` Share First Call: ``` Bank Account Dr. 160,000 To Share First Call Account 160,000 ``` Share Final Call: ``` Bank Account Dr. 200,000 To Share Final Call Account 200,000 ```

Answer for screen readers

The journal entries are as follows:

-

Share Application

Bank Account Dr. 240,000 To Share Application Account 240,000 -

Share Allotment

Share Application Account Dr. 240,000 To Share Allotment Account 200,000 To Share Capital Account 40,000 -

Share First Call

Bank Account Dr. 160,000 To Share First Call Account 160,000 -

Share Final Call

Bank Account Dr. 200,000 To Share Final Call Account 200,000

Steps to Solve

-

Calculate the Total Amount for Each Payment Stage

The company issued 8,000 shares with different amounts payable at each stage. The total amounts can be calculated as follows:- Application: $8,000 \text{ shares} \times 30 = 240,000$

- Allotment: $8,000 \text{ shares} \times 25 = 200,000$

- First Call: $8,000 \text{ shares} \times 20 = 160,000$

- Final Call: $8,000 \text{ shares} \times 25 = 200,000$

-

Journal Entry for Share Application

When the applications are received, the entry reflects an increase in cash and share application money:Bank Account Dr. 240,000 To Share Application Account 240,000 -

Journal Entry for Share Allotment

Upon allotment, the company recognizes the allotment amount:Share Application Account Dr. 240,000 To Share Allotment Account 200,000 To Share Capital Account 40,000 -

Journal Entry for First Call

When the first call payment is received, the entry reflects an increase in cash and the call amount:Bank Account Dr. 160,000 To Share First Call Account 160,000 -

Journal Entry for Final Call

After the final call, the entry also reflects an increase in cash and the last call amount:Bank Account Dr. 200,000 To Share Final Call Account 200,000

The journal entries are as follows:

-

Share Application

Bank Account Dr. 240,000 To Share Application Account 240,000 -

Share Allotment

Share Application Account Dr. 240,000 To Share Allotment Account 200,000 To Share Capital Account 40,000 -

Share First Call

Bank Account Dr. 160,000 To Share First Call Account 160,000 -

Share Final Call

Bank Account Dr. 200,000 To Share Final Call Account 200,000

More Information

These journal entries reflect the proper accounting treatment for issuing equity shares, detailing how funds are received at each stage during the share issuance process.

Tips

- Mixing up the accounts during journal entries (e.g., using the wrong account for the application money).

- Failing to calculate the total amounts correctly based on the given number of shares.

- Not recognizing share capital in the allotment entry correctly.

AI-generated content may contain errors. Please verify critical information