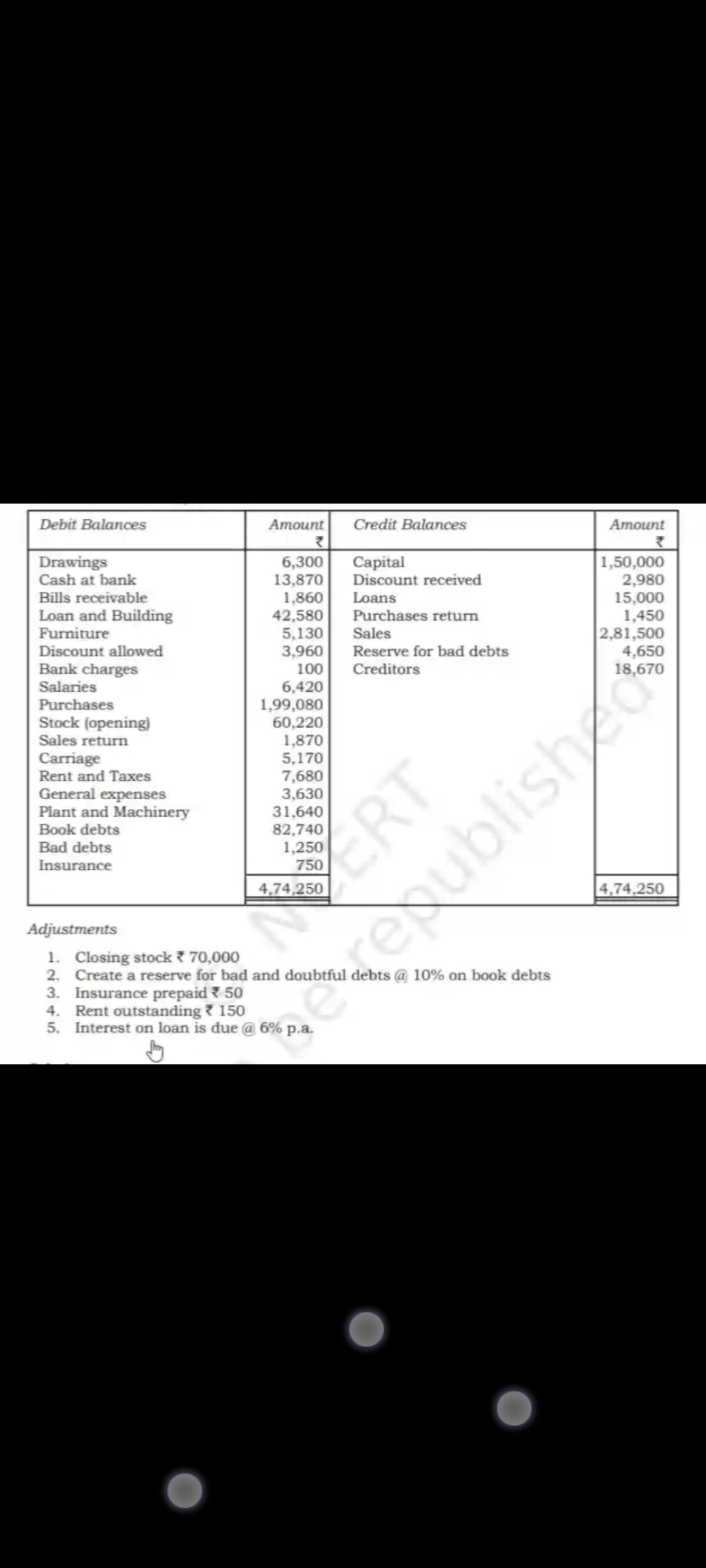

Prepare financial statements based on the following trial balance and adjustments: Debit Balances: Drawings: 6,300 Cash at bank: 13,870 Bills receivable: 1,860 Loan and Building:... Prepare financial statements based on the following trial balance and adjustments: Debit Balances: Drawings: 6,300 Cash at bank: 13,870 Bills receivable: 1,860 Loan and Building: 42,580 Furniture: 5,130 Discount allowed: 3,960 Bank charges: 100 Salaries: 6,420 Purchases: 1,99,080 Stock (opening): 60,220 Sales return: 1,870 Carriage: 5,170 Rent and Taxes: 7,680 General expenses: 3,630 Plant and Machinery: 31,640 Book debts: 82,740 Bad debts: 1,250 Insurance: 750 Credit Balances: Capital: 1,50,000 Discount received: 2,980 Loans: 15,000 Purchases return: 1,450 Sales: 2,81,500 Reserve for bad debts: 4,650 Creditors: 18,670 Adjustments: Closing stock: 70,000 Create a reserve for bad and doubtful debts @ 10% on book debts Insurance prepaid: 50 Rent outstanding: 150 Interest on loan is due @ 6% p.a.

Understand the Problem

The question provides a trial balance and a list of adjustments. The task is to use this information to prepare financial statements, potentially including an income statement and a balance sheet. This involves accounting principles and procedures such as adjusting entries, valuation of assets, and recognition of revenues and expenses.

Answer

Revised Reserve: ₹8,274, Additional Reserve: ₹3,624, Prepaid Insurance: ₹50, Outstanding Rent: ₹150, Interest on Loan: ₹900

Answer for screen readers

Revised Reserve for bad and doubtful debts: ₹8,274 Additional Reserve required: ₹3,624 Prepaid Insurance: ₹50 Outstanding Rent: ₹150 Interest due on loan: ₹900

Steps to Solve

- Calculate the revised reserve for bad and doubtful debts

The adjustment requires a 10% reserve on book debts. Book debts are ₹82,740. Reserve Required $ = 10% \times 82740 = 8274 $

- Determine the additional reserve required

Compare the required reserve with the existing reserve. The existing reserve is ₹4,650. Additional Reserve $ = 8274 - 4650 = 3624 $

- Calculate prepaid insurance

The adjustment states prepaid insurance is ₹50.

- Calculate outstanding rent

The adjustment states outstanding rent is ₹150.

- Calculate interest due on loan

The loan amount is ₹15,000 and interest is due at 6% p.a. Interest Due $ = 6% \times 15000 = 0.06 \times 15000 = 900 $

Note: Without specific instructions on which financial statements to prepare(Income Statement and Balance Sheet), it's not possible to completely solve the problem.

Revised Reserve for bad and doubtful debts: ₹8,274 Additional Reserve required: ₹3,624 Prepaid Insurance: ₹50 Outstanding Rent: ₹150 Interest due on loan: ₹900

More Information

These adjustments will affect various financial statements. For example, the changes will affect the income statement and balance sheet through updated expense and asset/liability values.

Tips

- Incorrectly calculating percentages.

- Forgetting to adjust both the income statement and balance sheet for adjustments.

- Misinterpreting what "reserve for bad debts" means.

- Not understanding how prepaid expenses or accrued expenses affect financial statements.

AI-generated content may contain errors. Please verify critical information