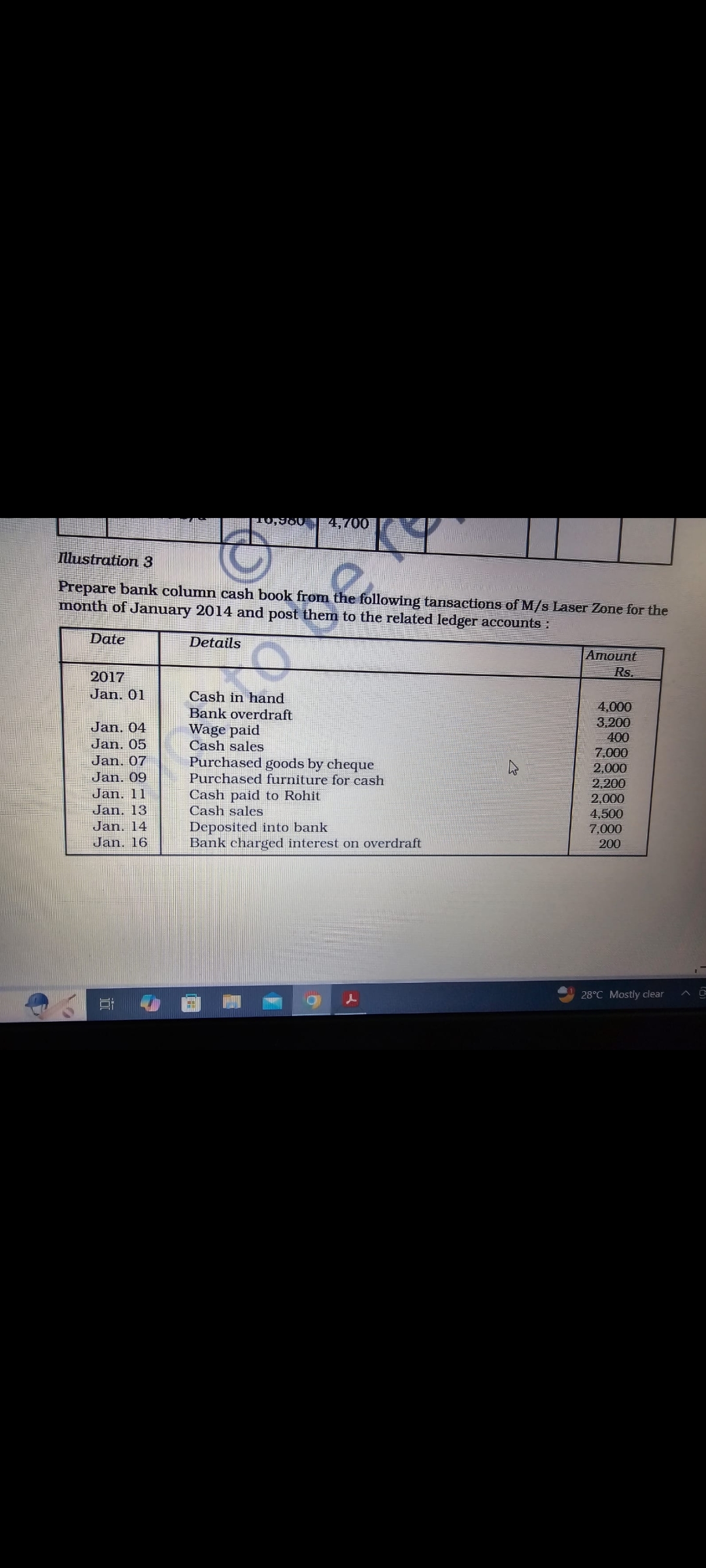

Prepare bank column cash book from the following transactions of M/s Laser Zone for the month of January 2014 and post them to the related ledger accounts.

Understand the Problem

The question is asking to prepare a bank column cash book from the given transactions for a specific month and to post these transactions to the related ledger accounts. This involves organizing the financial data into a structured format appropriate for accounting purposes.

Answer

Cash balance: $4,100$ Rs.; Bank balance: $-3,200$ Rs.

Answer for screen readers

Cash balance at the end of January: $4,100$ Rs.

Bank balance (overdraft): $-3,200$ Rs.

Steps to Solve

- Create a Cash Book Structure

Set up a cash book with the headings for dates, details, cash column, bank column, and total. There are two main sections: one for cash transactions and one for bank transactions.

- Enter Transactions in the Cash Column

For cash-related transactions:

- Jan. 01: Cash in hand: Add 4,000 Rs.

- Jan. 05: Wage paid: Subtract 400 Rs.

- Jan. 09: Purchased furniture for cash: Subtract 2,000 Rs.

- Jan. 11: Cash paid to Rohit: Subtract 2,000 Rs.

- Jan. 13: Cash sales: Add 4,500 Rs.

Sum the cash column: $$ 4000 - 400 - 2000 - 2000 + 4500 = 4100 Rs. $$

- Enter Transactions in the Bank Column

For bank-related transactions:

- Jan. 04: Bank overdraft: Subtract 3,200 Rs.

- Jan. 07: Purchased goods by cheque: Subtract 7,000 Rs.

- Jan. 14: Deposited into bank: Add 7,000 Rs.

- Jan. 16: Bank charged interest on overdraft: Subtract 200 Rs.

Sum the bank column: $$ -3200 - 7000 + 7000 - 200 = -3200 Rs. $$

- Total Both Columns

The total cash at the end of the month is 4,100 Rs. The balance in the bank is -3,200 Rs. which indicates an overdraft.

- Post Transactions to Ledger Accounts

Create ledger accounts for Cash, Bank, and any other accounts involved (such as Purchases, Sales, and Wages). Record each transaction as follows:

- Debit or Credit for cash transactions based on the cash book.

- Debit or Credit for bank transactions based on the bank column's effect.

Cash balance at the end of January: $4,100$ Rs.

Bank balance (overdraft): $-3,200$ Rs.

More Information

In preparing a cash book, all cash inflows are recorded as debits, and cash outflows are recorded as credits. A bank overdraft indicates that more has been withdrawn than is available in the bank account.

Tips

- Failing to differentiate between cash and bank transactions can lead to confusion.

- Not totaling the cash and bank columns correctly.

- Incorrectly recording debits and credits in the ledger accounts.

AI-generated content may contain errors. Please verify critical information