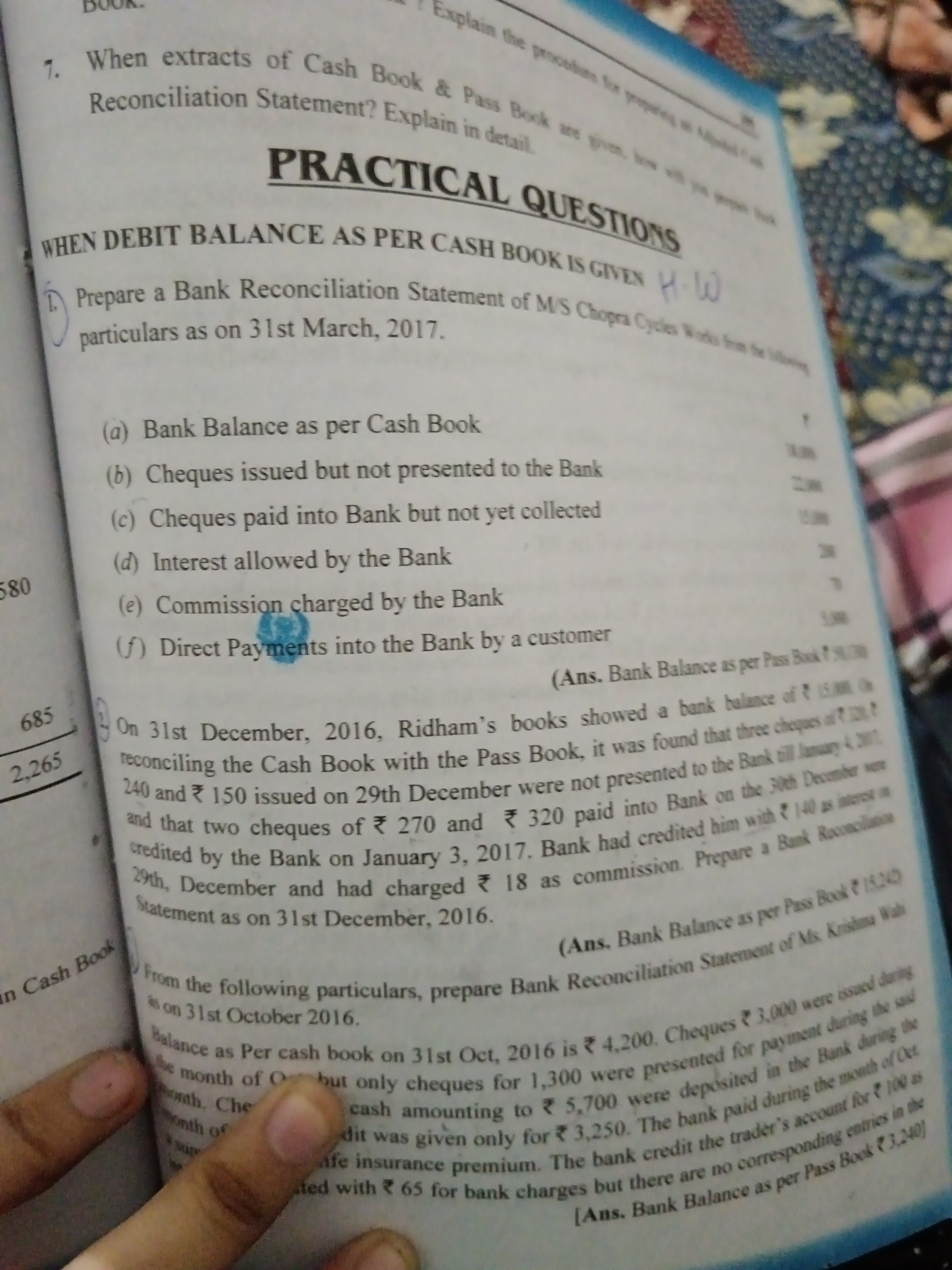

Prepare a Bank Reconciliation Statement of M/S Chopra Cycles with particulars as on 31st March, 2017.

Understand the Problem

The question is asking to prepare a Bank Reconciliation Statement for M/S Chopra Cycles based on provided particulars as of 31st March, 2017. This involves adjusting the bank balance through various items that affect the cash book and bank statements.

Answer

The final adjusted bank balance is \( 2,660 \).

Answer for screen readers

The final bank balance as per the Bank Reconciliation Statement is ( 2,660 ).

Steps to Solve

- List the Cash Book Balance

The bank balance as per the Cash Book is ( 1,580 ).

- Adjust for Cheques Issued

Subtract cheques issued but not presented to the bank:

- Cheques issued not presented: ( 700 )

So, adjust the balance: $$ 1,580 - 700 = 880 $$

- Adjust for Cheques Paid into Bank

Add cheques paid into the bank but not yet collected:

- Cheques paid not yet collected: ( 1,500 )

Adjust the balance: $$ 880 + 1,500 = 2,380 $$

- Adjust for Interest Allowed

Add any interest allowed by the bank:

- Interest allowed: ( 20 )

Adjust the balance: $$ 2,380 + 20 = 2,400 $$

- Adjust for Commission Charged

Subtract any commission charged by the bank:

- Commission charged: ( 40 )

Adjust the balance: $$ 2,400 - 40 = 2,360 $$

- Adjust for Direct Payments

Add any direct payments made into the bank:

- Direct payments: ( 300 )

Final adjustment of the balance: $$ 2,360 + 300 = 2,660 $$

- Prepare the Final Bank Reconciliation Statement

Prepare the statement with the final adjusted balance:

- Adjusted Bank Balance as per Pass Book: ( 2,660 )

The final bank balance as per the Bank Reconciliation Statement is ( 2,660 ).

More Information

The Bank Reconciliation Statement ensures that the bank's records match the company's cash book, highlighting any discrepancies caused by timing or errors. This process helps businesses maintain accurate financial records.

Tips

- Forgetting to include all items in the bank reconciliation can lead to an incorrect balance.

- Misclassifying items (e.g., treating cheques as paid when they are actually issued) can cause confusion. Always check the source of each item.

AI-generated content may contain errors. Please verify critical information