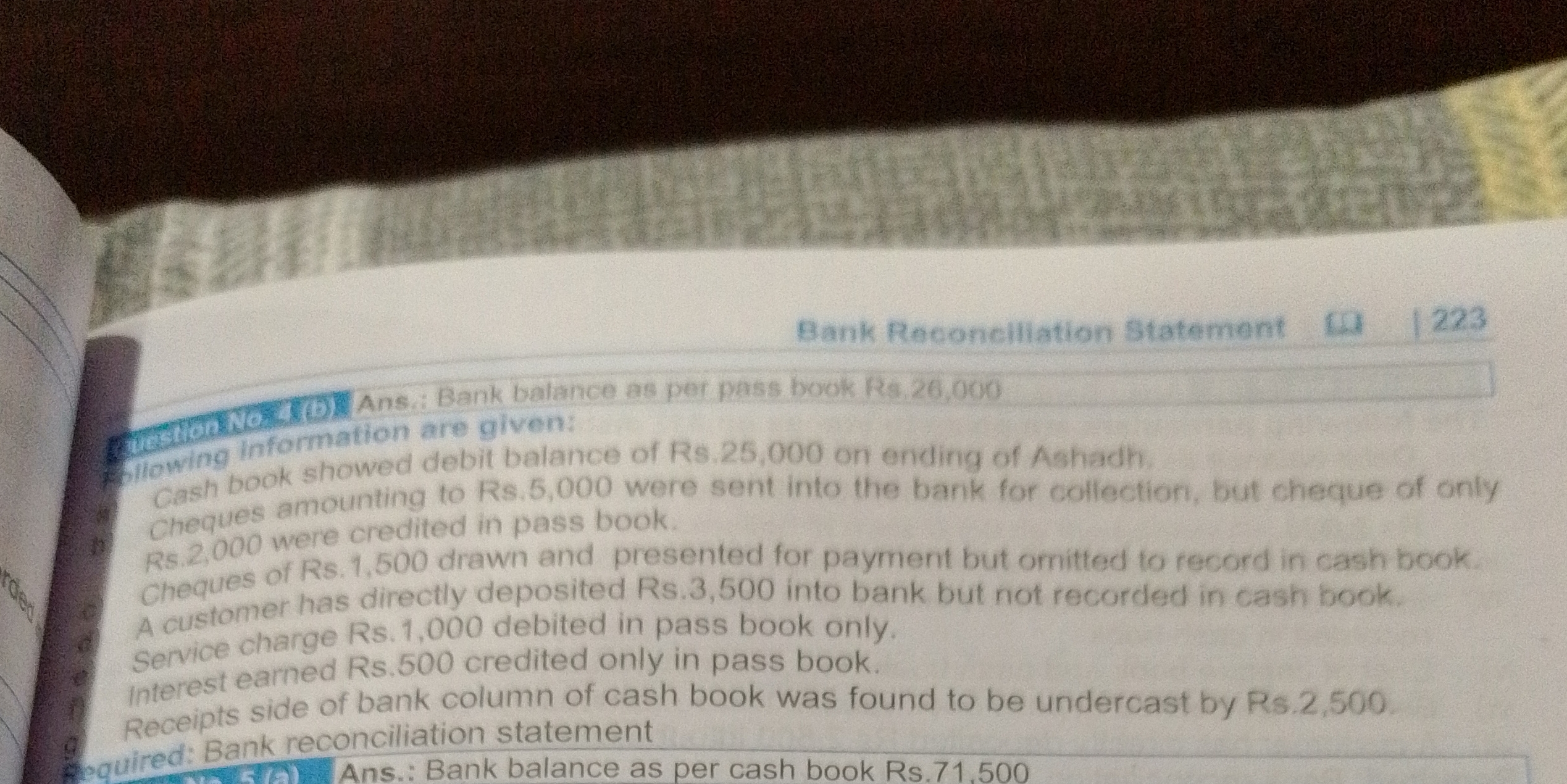

Prepare a bank reconciliation statement based on the given information.

Understand the Problem

The question is asking to prepare a bank reconciliation statement based on provided information about cash book balances, cheques, deposits, service charges, and undercasting.

Answer

The adjusted cash book balance is $71,500$.

Answer for screen readers

The bank reconciliation statement shows:

- Adjusted cash book balance: Rs. 71,500

- Adjusted bank balance: Rs. 71,500

Steps to Solve

-

Identify the cash book and bank balance The cash book shows a debit balance of Rs. 25,000, and the bank passbook shows a balance of Rs. 26,000.

-

Adjust for cheques sent for collection Cheques totaling Rs. 5,000 were sent to the bank, but only Rs. 2,000 were credited in the passbook. Thus, Rs. 3,000 (Rs. 5,000 - Rs. 2,000) should be added to the bank balance.

-

Adjust for cheques omitted in cash book Cheques of Rs. 1,500 were drawn but not recorded in the cash book. This amount should be deducted from the cash book balance.

-

Adjust for direct deposit not recorded in cash book A direct deposit of Rs. 3,500 was made, which was not recorded in the cash book. This amount should be added to the cash book balance.

-

Adjust for service charges Service charges of Rs. 1,000 were deducted by the bank but not recorded in the cash book, so this amount should be deducted from the bank balance.

-

Adjust for interest earned An interest of Rs. 500 was credited in the passbook but not recorded in the cash book. This amount should be added to the cash book balance.

-

Adjust for undercasting The receipts side of the bank column in the cash book was undercast by Rs. 2,500. This means an additional Rs. 2,500 should be added to the cash book balance.

-

Calculate adjusted balances Calculate the adjusted bank balance and cash book balance using the adjustments noted above.

-

Prepare the bank reconciliation statement Combine all adjusted values to finalize the bank reconciliation statement.

The bank reconciliation statement shows:

- Adjusted cash book balance: Rs. 71,500

- Adjusted bank balance: Rs. 71,500

More Information

The bank reconciliation statement helps reconcile discrepancies between the cash book and bank passbook balances, ensuring accurate financial reporting.

Tips

- Failing to account for all adjustments, such as direct deposits or service charges.

- Mixing up additions and subtractions for the cash book and bank adjustments.

- Not double-checking the final balances for accuracy.

AI-generated content may contain errors. Please verify critical information