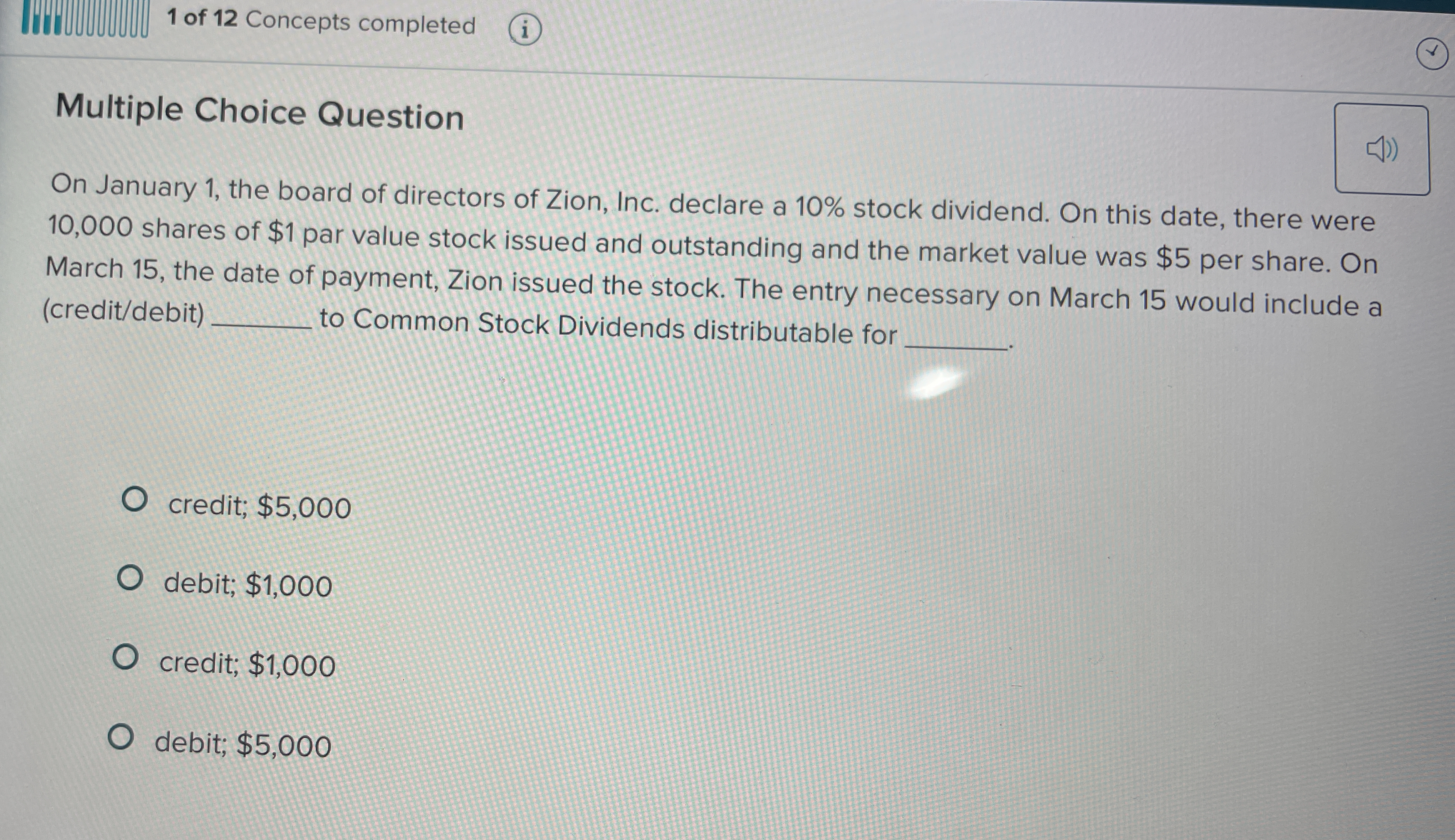

On January 1, the board of directors of Zion, Inc. declared a 10% stock dividend. On March 15, the date of payment, Zion issued the stock. The entry necessary on March 15 would inc... On January 1, the board of directors of Zion, Inc. declared a 10% stock dividend. On March 15, the date of payment, Zion issued the stock. The entry necessary on March 15 would include a (credit/debit) ________ to Common Stock Dividends distributable for ________.

Understand the Problem

The question is related to accounting entries for a stock dividend declared by Zion, Inc. It asks what kind of entry (credit or debit) should be made to Common Stock Dividends distributable on the payment date. This involves understanding stock dividends and their accounting treatment.

Answer

Credit to Common Stock Dividends distributable for $1,000.

The entry on March 15 would include a credit to Common Stock Dividends distributable for $1,000.

Answer for screen readers

The entry on March 15 would include a credit to Common Stock Dividends distributable for $1,000.

More Information

On the date of distribution, the Common Stock Dividends Distributable account is credited for the par value of the shares distributed.

Tips

Ensure the calculation of the stock dividend is based on the par value and not the market value.

AI-generated content may contain errors. Please verify critical information