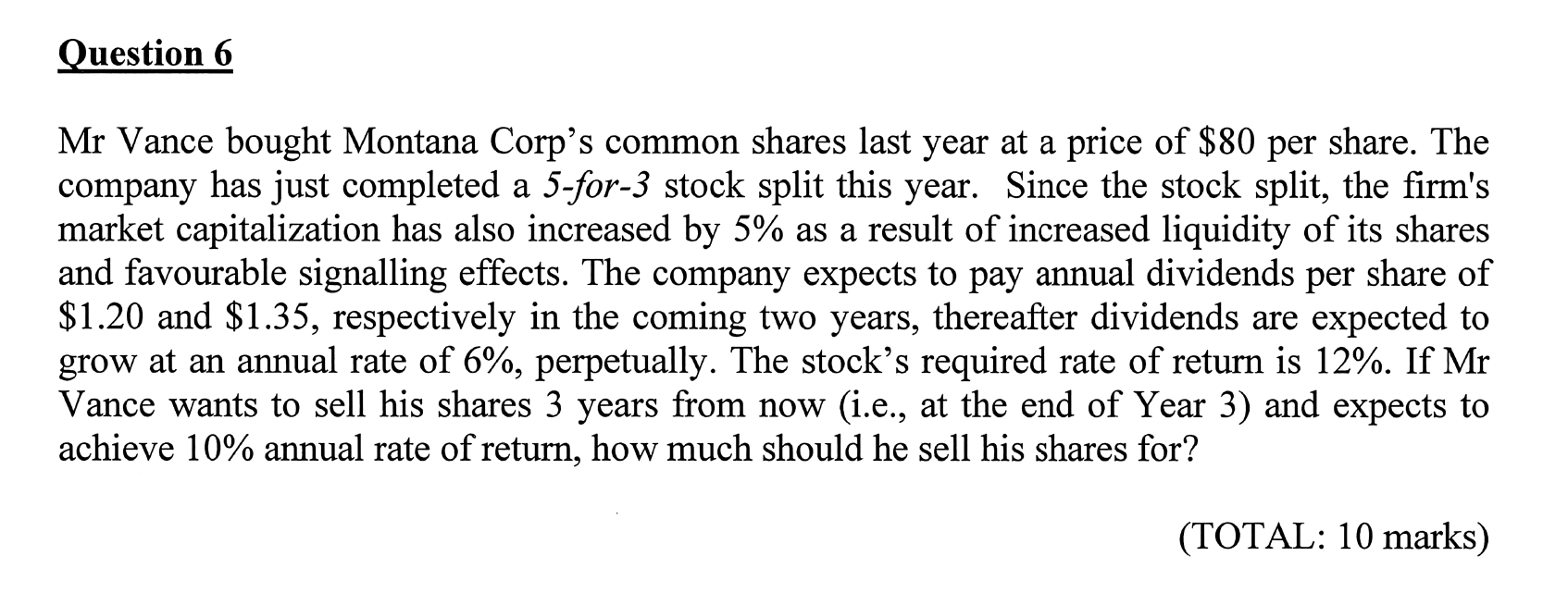

Mr. Vance bought Montana Corp’s common shares last year at a price of $80 per share. The company has just completed a 5-for-3 stock split. Since the stock split, the firm's market... Mr. Vance bought Montana Corp’s common shares last year at a price of $80 per share. The company has just completed a 5-for-3 stock split. Since the stock split, the firm's market capitalization has increased by 5% as a result of increased liquidity of its shares. The company expects to pay annual dividends per share of $1.20 and $1.35, respectively, in the coming two years; thereafter, dividends are expected to grow at an annual rate of 6%, perpetually. The stock’s required rate of return is 12%. If Mr. Vance wants to sell his shares 3 years from now and expects to achieve a 10% annual rate of return, how much should he sell his shares for?

Understand the Problem

The question requires calculating the expected selling price of Mr. Vance's shares after three years, taking into account the dividends per share, the growth rate of those dividends, and the required rate of return.

Answer

$21.12$

Answer for screen readers

The total expected selling price of Mr. Vance's shares after three years is approximately $21.12.

Steps to Solve

- Determine future dividends for Year 1 and Year 2

The company expects dividends of $1.20 in Year 1 and $1.35 in Year 2.

- Calculate the dividend for Year 3

The dividend in Year 3 is expected to grow by 6% from Year 2: $$ D_3 = D_2 \times (1 + g) = 1.35 \times (1 + 0.06) $$ Calculating: $$ D_3 = 1.35 \times 1.06 = 1.431 $$

- Calculate the present value of dividends for Years 1, 2, and 3

Use the formula for present value: $$ PV = \frac{D_t}{(1 + r)^t} $$

For Year 1: $$ PV_1 = \frac{1.20}{(1 + 0.10)^1} $$ For Year 2: $$ PV_2 = \frac{1.35}{(1 + 0.10)^2} $$ For Year 3: $$ PV_3 = \frac{D_3}{(1 + 0.10)^3} = \frac{1.431}{(1 + 0.10)^3} $$

Calculating these values: $$ PV_1 = \frac{1.20}{1.10} = 1.0909 $$ $$ PV_2 = \frac{1.35}{1.21} = 1.1157 $$ $$ PV_3 = \frac{1.431}{1.331} = 1.0752 $$

- Sum the present values of the dividends

Calculate the total present value: $$ PV_{total} = PV_1 + PV_2 + PV_3 $$

- Calculate the stock price at Year 3 (using Gordon Growth Model)

After Year 3, dividends are expected to grow at a perpetual rate of 6%. Use the formula: $$ P_3 = \frac{D_4}{r - g} $$ Where: $$ D_4 = D_3 \times (1 + g) $$

First, calculate $D_4$: $$ D_4 = 1.431 \times 1.06 = 1.51586 $$

Now calculate $P_3$: $$ P_3 = \frac{1.51586}{0.12 - 0.06} = \frac{1.51586}{0.06} = 25.2643 $$

- Calculate the present value of $P_3$

The present value of $P_3$ at Year 0: $$ PV_{P3} = \frac{P_3}{(1 + 0.10)^3} = \frac{25.2643}{1.331} = 18.980 $$

- Calculate the total selling price of the shares at Year 3

Combine the present values: $$ Total\ Selling\ Price = PV_{total} + PV_{P3} $$

The total expected selling price of Mr. Vance's shares after three years is approximately $21.12.

More Information

Mr. Vance's calculation takes into account both the dividends received over the first three years and the estimated sale price of the shares based on future growth in dividends. This method is commonly used in finance to appraise stock values.

Tips

- Forgetting to account for the dividend growth rate when calculating future dividends.

- Misapplying the present value formula by neglecting to adjust for the rate.

- Not correctly summing the present values of individual dividends and the price.

AI-generated content may contain errors. Please verify critical information