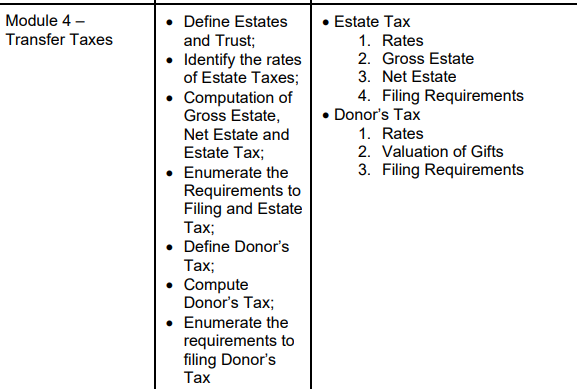

Module 4 – Transfer Taxes: Define Estates and Trust; Identify the rates of Estate Taxes; Computation of Gross Estate, Net Estate and Estate Tax; Enumerate the Requirements to Filin... Module 4 – Transfer Taxes: Define Estates and Trust; Identify the rates of Estate Taxes; Computation of Gross Estate, Net Estate and Estate Tax; Enumerate the Requirements to Filing and Estate Tax; Define Donor’s Tax; Compute Donor’s Tax; Enumerate the requirements to filing Donor’s Tax; Estate Tax: Rates, Gross Estate, Net Estate, Filing Requirements; Donor’s Tax: Rates, Valuation of Gifts, Filing Requirements.

Understand the Problem

The question appears to be summarizing a module covering aspects of transfer taxes, specifically focusing on estate and donor's taxes, their definitions, computations, rates, and filing requirements.

Answer

Define estates and trusts, identify estate tax rates, compute gross/net estate, understand filing requirements, define donor's tax, and compute and file donor's tax.

The discussion in Module 4 involves defining estates and trusts, identifying estate tax rates, computing gross and net estates, understanding estate tax filing, defining and calculating donor's tax, and listing filing requirements for donor's tax.

Answer for screen readers

The discussion in Module 4 involves defining estates and trusts, identifying estate tax rates, computing gross and net estates, understanding estate tax filing, defining and calculating donor's tax, and listing filing requirements for donor's tax.

More Information

Both estate and donor’s taxes revolve around the transfer of property, either at death or as gifts, and have specific rates, computation methods, and filing requirements.

Tips

A common mistake is not including all taxable assets in the gross estate or misunderstanding deductible expenses.

Sources

AI-generated content may contain errors. Please verify critical information