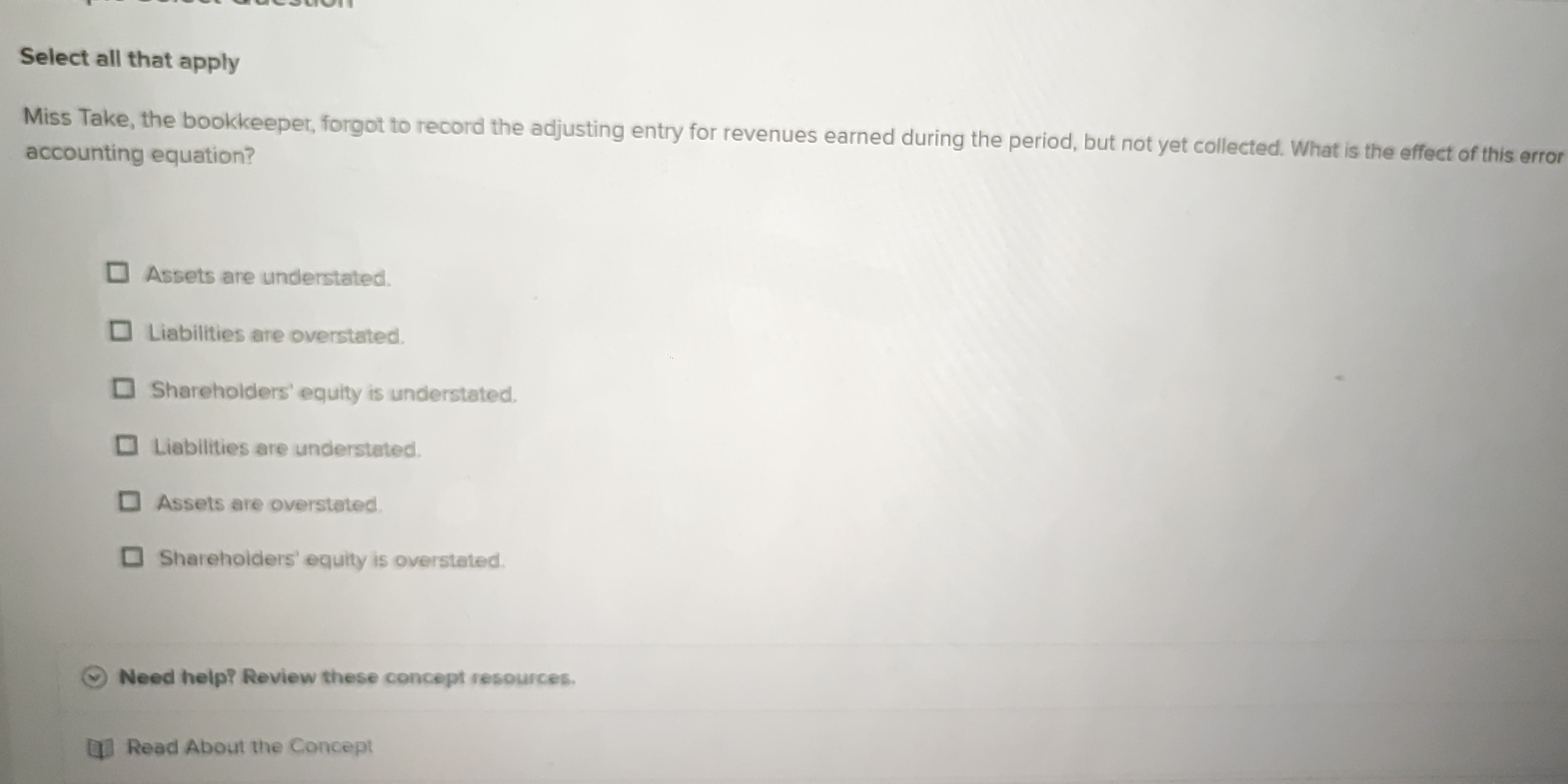

Miss Take, the bookkeeper, forgot to record the adjusting entry for revenues earned during the period, but not yet collected. What is the effect of this error on the accounting equ... Miss Take, the bookkeeper, forgot to record the adjusting entry for revenues earned during the period, but not yet collected. What is the effect of this error on the accounting equation?

Understand the Problem

The question asks about the effects on the accounting equation resulting from the bookkeeper's failure to record revenues earned but not yet collected. It requires identifying which financial statement elements are affected by this error.

Answer

Assets and shareholders' equity are understated.

Assets are understated, and shareholders' equity is understated.

Answer for screen readers

Assets are understated, and shareholders' equity is understated.

More Information

If the adjusting entry for revenues earned but not yet collected is not recorded, it leads to an understatement of accounts receivable (assets) and revenue (equity), hence also an understatement of net income and shareholders’ equity.

Tips

A common mistake is assuming liabilities are impacted; they remain unchanged in this scenario.

Sources

AI-generated content may contain errors. Please verify critical information