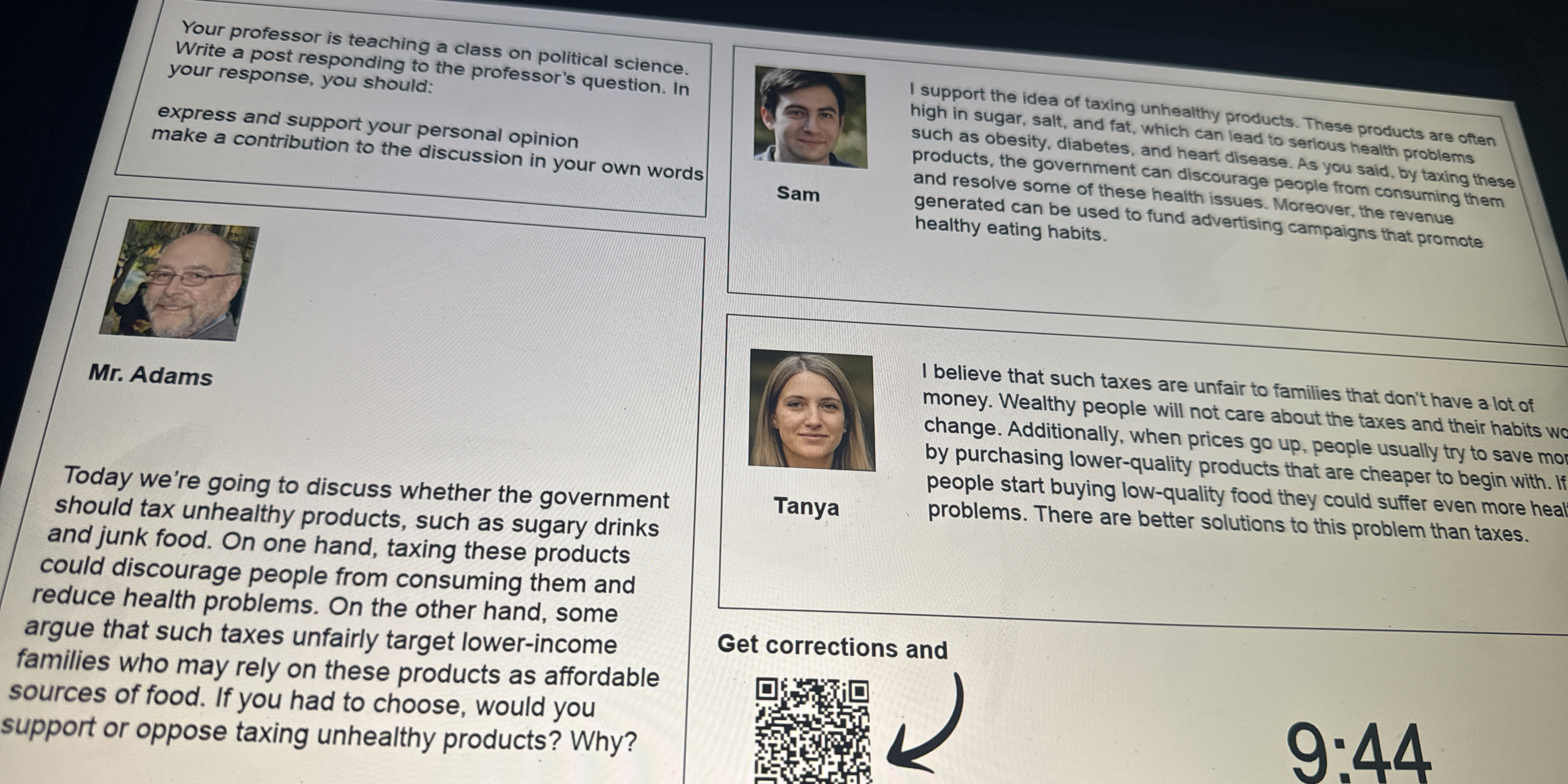

If you had to choose, would you support or oppose taxing unhealthy products? Why?

Understand the Problem

The question asks for a personal opinion on whether to support or oppose taxing unhealthy products. The respondent is expected to express and justify their stance in a discussion format.

Answer

Taxing unhealthy products can reduce consumption but may unfairly affect low-income families.

Taxing unhealthy products can discourage consumption and improve public health, but it may disproportionately affect low-income families who rely on these products. An effective approach might balance these concerns by also providing subsidies or incentives for healthier food options.

Answer for screen readers

Taxing unhealthy products can discourage consumption and improve public health, but it may disproportionately affect low-income families who rely on these products. An effective approach might balance these concerns by also providing subsidies or incentives for healthier food options.

More Information

Taxing unhealthy products, like sugary drinks and junk food, aims to reduce health issues like obesity and diabetes by discouraging consumption through higher prices. However, the economic impact on low-income families is a significant concern.

Tips

Ensure that arguments consider both public health benefits and the socioeconomic impact on different communities.

Sources

- Would taxes on unhealthy foods reduce obesity? - economicsobservatory.com

- Should we tax unhealthy food and drink? - PMC - pmc.ncbi.nlm.nih.gov

- Should governments tax unhealthy foods and drinks? - urban.org

AI-generated content may contain errors. Please verify critical information