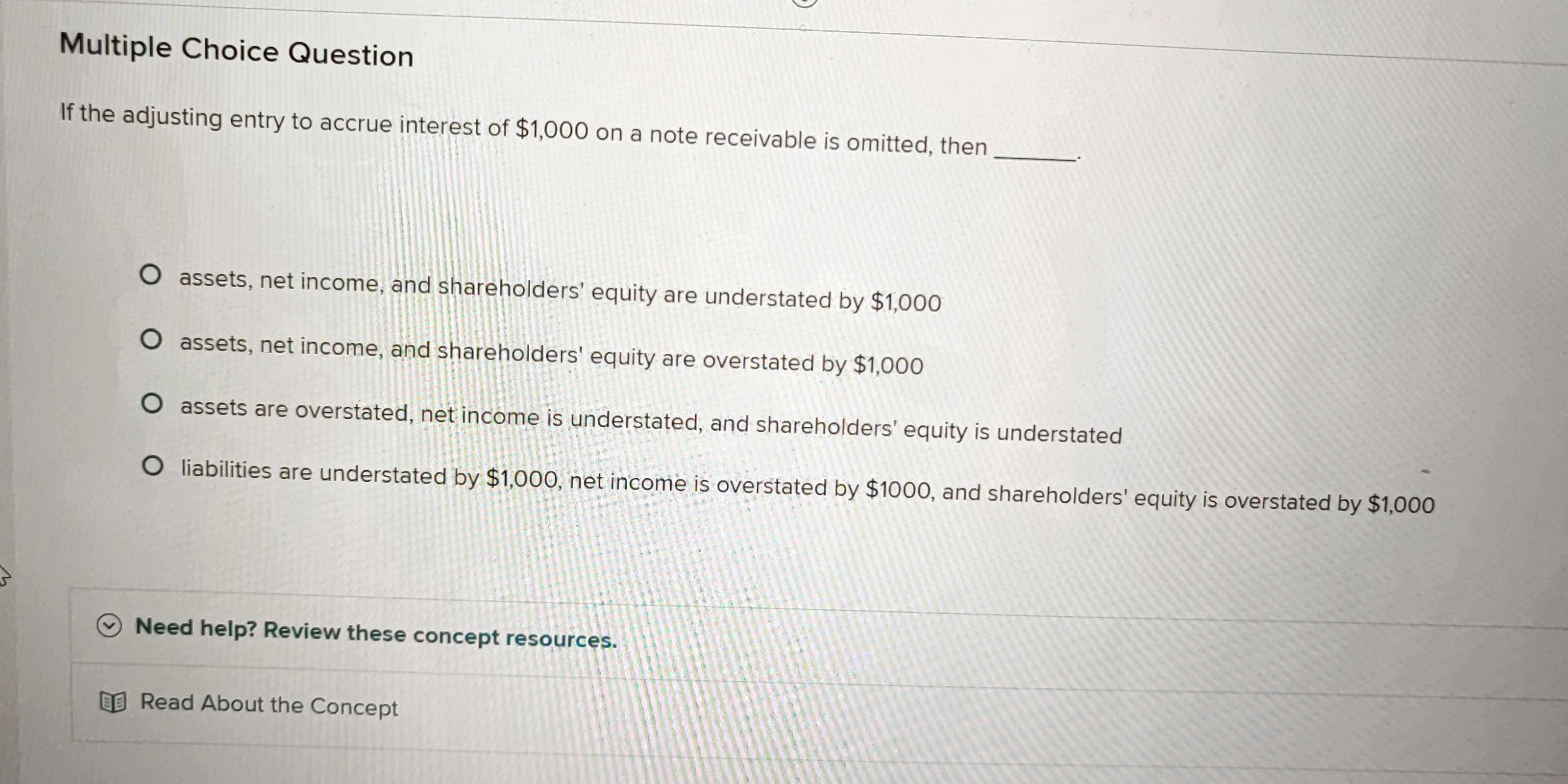

If the adjusting entry to accrue interest of $1,000 on a note receivable is omitted, then _____

Understand the Problem

The question is asking what would happen if the adjusting entry to accrue interest on a note receivable is omitted, specifically regarding the impact on assets, net income, and shareholders' equity.

Answer

Assets, net income, and shareholders' equity are understated by $1,000.

The final answer is assets, net income, and shareholders' equity are understated by $1,000.

Answer for screen readers

The final answer is assets, net income, and shareholders' equity are understated by $1,000.

More Information

When the adjusting entry to accrue interest is omitted, the company does not recognize an increase in interest receivable (assets) and interest income (part of net income), which in turn affects the equity.

Tips

A common mistake is thinking liabilities are affected, but in this case, it’s the assets and income statements that are impacted.

Sources

- Homework Study - Adjusting entry omission effects - homework.study.com

AI-generated content may contain errors. Please verify critical information