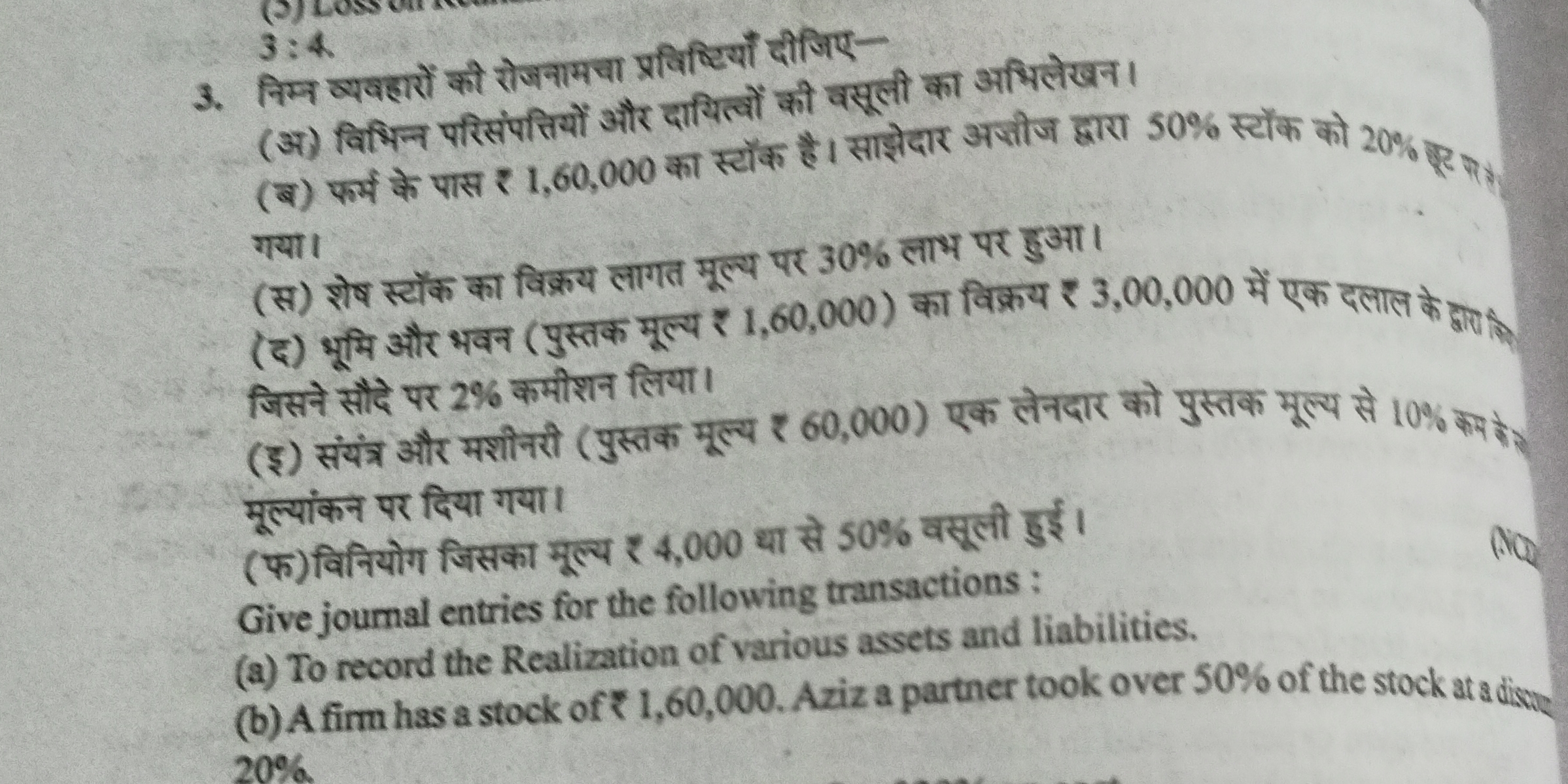

Give journal entries for the following transactions: (a) To record the realization of various assets and liabilities. (b) A firm has a stock of ₹ 1,60,000. Aziz a partner took over... Give journal entries for the following transactions: (a) To record the realization of various assets and liabilities. (b) A firm has a stock of ₹ 1,60,000. Aziz a partner took over 50% of the stock at a discount of 20%.

Understand the Problem

प्रश्न में विभिन्न लेनदेन के लिए जर्नल प्रविष्टियाँ देने को कहा गया है, जैसे स्टॉक की मान्यता और संपत्ति से संबंधित विवरण। यह प्रश्न लेखांकन के लिए संबंधित है और छात्रों को जर्नल प्रविष्टियाँ बनाने के तरीके को समझने में मदद करता है।

Answer

1. Debit: Realization Account, Credit: Liabilities Account 2. Debit: Aziz's Capital Account ₹ 64,000, Credit: Stock Account ₹ 80,000, Debit: Discount Allowed Account ₹ 16,000

Answer for screen readers

-

To record the realization of various assets and liabilities:

- Debit: Realization Account

- Credit: Liabilities Account

-

Journal entry for Aziz:

- Debit: Aziz's Capital Account ₹ 64,000

- Credit: Stock Account ₹ 80,000

- Debit: Discount Allowed Account ₹ 16,000

Steps to Solve

- Recording the Realization of Assets and Liabilities

To record the realization of various assets and liabilities, we will generally credit the assets and debit the liabilities.

- Debit: Realization Account $ (TOTAL ASSETS) $

- Credit: Liabilities Account $ (TOTAL LIABILITIES) $

- Journal Entry for Stock Transfer to Aziz

Aziz is taking over 50% of the stock valued at ₹ 1,60,000 at a discount of 20%.

-

Calculate the total stock Aziz is taking over:

- $ 50% \text{ of } ₹ 1,60,000 = ₹ 80,000 $

-

Calculate the discount on the stock:

- $ 20% \text{ of } ₹ 80,000 = ₹ 16,000 $

-

Therefore, the book value for Aziz:

- $ ₹ 80,000 - ₹ 16,000 = ₹ 64,000 $

- Journal Entry for Aziz's Purchase

Now we will create the journal entry reflecting Aziz's purchase of the stock.

-

Debit: Aziz's Capital Account

- Amount: ₹ 64,000

-

Credit: Stock Account

- Amount: ₹ 80,000

- Recording the Discount

We also need to record the discount on stock.

- Debit: Discount Allowed Account

- Amount: ₹ 16,000

-

To record the realization of various assets and liabilities:

- Debit: Realization Account

- Credit: Liabilities Account

-

Journal entry for Aziz:

- Debit: Aziz's Capital Account ₹ 64,000

- Credit: Stock Account ₹ 80,000

- Debit: Discount Allowed Account ₹ 16,000

More Information

The journal entries help in understanding the financial transactions related to asset realization and partner contributions. It ensures that all transactions are accurately recorded in the books of accounts.

Tips

- Forgetting to account for the discount on stock can lead to incorrect valuation of stock and capital accounts.

- Not recording the realization of liabilities properly can affect the financial position of the firm.

AI-generated content may contain errors. Please verify critical information