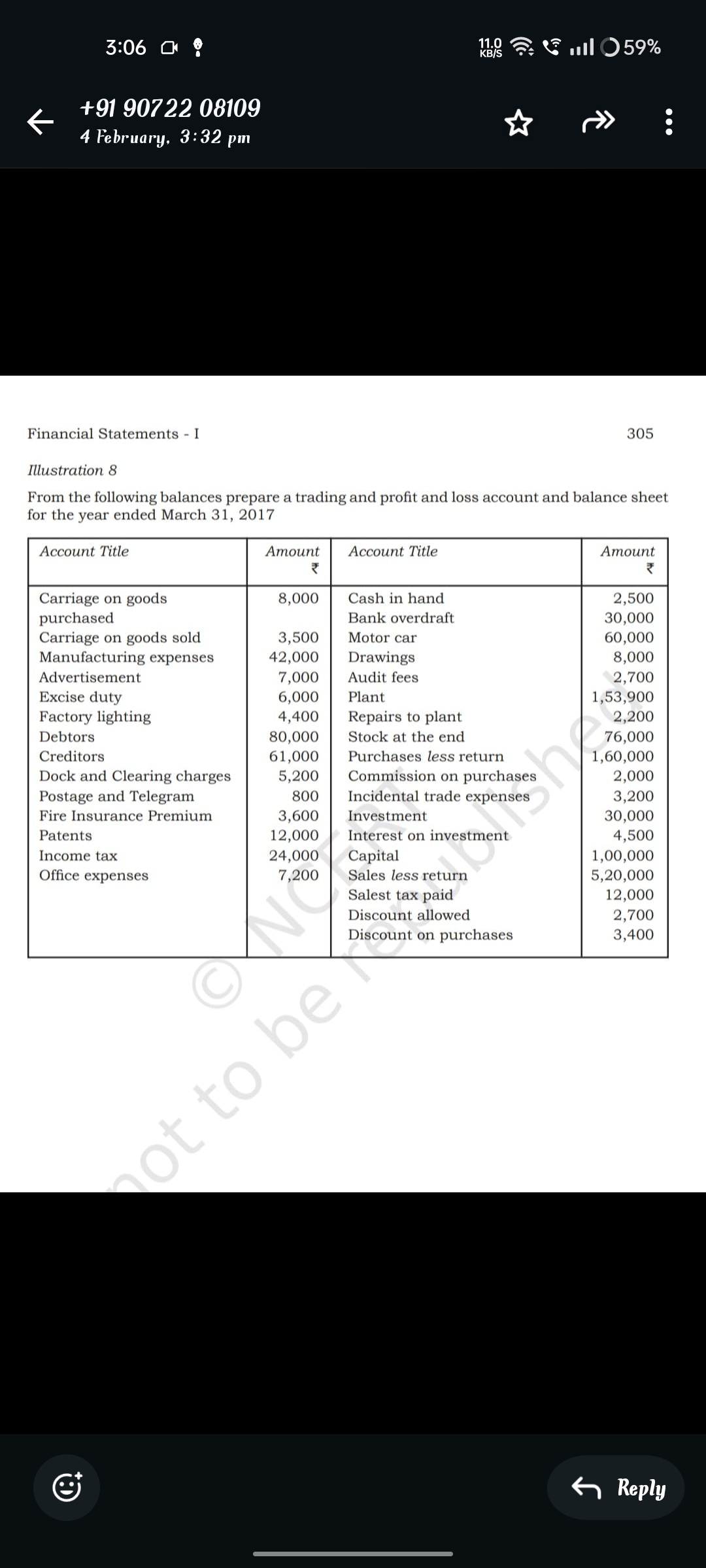

From the following balances prepare a trading and profit and loss account and balance sheet for the year ended March 31, 2017.

Understand the Problem

The question is asking to prepare a trading and profit and loss account as well as a balance sheet based on the provided financial balances for the year ending March 31, 2017. This involves organizing the given amounts into appropriate financial statements while applying relevant accounting principles.

Answer

Gross Profit: ₹4,74,500, Net Profit: ₹3,85,800, Total Assets: ₹4,63,400.

Answer for screen readers

- Gross Profit: ₹4,74,500

- Net Profit: ₹3,85,800

- Total Assets: ₹4,63,400

Steps to Solve

-

Calculate Gross Profit To calculate the Gross Profit, we need to determine the Total Revenue and Total Cost of Goods Sold (COGS).

1.1 Calculate Total Revenue: Revenue is derived from the sales amount: $$ \text{Total Revenue} = \text{Sales} - \text{Sales less return} $$ Given: Total Sales = ₹5,20,000, Sales less return = ₹5,20,000.

Therefore, $$ \text{Total Revenue} = ₹5,20,000 $$

1.2 Calculate COGS: COGS includes cost of goods sold and any direct expenses related to the manufacturing goods: $$ \text{COGS} = \text{Carriage on goods sold} + \text{Manufacturing expenses} $$ Using values from the table: $$ \text{COGS} = ₹3,500 + ₹42,000 = ₹45,500 $$

1.3 Gross Profit Calculation: Now, subtract COGS from Total Revenue: $$ \text{Gross Profit} = \text{Total Revenue} - \text{COGS} $$ $$ \text{Gross Profit} = ₹5,20,000 - ₹45,500 = ₹4,74,500 $$

-

Calculate Net Profit To calculate Net Profit, we need to subtract all operating expenses from Gross Profit.

2.1 Calculate Total Expenses: Total expenses include items such as office expenses, advertisement expenses, and other trade expenses:

- Total Expenses = ₹7,200 (Office expenses) + ₹42,000 (Advertisement expenses) + ₹3,200 (Trade expenses) + ₹2,700 (Audit fees) + ₹3,600 (Fire Insurance Premium) + ₹24,000 (Income tax) + ₹6,000 (Excise duty).

Adding these amounts gives: $$ \text{Total Expenses} = ₹7,200 + ₹42,000 + ₹3,200 + ₹2,700 + ₹3,600 + ₹24,000 + ₹6,000 = ₹88,700 $$

2.2 Net Profit Calculation: Subtract Total Expenses from Gross Profit: $$ \text{Net Profit} = \text{Gross Profit} - \text{Total Expenses} $$ $$ \text{Net Profit} = ₹4,74,500 - ₹88,700 = ₹3,85,800 $$

-

Prepare the Balance Sheet The balance sheet includes Total Assets, Liabilities, and Capital.

3.1 Calculate Total Assets: Total Assets are the sum of all asset account balances: $$ \text{Total Assets} = \text{Cash in hand} + \text{Bank overdraft} + \text{Debtors} + \text{Creditors} + \text{Stock at end} + \text{Motor car} + \text{Plant} $$ Given the values: Cash in hand = ₹2,500, Bank overdraft (liability) = ₹30,000, Debtors = ₹80,000, Creditors = ₹61,000, Stock at end = ₹76,000, Motor car = ₹60,000, Plant = ₹1,53,900.

Therefore, the Total Assets balance equals: $$ \text{Total Assets} = ₹2,500 + ₹30,000 + ₹80,000 + ₹61,000 + ₹76,000 + ₹60,000 + ₹1,53,900 = ₹4,63,400 $$

3.2 Calculate Total Liabilities: Liabilities are the sum of the Bank overdraft, Creditors, and any other liabilities not specified in the problem.

3.3 Prepare Capital Calculation: Finally, calculate Capital: $$ \text{Capital} = \text{Net Profit} + \text{Initial Capital} $$ Assuming capital before profit is given, add net profit to find the closing capital.

- Gross Profit: ₹4,74,500

- Net Profit: ₹3,85,800

- Total Assets: ₹4,63,400

More Information

These financial statements summarize the financial position of the business for the year ended March 31, 2017. Understanding these components can help stakeholders assess profitability and financial stability.

Tips

- Mixing up total revenues and total expenses can lead to an incorrect net profit calculation.

- Forgetting to adjust for returns in sales revenue calculation.

- Misclassifying liabilities and assets when preparing the balance sheet.

AI-generated content may contain errors. Please verify critical information