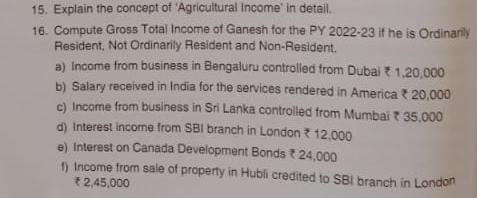

Explain the concept of 'Agricultural Income' in detail. Compute Gross Total Income of Ganesh for the PY 2022-23 if he is Ordinarily Resident, Not Ordinarily Resident and Non-Reside... Explain the concept of 'Agricultural Income' in detail. Compute Gross Total Income of Ganesh for the PY 2022-23 if he is Ordinarily Resident, Not Ordinarily Resident and Non-Resident.

Understand the Problem

The question consists of two parts: the first part asks for an explanation of the concept of 'Agricultural Income,' while the second part requests the calculation of the total income of an individual named Ganesh for a specific financial year considering his residency status and various sources of income.

Answer

Ganesh's Gross Total Income: OR: ₹4,56,000; NOR: ₹4,20,000; NR: ₹2,65,000.

Ganesh's Gross Total Income will vary based on his residential status.

-

Ordinarily Resident

- Include all incomes: Bengaluru business, American salary, Sri Lanka business, London SBI interest, Canada Bonds, Hubli property.

- Total: ₹4,56,000.

-

Not Ordinarily Resident

- Include incomes received or accruing in India or controlled from India: Bengaluru business, American salary, Sri Lanka business, Hubli property.

- Total: ₹4,20,000.

-

Non-Resident

- Include incomes received/accrued in India: American salary, Hubli property.

- Total: ₹2,65,000.

Answer for screen readers

Ganesh's Gross Total Income will vary based on his residential status.

-

Ordinarily Resident

- Include all incomes: Bengaluru business, American salary, Sri Lanka business, London SBI interest, Canada Bonds, Hubli property.

- Total: ₹4,56,000.

-

Not Ordinarily Resident

- Include incomes received or accruing in India or controlled from India: Bengaluru business, American salary, Sri Lanka business, Hubli property.

- Total: ₹4,20,000.

-

Non-Resident

- Include incomes received/accrued in India: American salary, Hubli property.

- Total: ₹2,65,000.

More Information

Agricultural income is generally exempt from income tax, influencing how other incomes are assessed, particularly for residents with foreign income.

Tips

Avoid confusing 'agricultural income' with other types of income, ensuring it's correctly identified as exempt under the Income Tax Act.

Sources

- Agricultural Income in Income Tax: Exemption Limit, Tax Calculation - cleartax.in

- Residential Status & Scope of Total Income - Studycaller - studycaller.com

AI-generated content may contain errors. Please verify critical information