Compute the static budget variance, the sales-activity variance and the flexible-budget variance for both (i) revenues and (ii) operating income. Use U or F to indicate whether the... Compute the static budget variance, the sales-activity variance and the flexible-budget variance for both (i) revenues and (ii) operating income. Use U or F to indicate whether the variances are favorable or unfavorable. Compute the direct material flexible budget variance for the quarter and split it down into the quantity variance and the price variance. Use U or F to indicate whether the variances are favorable or unfavorable. Compute the variable manufacturing overhead flexible budget variance for the quarter and split it down into the quantity variance and the spending variance. Use U or F to indicate whether the variances are favorable or unfavorable.

Understand the Problem

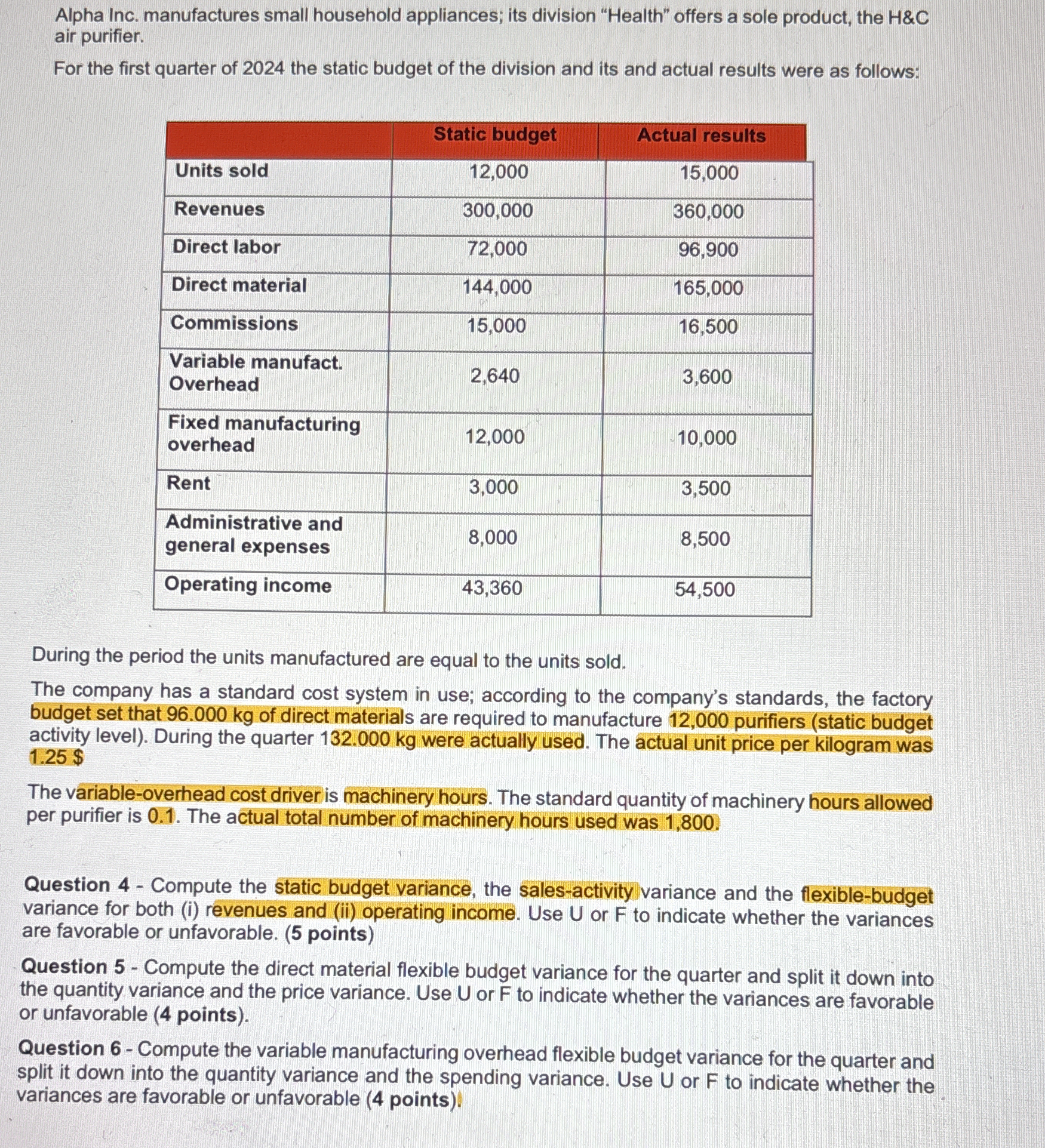

The question is asking to compute various financial variances based on provided static budget and actual results for Alpha Inc.'s Health division. Specifically, it wants to calculate the static budget variance, sales-activity variance, and flexible-budget variance for revenues and operating income, while indicating whether these variances are favorable or unfavorable.

Answer

- Static Budget Revenue Variance: $60,000 \, (F)$, Static Budget Operating Income Variance: $11,140 \, (F)$, Sales-Activity Revenue Variance: $75,000 \, (F)$, Sales-Activity Operating Income Variance: $39,590 \, (F)$, Flexible Budget Revenue Variance: $-15,000 \, (U)$, Flexible Budget Operating Income Variance: $-28,450 \, (U)$.

Answer for screen readers

- Static Budget Variance for Revenues: $60,000 , (F)$

- Static Budget Variance for Operating Income: $11,140 , (F)$

- Sales-Activity Variance for Revenues: $75,000 , (F)$

- Sales-Activity Variance for Operating Income: $39,590 , (F)$

- Flexible-Budget Variance for Revenues: $-15,000 , (U)$

- Flexible-Budget Variance for Operating Income: $-28,450 , (U)$

Steps to Solve

-

Calculating Static Budget Variance for Revenues

The static budget variance for revenues is calculated as: [ \text{Static Budget Variance} = \text{Actual Revenues} - \text{Static Budget Revenues} ] Plugging in the values: [ \text{Static Budget Variance} = 360,000 - 300,000 = 60,000 ] Since actual revenues are higher than the budget, this is favorable (F).

-

Calculating Static Budget Variance for Operating Income

The static budget variance for operating income is calculated as: [ \text{Static Budget Variance} = \text{Actual Operating Income} - \text{Static Budget Operating Income} ] Plugging in the values: [ \text{Static Budget Variance} = 54,500 - 43,360 = 11,140 ] This is also favorable (F) since actual income exceeded the budgeted amount.

-

Calculating Sales-Activity Variance for Revenues

The sales-activity variance for revenues is calculated based on the difference between the flexible budget at actual units sold and the static budget. First, calculate flexible revenues: [ \text{Flexible Budget Revenues} = \text{Units Sold (Actual)} \times \left(\frac{\text{Static Budget Revenues}}{\text{Static Budget Units Sold}}\right) ] Using the values: [ \text{Flexible Budget Revenues} = 15,000 \times \left(\frac{300,000}{12,000}\right) = 15,000 \times 25 = 375,000 ] Now calculate the variance: [ \text{Sales-Activity Variance} = \text{Flexible Budget Revenues} - \text{Static Budget Revenues} = 375,000 - 300,000 = 75,000 ] This results in a favorable (F) variance.

-

Calculating Sales-Activity Variance for Operating Income

Follow a similar calculation as revenues for the operating income: [ \text{Flexible Budget Operating Income} = \text{Flexible Budget Revenues} - \text{Variable Costs (Flexible Budget)} ] First, calculate variable costs for the flexible budget. Start with direct labor and materials using the actual sold units:

- Direct labor: [ \text{Direct Labor} = 15,000 \times \left(\frac{72,000}{12,000}\right) = 90,000 ]

- Direct material: [ \text{Direct Material} = 15,000 \times \left(\frac{144,000}{12,000}\right) = 180,000 ]

- Commissions: [ \text{Commissions} = 15,000 \times \left(\frac{15,000}{12,000}\right) = 18,750 ]

- Variable Manufacturing Overhead: [ \text{Variable Overhead} = 15,000 \times \left(\frac{2,640}{12,000}\right) = 3,300 ]

Now summing these costs: [ \text{Total Variable Costs} = 90,000 + 180,000 + 18,750 + 3,300 = 292,050 ] Calculate flexible budget operating income: [ \text{Flexible Budget Operating Income} = 375,000 - 292,050 = 82,950 ] The sales-activity variance for operating income is: [ \text{Sales-Activity Variance} = \text{Flexible Budget Operating Income} - \text{Static Budget Operating Income} ] Plugging in the values: [ \text{Sales-Activity Variance} = 82,950 - 43,360 = 39,590 ] Also favorable (F).

-

Calculating Flexible-Budget Variance for Revenues

This variance is computed as: [ \text{Flexible-Budget Variance} = \text{Actual Revenues} - \text{Flexible Budget Revenues} ] Plugging in the values: [ \text{Flexible-Budget Variance} = 360,000 - 375,000 = -15,000 ] This is unfavorable (U) as actual revenues were less than the flexible budget.

-

Calculating Flexible-Budget Variance for Operating Income

Similarly, calculate the flexible-budget variance for operating income: [ \text{Flexible-Budget Variance} = \text{Actual Operating Income} - \text{Flexible Budget Operating Income} ] Plugging in the values: [ \text{Flexible-Budget Variance} = 54,500 - 82,950 = -28,450 ] This is also unfavorable (U).

- Static Budget Variance for Revenues: $60,000 , (F)$

- Static Budget Variance for Operating Income: $11,140 , (F)$

- Sales-Activity Variance for Revenues: $75,000 , (F)$

- Sales-Activity Variance for Operating Income: $39,590 , (F)$

- Flexible-Budget Variance for Revenues: $-15,000 , (U)$

- Flexible-Budget Variance for Operating Income: $-28,450 , (U)$

More Information

The calculations reveal how actual performance compared to budgeted expectations. The terms "favorable" and "unfavorable" indicate whether the actual results exceeded or fell short of expectations.

Tips

- Forgetting to clearly specify which budget (static, flexible) is being used for each calculation.

- Miscalculating flexible budgets by not adjusting for actual units sold.

AI-generated content may contain errors. Please verify critical information