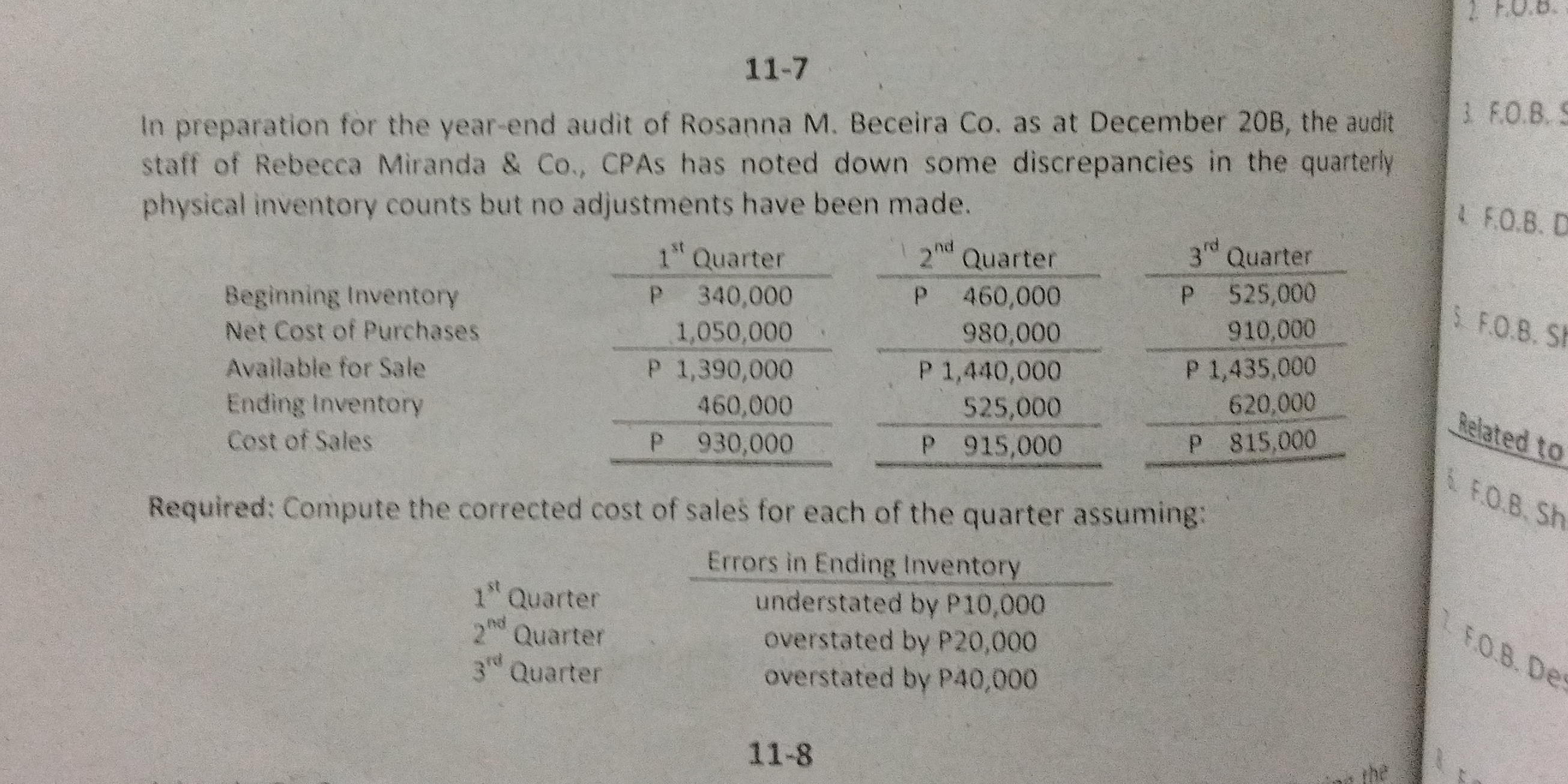

Compute the corrected cost of sales for each of the quarter assuming: 1st Quarter understated by P10,000; 2nd Quarter overstated by P20,000; 3rd Quarter overstated by P40,000.

Understand the Problem

The question requires the computation of the corrected cost of sales for each quarter, taking into consideration specific errors in the ending inventory for each quarter. The solution will involve adjustments based on the listed errors in inventory and the existing financial data provided.

Answer

1st Quarter: P920,000; 2nd Quarter: P935,000; 3rd Quarter: P855,000

Answer for screen readers

1st Quarter: P920,000; 2nd Quarter: P935,000; 3rd Quarter: P855,000

Steps to Solve

-

Calculate the Corrected Ending Inventory for Each Quarter

To find the corrected ending inventory, we adjust the reported ending inventory for each quarter based on the errors noted. The adjustments are:

- 1st Quarter: Understated by P10,000

- 2nd Quarter: Overstated by P20,000

- 3rd Quarter: Overstated by P40,000

Therefore:

- Corrected Ending Inventory for 1st Quarter = $460,000 + P10,000 = P470,000$

- Corrected Ending Inventory for 2nd Quarter = $525,000 - P20,000 = P505,000$

- Corrected Ending Inventory for 3rd Quarter = $620,000 - P40,000 = P580,000$

-

Calculate the Corrected Cost of Sales for Each Quarter

The Cost of Sales is computed as follows:

[ \text{Cost of Sales} = \text{Available for Sale} - \text{Ending Inventory} ]

Using the previously calculated adjusted ending inventories:

- For 1st Quarter (Available for Sale = P1,390,000): $$ \text{Corrected Cost of Sales} = P1,390,000 - P470,000 = P920,000 $$

- For 2nd Quarter (Available for Sale = P1,440,000): $$ \text{Corrected Cost of Sales} = P1,440,000 - P505,000 = P935,000 $$

- For 3rd Quarter (Available for Sale = P1,435,000): $$ \text{Corrected Cost of Sales} = P1,435,000 - P580,000 = P855,000 $$

-

Summary of Corrected Cost of Sales for Each Quarter

Thus, the corrected cost of sales for each quarter is:

- 1st Quarter: P920,000

- 2nd Quarter: P935,000

- 3rd Quarter: P855,000

1st Quarter: P920,000; 2nd Quarter: P935,000; 3rd Quarter: P855,000

More Information

The adjustments made to the ending inventory directly impact the cost of sales, as they alter the calculation by changing the available value that has not yet been sold. Accurate inventory management is crucial for financial reporting.

Tips

- Neglecting Inventory Adjustments: Always remember to account for any inventory discrepancies before calculating cost of sales.

- Incorrect Application of Adjustments: Ensure that understatements are added and overstatements are subtracted properly.

AI-generated content may contain errors. Please verify critical information