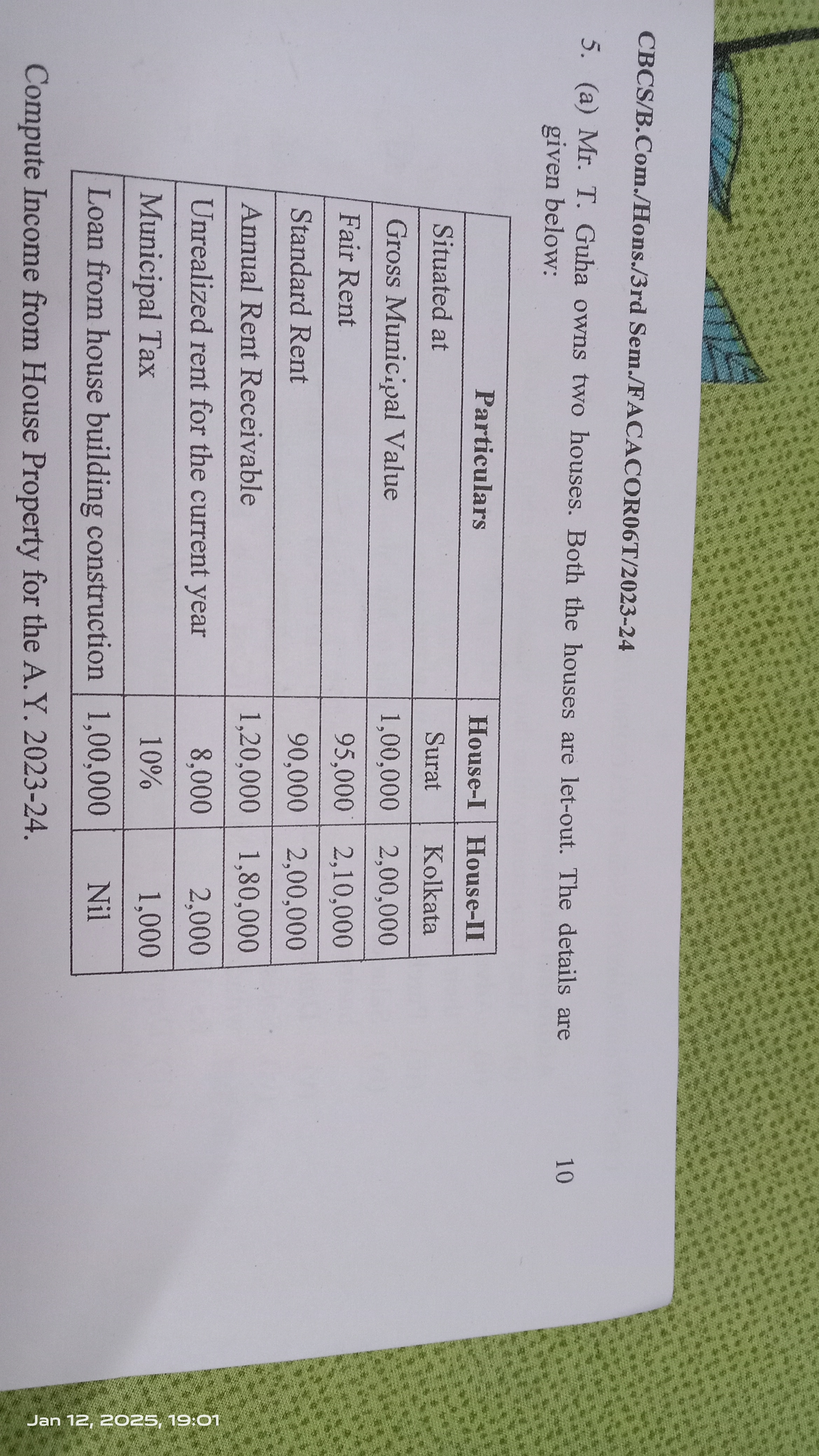

Compute Income from House Property for Mr. T. Guha based on the details provided for two houses in Surat and Kolkata.

Understand the Problem

The question is asking to compute the income from house property based on the provided details of two houses owned by Mr. T. Guha. The details include figures such as gross municipal value, fair rent, standard rent, and municipal tax which are essential for calculating the net income from the properties.

Answer

The total income from house property is ₹269,100.

Answer for screen readers

The total income from house property for the A.Y. 2023-24 is ₹269,100.

Steps to Solve

- Identify the Inputs for Each House

For House-I:

- Gross Municipal Value (GMV): $100,000$

- Fair Rent: $120,000$

- Standard Rent: $90,000$

- Municipal Tax (10% of GMV): $10,000$

For House-II:

- GMV: $209,000$

- Fair Rent: $209,000$

- Standard Rent: $210,000$

- Municipal Tax (10% of GMV): $20,900$

- Calculate Annual Rent Receivable

For House-I:

- Annual Rent Receivable: $90,000$ (as this is the Standard Rent)

For House-II:

- Annual Rent Receivable: $210,000$ (also the Standard Rent)

- Determine the Net Annual Value (NAV)

NAV is calculated as: $$ \text{NAV} = \text{Annual Rent Receivable} - \text{Municipal Tax} $$

For House-I: $$ \text{NAV}_1 = 90,000 - 10,000 = 80,000 $$

For House-II: $$ \text{NAV}_2 = 210,000 - 20,900 = 189,100 $$

- Calculate Total Income from House Property

Total Income from both houses is: $$ \text{Total Income} = \text{NAV}_1 + \text{NAV}_2 $$

Calculating it: $$ \text{Total Income} = 80,000 + 189,100 = 269,100 $$

The total income from house property for the A.Y. 2023-24 is ₹269,100.

More Information

This calculation summarizes the income derived from the properties owned by Mr. T. Guha, showcasing the impact of municipal taxes and rental values on property income. Understanding these concepts is vital for property owners and tax assessments.

Tips

- Forgetting to apply the municipal tax percentage correctly.

- Using net values from fair rent instead of standard rent, which leads to incorrect annual rent receivable calculations.

AI-generated content may contain errors. Please verify critical information