Calculate the capital fund on 31st December, 2019, considering given financial information.

Understand the Problem

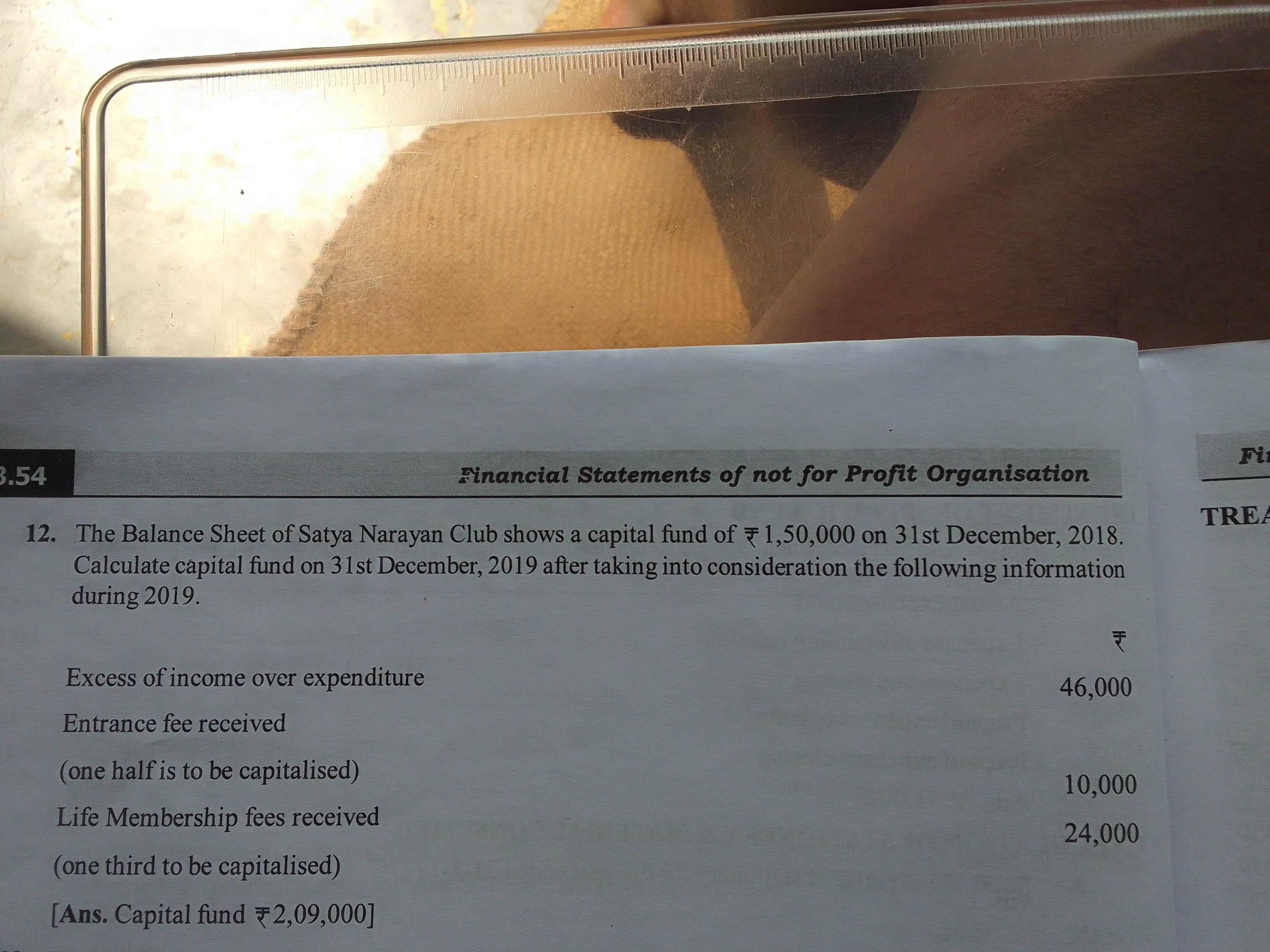

The question is asking to calculate the capital fund of Satya Narayan Club for the year ending 31st December 2019, based on the provided financial data. The user needs to analyze the excess of income over expenditure, entrance fee, and life membership fees, some of which need to be capitalized.

Answer

The capital fund is ₹ 2,09,000.

Answer for screen readers

The capital fund on 31st December 2019 is ₹ 2,09,000.

Steps to Solve

-

Initial Capital Fund The capital fund on 31st December 2018 is given as ₹ 1,50,000.

-

Excess of Income Over Expenditure Add the excess of income over expenditure (₹ 46,000) to the initial capital fund: $$ 1,50,000 + 46,000 = 1,96,000 $$

-

Entrance Fee Calculation The entrance fee received is ₹ 10,000, and one half (50%) needs to be capitalized. Therefore, the capitalized amount is: $$ 10,000 \times \frac{1}{2} = 5,000 $$

-

Life Membership Fee Calculation The life membership fees received is ₹ 24,000, and one third (33.33%) needs to be capitalized. Therefore, the capitalized amount is: $$ 24,000 \times \frac{1}{3} = 8,000 $$

-

Total Capital Fund Calculation Now, add the capitalized amounts of the entrance fee and life membership fees to the recently calculated capital fund: $$ 1,96,000 + 5,000 + 8,000 = 2,09,000 $$

The capital fund on 31st December 2019 is ₹ 2,09,000.

More Information

The capital fund reflects the total reserves of the club, considering both income generated during the year and specific fees received that enhance the fund. Proper accounting ensures transparency and effective management of club finances.

Tips

- Forgetting to capitalize only the specified portions of entrance and life membership fees.

- Neglecting to add the excess income over expenditure correctly before adding additional capitalized amounts.

AI-generated content may contain errors. Please verify critical information