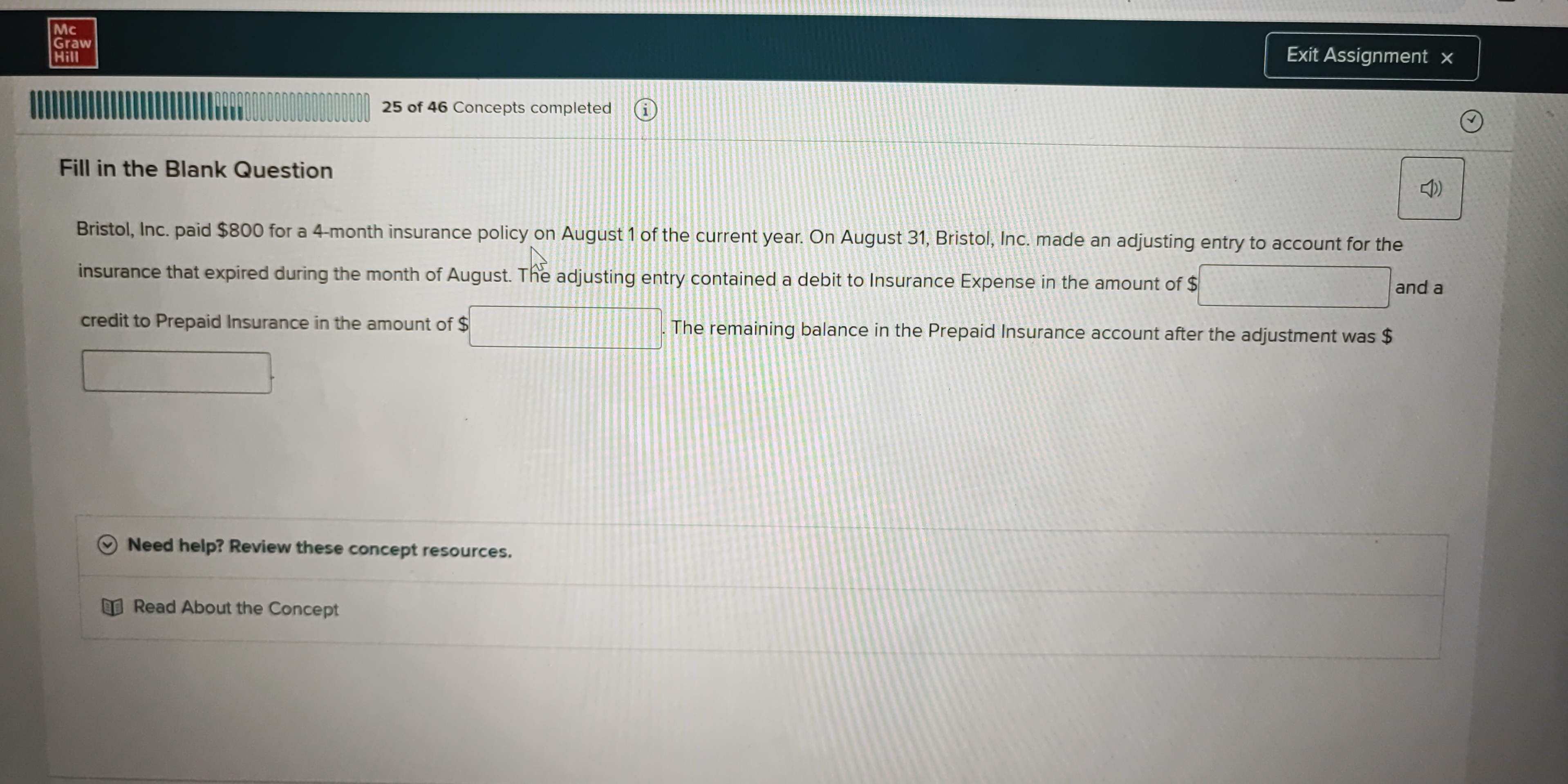

Bristol, Inc. paid $800 for a 4-month insurance policy on August 1 of the current year. On August 31, Bristol, Inc. made an adjusting entry. The adjusting entry contained a debit t... Bristol, Inc. paid $800 for a 4-month insurance policy on August 1 of the current year. On August 31, Bristol, Inc. made an adjusting entry. The adjusting entry contained a debit to Insurance Expense in the amount of $ and a credit to Prepaid Insurance in the amount of $. The remaining balance in the Prepaid Insurance account after the adjustment was $.

Understand the Problem

The question is asking for the amounts to be filled in related to the accounting entries for an insurance policy that Bristol, Inc. paid for and how it impacts their financial statements.

Answer

The adjusting entry contained a debit to Insurance Expense in the amount of $200 and a credit to Prepaid Insurance in the amount of $200. The remaining balance in the Prepaid Insurance account after the adjustment was $600.

Answer for screen readers

The adjusting entry contained a debit to Insurance Expense in the amount of $200 and a credit to Prepaid Insurance in the amount of $200. The remaining balance in the Prepaid Insurance account after the adjustment was $600.

Steps to Solve

-

Calculate Monthly Insurance Expense Bristol, Inc. paid $800 for a 4-month insurance policy. To find the monthly insurance expense, divide the total cost by the number of months: $$ \text{Monthly Insurance Expense} = \frac{800}{4} = 200 $$

-

Determine Adjusting Entry for August Since one month (August) of insurance has expired, the adjusting entry for Insurance Expense will be the amount for that month: $$ \text{Debit to Insurance Expense} = 200 $$

-

Calculate Remaining Balance in Prepaid Insurance Initially, the Prepaid Insurance account had $800. After debiting $200 for the expense, we calculate the remaining balance: $$ \text{Remaining Balance} = 800 - 200 = 600 $$

-

Fill in the Blanks Now we can use the amounts calculated to fill in the blanks in the question.

The adjusting entry contained a debit to Insurance Expense in the amount of $200 and a credit to Prepaid Insurance in the amount of $200. The remaining balance in the Prepaid Insurance account after the adjustment was $600.

More Information

Bristol, Inc. uses a common accounting method called "prepaid expenses," where the cost paid in advance is recorded as an asset and expensed over time as the service is received.

Tips

- Forgetting to divide by the number of months.

- Miscalculating the remaining balance in Prepaid Insurance by not subtracting the used portion.

AI-generated content may contain errors. Please verify critical information