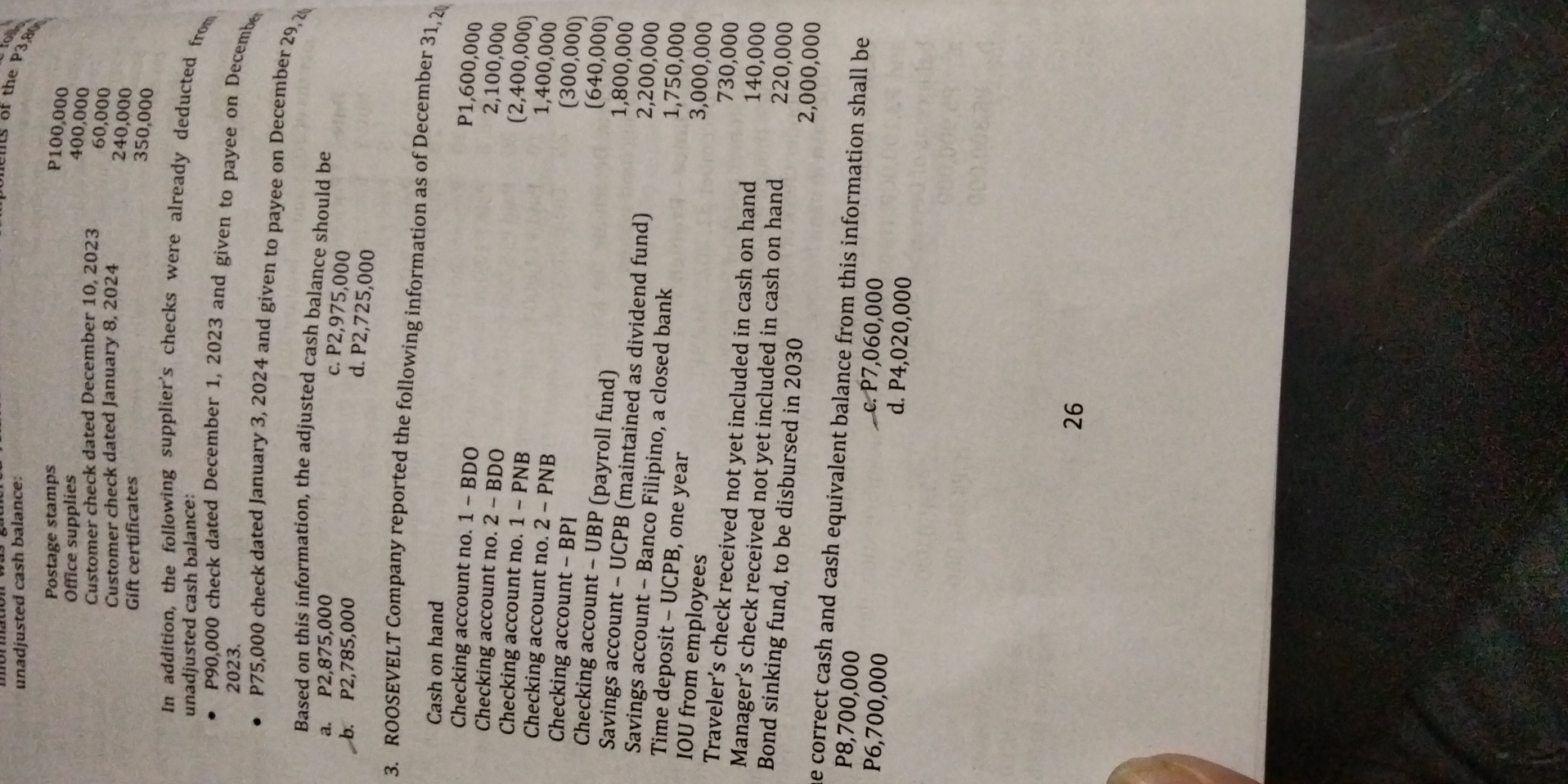

Based on this information, the adjusted cash balance should be: a. P2,975,000 b. P2,785,000 c. P7,060,000 d. P4,020,000

Understand the Problem

The question involves calculating the adjusted cash balance based on given transactions and account details for Roosevelt Company as of December 31, 2023. It requires taking into account checks already issued, cash availability, and deposits to find the correct ending balance.

Answer

The adjusted cash balance is P2,975,000.

Answer for screen readers

The adjusted cash balance is P2,975,000.

Steps to Solve

-

Identify the unadjusted cash balance

From the provided information, note the total unadjusted cash balance. This is typically listed as "cash on hand" or similar.

-

Account for outstanding checks

Identify checks issued that have not cleared yet. Subtract these amounts from the unadjusted cash balance.

-

Include any additional cash inflows

Add any deposits that are not yet included but will be available. This might include checks that have not yet been deposited.

-

Consider cash equivalents

Include any cash equivalents that can be used. This may consist of items such as savings accounts or time deposits that are readily accessible.

-

Calculate the adjusted cash balance

The formula is as follows:

$$ \text{Adjusted Cash Balance} = \text{Unadjusted Cash Balance} - \text{Outstanding Checks} + \text{Deposits} + \text{Cash Equivalents} $$

-

Check calculations against provided options

Compare your calculated adjusted cash balance with the given options to determine the correct answer.

The adjusted cash balance is P2,975,000.

More Information

The adjusted cash balance provides a more accurate reflection of funds available for operations as it considers the actual cash that can be accessed once outstanding items are accounted for.

Tips

- Not accounting for all outstanding checks.

- Forgetting to include additional deposits that are available.

- Miscalculating the cash equivalents or failing to consider them altogether.

AI-generated content may contain errors. Please verify critical information