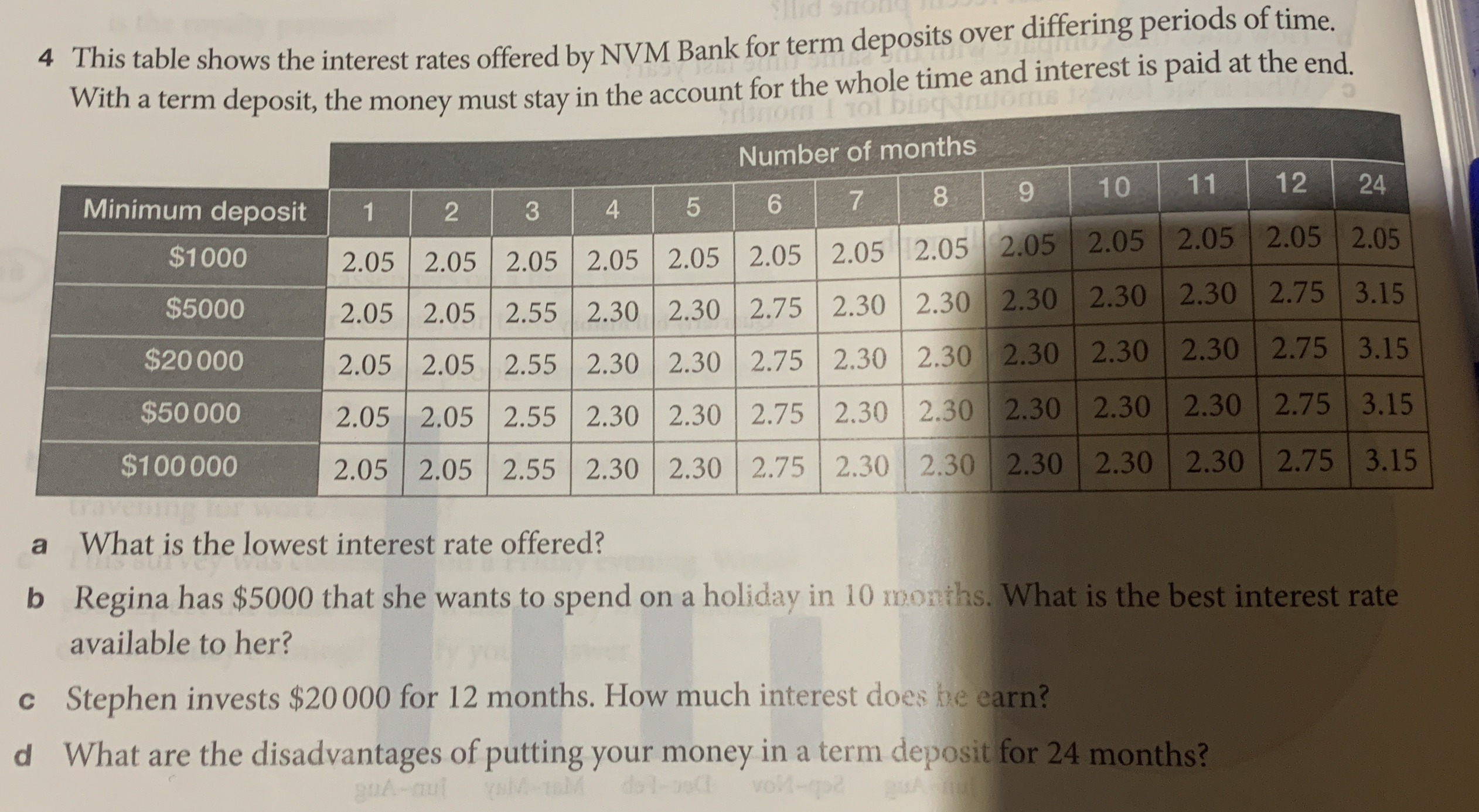

Based on the table provided: a) What is the lowest interest rate offered? b) Regina has $5000 that she wants to spend on a holiday in 10 months. What is the best interest rate av... Based on the table provided: a) What is the lowest interest rate offered? b) Regina has $5000 that she wants to spend on a holiday in 10 months. What is the best interest rate available to her? c) Stephen invests $20000 for 12 months. How much interest does he earn? d) What are the disadvantages of putting your money in a term deposit for 24 months?

Understand the Problem

The question involves understanding interest rates for term deposits at NVM Bank. Part (a) requires identifying the lowest interest rate from the provided table. Part (b) asks to find the best interest rate for a $5000 deposit over 10 months. Part (c) involves calculating the interest earned on a $20000 investment for 12 months. Part (d) requires brainstorming the downsides of locking money in a 24-month term deposit.

Answer

a. 2.05% b. 2.30% c. $550 d. Limited access to funds, missed opportunities for higher interest rates, inability to address unexpected needs.

Answer for screen readers

a. The lowest interest rate offered is 2.05%. b. The best interest rate available to Regina is 2.30%. c. Stephen earns $5500 in interest. d. Disadvantages of a 24-month term deposit include:

- You cannot access your money during that time without penalty.

- You may miss out on higher interest rates if they become available later.

- Unexpected financial needs may arise that you cannot address without breaking the term deposit.

Steps to Solve

- Identify the lowest interest rate

Scan the entire table to find the smallest interest rate.

- Find the best interest rate for $5000 over 10 months

Locate the row corresponding to the $5000 minimum deposit and the column corresponding to 10 months.

- Calculate interest earned on $20000 for 12 months

Find the interest rate for a $20000 deposit over 12 months. Then calculate the interest earned using the formula: Interest = Principal x Interest Rate.

- Brainstorm disadvantages of a 24-month term deposit

Consider scenarios where locking money away for 24 months could be problematic.

a. The lowest interest rate offered is 2.05%. b. The best interest rate available to Regina is 2.30%. c. Stephen earns $5500 in interest. d. Disadvantages of a 24-month term deposit include:

- You cannot access your money during that time without penalty.

- You may miss out on higher interest rates if they become available later.

- Unexpected financial needs may arise that you cannot address without breaking the term deposit.

More Information

The interest earned by Stephen is calculated as follows: Interest rate for $20000 for 12 months = $2.75% = 0.0275$. Interest = Principal x Interest Rate = $20000 \times 0.0275 = $550$.

Tips

A common mistake is misreading the table or misinterpreting the interest rates. Careful reading is important. Another common mistake is calculating percentage: Remember to divide the percentage rate by 100 before perfoming the calculations e.g. 2.75% is 0.0275 in decimal form.

AI-generated content may contain errors. Please verify critical information