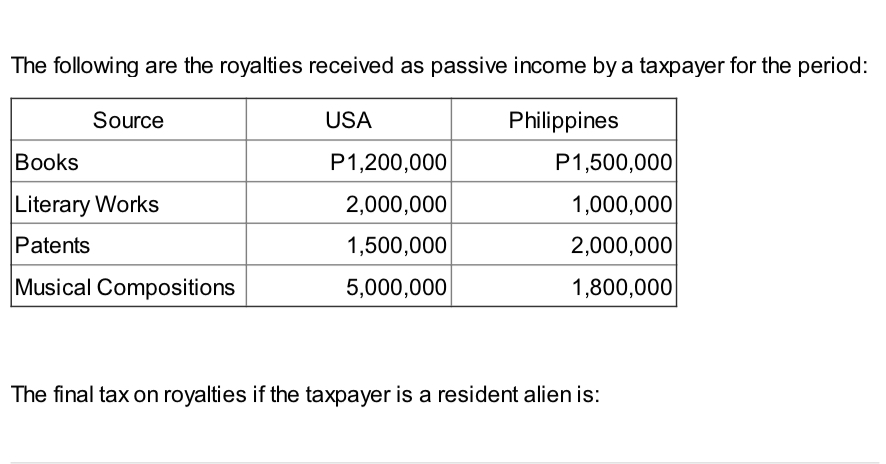

The following are the royalties received as passive income by a taxpayer for the period: | Source | USA | Philippines | | -------- | ---------- | ------------- | | Books | P1,200,... The following are the royalties received as passive income by a taxpayer for the period: | Source | USA | Philippines | | -------- | ---------- | ------------- | | Books | P1,200,000 | P1,500,000 | | Literary Works | 2,000,000 | 1,000,000 | | Patents | 1,500,000 | 2,000,000 | | Musical Compositions | 5,000,000 | 1,800,000 | The final tax on royalties if the taxpayer is a resident alien is:

Understand the Problem

The question presents a table of royalty income received by a taxpayer from various sources (Books, Literary Works, Patents, Musical Compositions) in both the USA and the Philippines. The task is to determine the final tax on these royalties if the taxpayer is a resident alien.

Answer

P1,260,000

Answer for screen readers

P1,260,000

Steps to Solve

-

Calculate total royalty income from the Philippines Add up all the royalty income received from sources within the Philippines. $$ \text{Total Philippine Royalty Income} = 1,500,000 + 1,000,000 + 2,000,000 + 1,800,000 = 6,300,000 $$

-

Apply the tax rate for resident aliens Resident aliens are taxed at a rate of 20% on royalties derived from sources within the Philippines. $$ \text{Final Tax} = 0.20 \times \text{Total Philippine Royalty Income} $$

-

Calculate the final tax Substitute the total Philippine royalty income calculated in Step 1 to the formula in Step 2 $$ \text{Final Tax} = 0.20 \times 6,300,000 = 1,260,000 $$

P1,260,000

More Information

The final tax on royalties for a resident alien is calculated based only on the royalty income earned from sources within the Philippines. The royalty income from the USA is not included in the calculation of the final tax in the Philippines.

Tips

A common mistake is to include the royalty income from both the USA and the Philippines when calculating the final tax. Remember, for resident aliens, only income from sources within the Philippines is subject to the final tax on royalties. Another common mistake is using the incorrect tax rate. The tax rate for royalties for resident aliens is 20%.

AI-generated content may contain errors. Please verify critical information