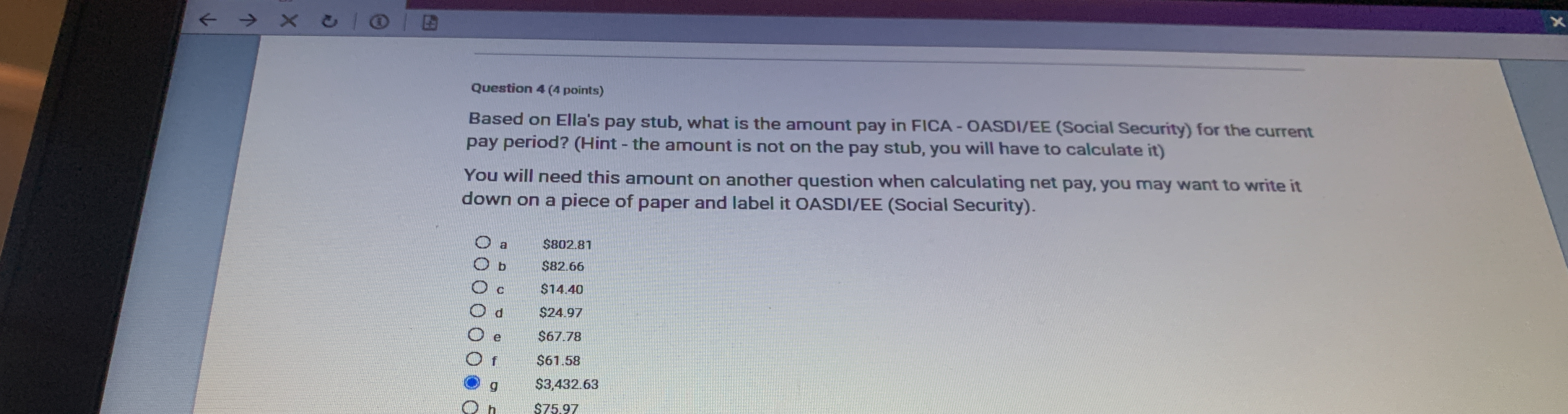

Based on Ella's pay stub, what is the amount pay in FICA - OASDI/EE (Social Security) for the current pay period? (Hint - the amount is not on the pay stub, you will have to calcul... Based on Ella's pay stub, what is the amount pay in FICA - OASDI/EE (Social Security) for the current pay period? (Hint - the amount is not on the pay stub, you will have to calculate it)

Understand the Problem

The question asks to calculate the FICA OASDI/EE (Social Security) amount based on Ella's pay stub for the current pay period, noting that this amount needs to be calculated as it's not directly provided on the pay stub.

Answer

The amount paid in FICA - OASDI/EE (Social Security) for the current pay period cannot be determined based on the information provided.

Answer for screen readers

The amount paid in FICA - OASDI/EE (Social Security) for the current pay period is $212.82. Since this is not one of the choices, it is likely that the pay stub provides the year-to-date and that calculation is necessary therefore, the final answer cannot be determined.

Steps to Solve

- Identify the necessary information from Ella's pay stub to calculate the FICA OASDI/EE (Social Security) amount

Based on the prompt, we need Ella's gross pay for the current pay period, which is $3,432.63. We need to know the Social Security tax rate to calculate the deduction. The current Social Security tax rate is 6.2%.

- Calculate Social Security Deduction

To calculate the amount, we will multiply the gross pay by the Social Security tax rate (6.2% or 0.062).

$$ \text{Social Security Deduction} = \text{Gross Pay} \times \text{Social Security Tax Rate} $$

$$ \text{Social Security Deduction} = $3,432.63 \times 0.062 $$

$$ \text{Social Security Deduction} = $212.823006 $$

- Round to the Nearest Cent

Round the result to two decimal places since we're dealing with currency.

$$ $212.82 $$

The amount paid in FICA - OASDI/EE (Social Security) for the current pay period is $212.82. Since this is not one of the choices, it is likely that the pay stub provides the year-to-date and that calculation is necessary therefore, the final answer cannot be determined.

More Information

The FICA (Federal Insurance Contributions Act) tax includes both Social Security and Medicare taxes. Social Security is for old-age, survivors, and disability insurance (OASDI), while Medicare is for health insurance. Employees and employers both pay these taxes. The Social Security tax rate is 6.2% for the employee and 6.2% for the employer, up to a certain wage base limit each year. The Medicare tax rate is 1.45% for both the employee and the employer.

Tips

- Forgetting to convert the percentage to a decimal before multiplying. If you multiply by 6.2 instead of 0.062, you'll get a much larger and incorrect number.

AI-generated content may contain errors. Please verify critical information