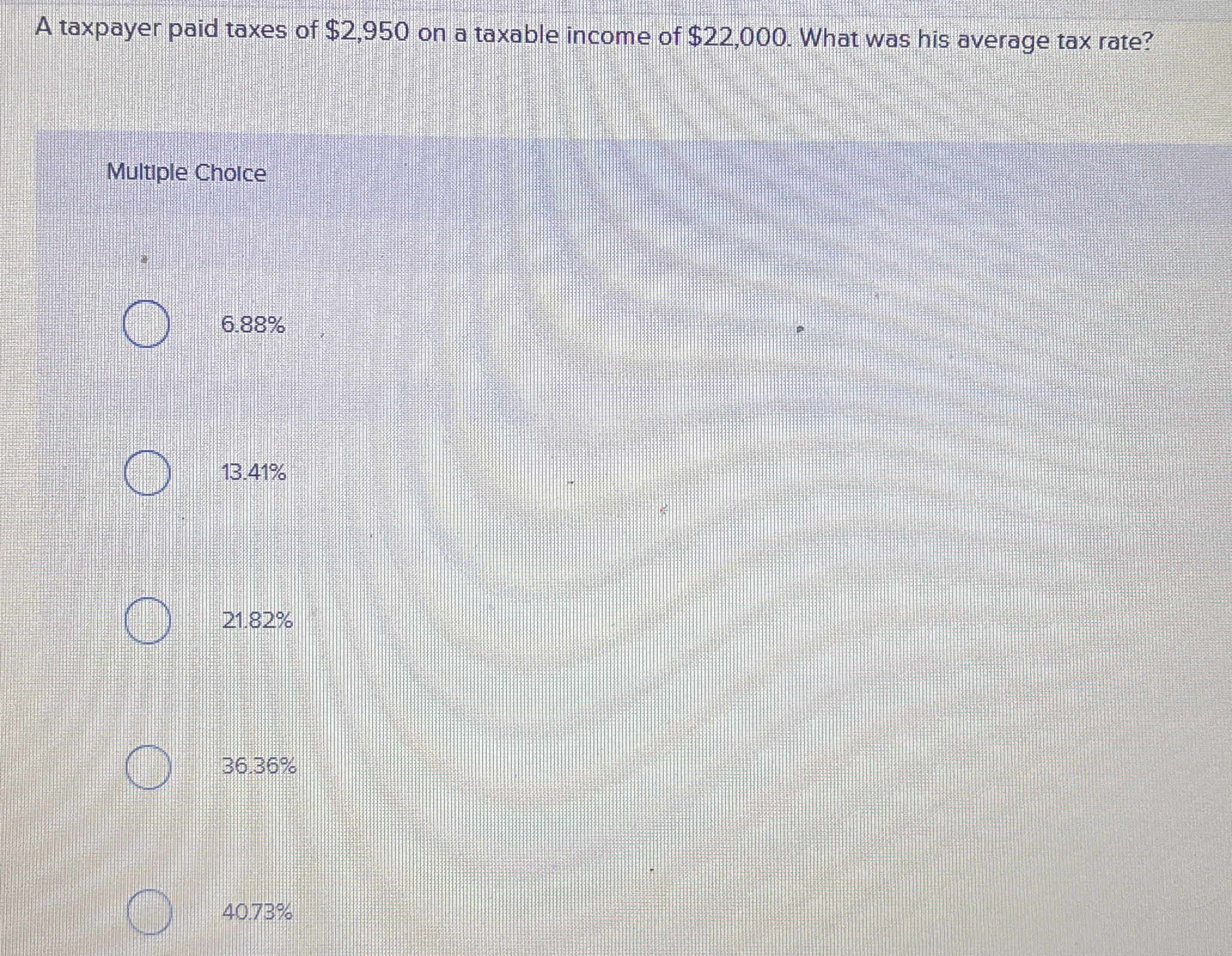

A taxpayer paid taxes of $2,950 on a taxable income of $22,000. What was his average tax rate?

Understand the Problem

The question is asking for the average tax rate based on the amount of taxes paid and the taxable income. To find the average tax rate, we will divide the taxes paid by the taxable income and then multiply by 100 to get a percentage.

Answer

The average tax rate is $13.41\%$.

Answer for screen readers

The average tax rate is approximately $13.41%$.

Steps to Solve

- Identify the given values

The problem states that the taxpayer paid taxes of $2,950 and had a taxable income of $22,000.

- Calculate the average tax rate

To find the average tax rate, use the formula:

$$ \text{Average Tax Rate} = \left( \frac{\text{Taxes Paid}}{\text{Taxable Income}} \right) \times 100 $$

Substituting in the values:

$$ \text{Average Tax Rate} = \left( \frac{2,950}{22,000} \right) \times 100 $$

- Perform the division

Calculate the fraction:

$$ \frac{2,950}{22,000} = 0.13363636 $$

- Convert to percentage

Multiply by 100 to convert to a percentage:

$$ 0.13363636 \times 100 = 13.363636 \approx 13.41% $$

The average tax rate is approximately $13.41%$.

More Information

The average tax rate helps assess how much tax is paid relative to total taxable income. This metric can be useful for evaluating tax burdens across different income levels.

Tips

- Forgetting to multiply the result by 100 to convert to a percentage.

- Incorrect division of taxes paid by taxable income, leading to an inaccurate average tax rate.

AI-generated content may contain errors. Please verify critical information