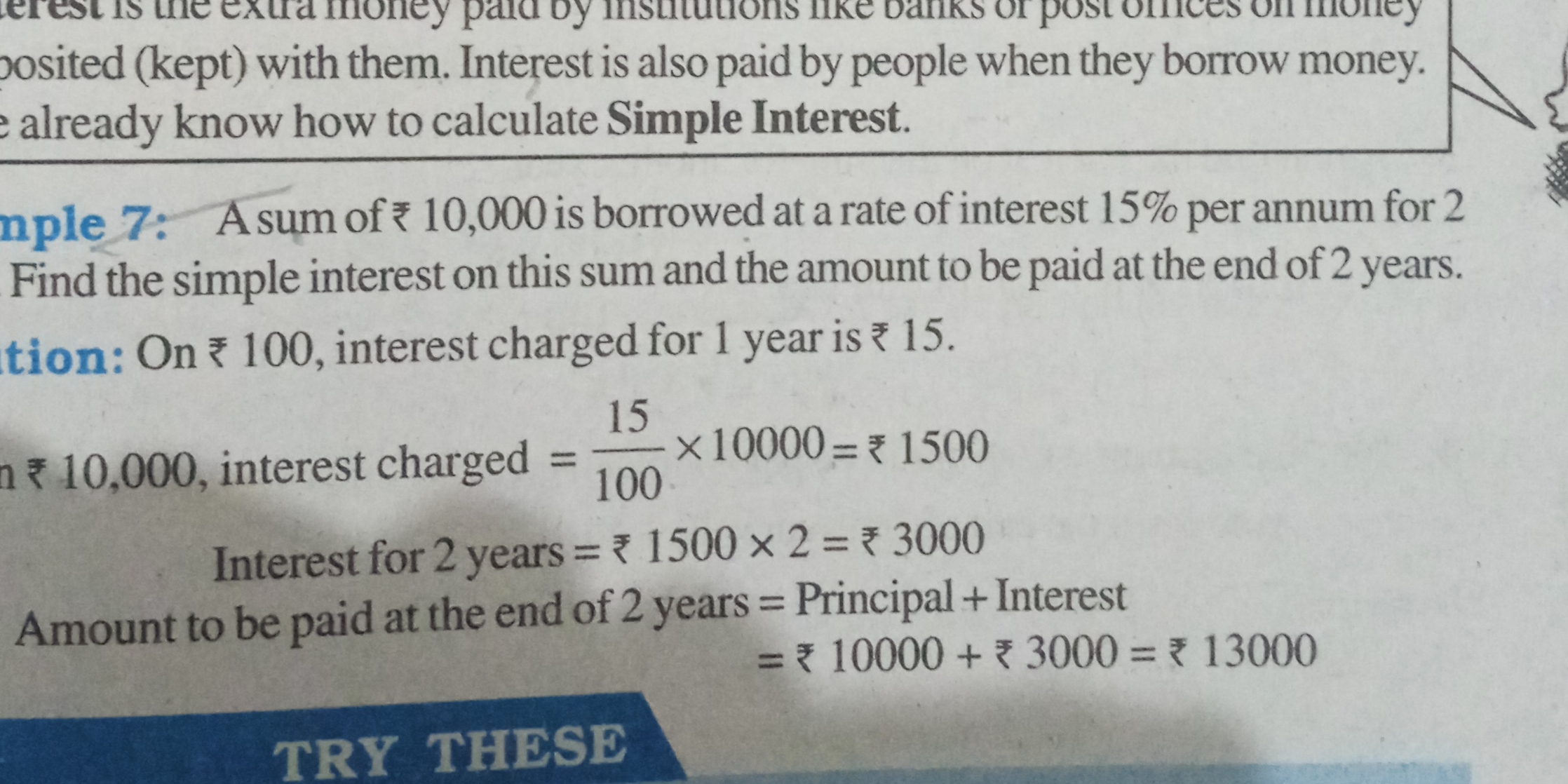

A sum of ₹10,000 is borrowed at a rate of interest 15% per annum for 2 years. Find the simple interest on this sum and the amount to be paid at the end of 2 years.

Understand the Problem

The question requires us to calculate the simple interest on a borrowed sum of ₹10,000 at a 15% annual interest rate over a period of 2 years. Additionally, it asks for the total amount to be paid back at the end of this period.

Answer

The simple interest is ₹3000, and the total amount to be paid back is ₹13000.

Answer for screen readers

The simple interest is ₹3000, and the total amount to be paid back is ₹13000.

Steps to Solve

- Identify the formula for Simple Interest

The formula for calculating simple interest (SI) is given by:

$$ SI = \frac{P \times R \times T}{100} $$

where:

$P$ = Principal amount (the initial sum of money)

$R$ = Rate of interest per annum

$T$ = Time in years

- Substitute the values into the formula

In this case:

$P = 10000$ (the borrowed sum)

$R = 15$ (interest rate)

$T = 2$ (time in years)

Substituting these values into the formula gives:

$$ SI = \frac{10000 \times 15 \times 2}{100} $$

- Calculate the Simple Interest

Now, calculate the simple interest:

$$ SI = \frac{300000}{100} = 3000 $$

So, the simple interest for 2 years is ₹3000.

- Calculate the total amount to be paid back

The total amount (A) to be paid back at the end of 2 years is the sum of the principal amount and the simple interest:

$$ A = P + SI $$

Substituting in the values gives:

$$ A = 10000 + 3000 $$

- Final Calculation for Total Amount

Thus, the total amount to be paid back is:

$$ A = 13000 $$

The simple interest is ₹3000, and the total amount to be paid back is ₹13000.

More Information

Simple interest is a straightforward way to calculate interest, commonly used in loans and deposits. The total amount reflects the initial principal plus the interest earned or paid.

Tips

- Forgetting to multiply the interest by the number of years.

- Miscalculating either the formula variables or the final addition of principal and interest.

- Not converting the percentage to a decimal or appropriately adjusting for the formula.

AI-generated content may contain errors. Please verify critical information