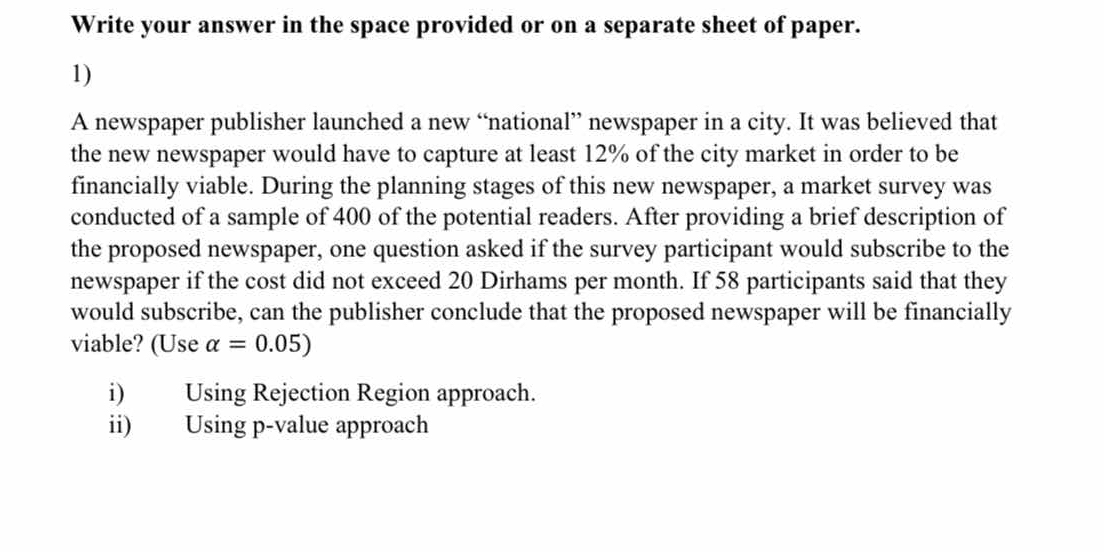

A newspaper publisher launched a new national newspaper in a city. It was believed that the new newspaper would have to capture at least 12% of the city market to be financially vi... A newspaper publisher launched a new national newspaper in a city. It was believed that the new newspaper would have to capture at least 12% of the city market to be financially viable. During the planning stages of this new newspaper, a market survey of 400 potential readers was conducted. After providing a brief description of the proposed newspaper, it was asked if the participants would subscribe if the cost did not exceed 20 Dirhams per month. If 58 participants said they would subscribe, can the publisher conclude that the proposed newspaper will be financially viable? Use α = 0.05. i) Using Rejection Region approach. ii) Using p-value approach.

Understand the Problem

The question is asking to determine the financial viability of a new newspaper based on survey data. Specifically, it asks whether the publisher can conclude that at least 12% of the market would subscribe, using two statistical approaches: Rejection Region and p-value, at a significance level of 0.05.

Answer

The publisher cannot conclude financial viability as both methods indicate not enough evidence to support that at least 12% would subscribe.

Answer for screen readers

The publisher cannot conclude that the proposed newspaper will be financially viable based on both the Rejection Region and p-value approaches.

Steps to Solve

-

Define the hypotheses

- Null hypothesis ($H_0$): $p < 0.12$ (fewer than 12% of the market will subscribe)

- Alternative hypothesis ($H_a$): $p \geq 0.12$ (at least 12% of the market will subscribe)

-

Determine the sample proportion

- Sample size ($n$): 400

- Number of subscribers ($X$): 58

- Sample proportion ($\hat{p}$): $$ \hat{p} = \frac{X}{n} = \frac{58}{400} = 0.145 $$

-

Calculate the standard error (SE)

- Using the null hypothesis proportion ($p_0 = 0.12$): $$ SE = \sqrt{\frac{p_0(1 - p_0)}{n}} = \sqrt{\frac{0.12 \cdot 0.88}{400}} \approx 0.025 $$

-

Calculate the z-statistic

- Using the formula for the z-statistic: $$ z = \frac{\hat{p} - p_0}{SE} = \frac{0.145 - 0.12}{0.025} \approx 1.00 $$

-

Determine the rejection region

- For a one-tailed test at $\alpha = 0.05$, the critical z-value is approximately 1.645.

- If $z > 1.645$, we reject $H_0$.

-

Make a decision using rejection region

- Since $z \approx 1.00 < 1.645$, we do not reject $H_0$. There isn’t enough evidence to conclude that at least 12% of the market would subscribe.

-

Calculate the p-value

- The p-value associated with $z \approx 1.00$ can be found using a standard normal distribution table or calculator. It is approximately 0.1587.

-

Make a decision using p-value

- Since the p-value (0.1587) is greater than the significance level ($\alpha = 0.05$), we do not reject $H_0$.

The publisher cannot conclude that the proposed newspaper will be financially viable based on both the Rejection Region and p-value approaches.

More Information

This analysis shows that with a sample size of 400 and 58 interested participants, the statistical evidence does not support the claim that at least 12% of the potential subscribers would subscribe. Statistical methods like the Rejection Region and p-value give insight into market viability based on collected survey data.

Tips

- Failing to define hypotheses clearly can lead to incorrect interpretations.

- Confusing one-tailed and two-tailed tests; this example requires a one-tailed test.

AI-generated content may contain errors. Please verify critical information