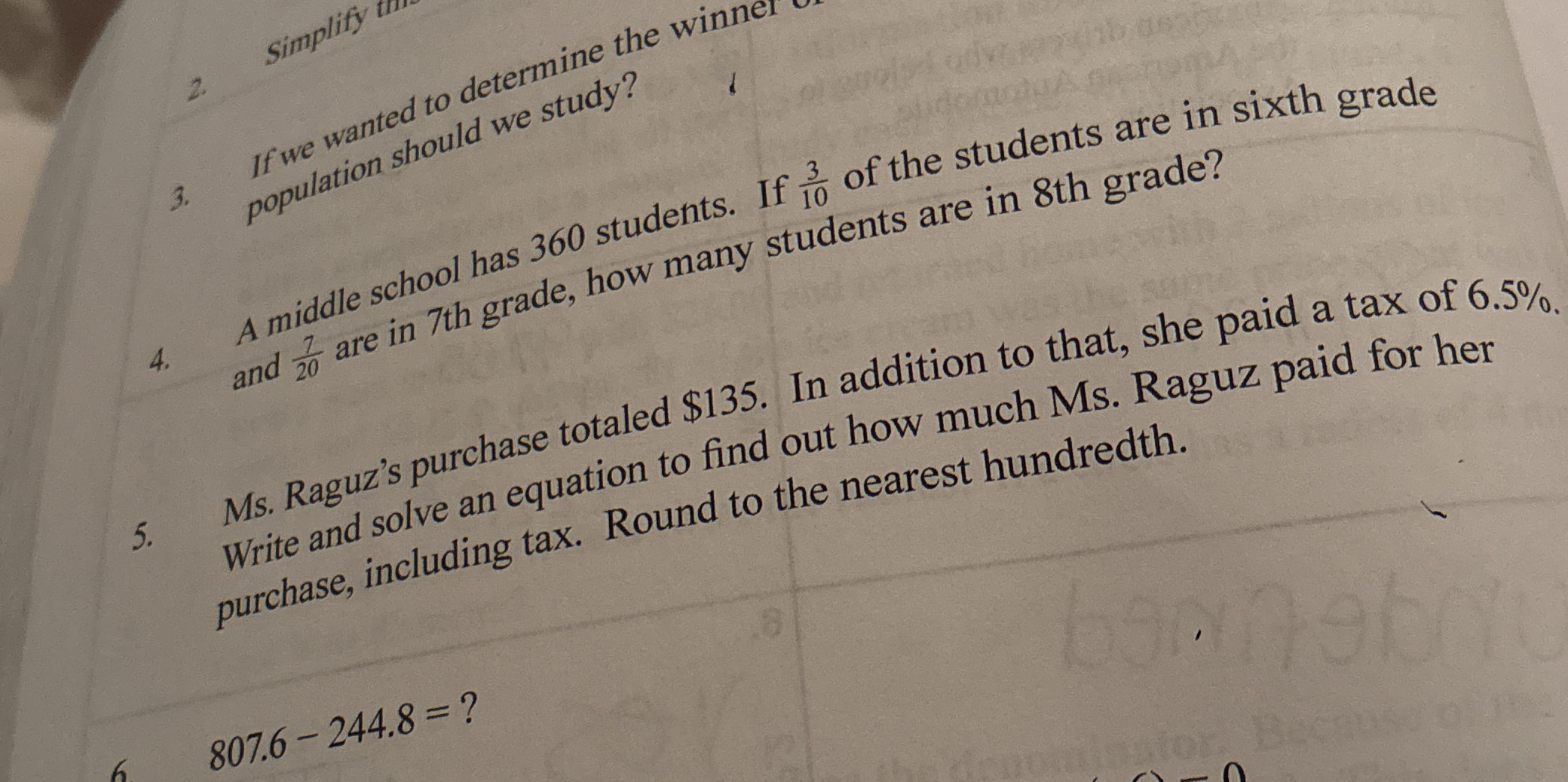

A middle school has 360 students. If 3/10 of the students are in sixth grade and 7/20 are in 7th grade, how many students are in 8th grade? Ms. Raguz's purchase totaled $135. In ad... A middle school has 360 students. If 3/10 of the students are in sixth grade and 7/20 are in 7th grade, how many students are in 8th grade? Ms. Raguz's purchase totaled $135. In addition to that, she paid a tax of 6.5%. Write and solve an equation to find out how much Ms. Raguz paid for her purchase, including tax. Round to the nearest hundredth. 807.6 - 244.8 = ?

Understand the Problem

The question asks how to solve a series of math problems related to population distribution in a school and calculating taxes involved in a purchase. Specifically, it targets understanding fractions, proportions, and basic arithmetic operations.

Answer

The amount paid before tax is approximately $126.98.

Answer for screen readers

The amount paid before tax is approximately $126.98.

Steps to Solve

- Identify the Given Information

We know that Ms. Raguz's total purchase after tax is $135, and the tax rate is 6.5%. Let ( x ) be the amount before tax.

- Setting Up the Equation

To find the equation, we recognize that the total amount includes the original price ( x ) plus the tax. The tax can be calculated as ( 0.065 \times x ). Therefore, the equation becomes:

$$ x + 0.065x = 135 $$

- Combine Like Terms

Now combine the ( x ) terms:

$$ 1.065x = 135 $$

- Solving for ( x )

Next, we divide both sides of the equation by 1.065 to isolate ( x ):

$$ x = \frac{135}{1.065} $$

Calculate the value of ( x ):

$$ x \approx 126.984 \text{ (rounded to three decimal places)} $$

- Finding the Total Amount Paid Including Tax

Now, we can find the total amount paid by rounding ( x ) to the nearest hundredth:

$$ 126.98 $$

The total amount paid by Ms. Raguz including tax is $135.

The amount paid before tax is approximately $126.98.

More Information

To find how much Ms. Raguz paid before tax, we set up an equation incorporating the tax rate. By isolating ( x ), we calculated the pre-tax amount, rounded to two decimal places.

Tips

- Forgetting to properly convert the percentage into a decimal format.

- Miscalculating when combining like terms.

- Rounding too early instead of keeping the full calculation precise until the final step.

AI-generated content may contain errors. Please verify critical information