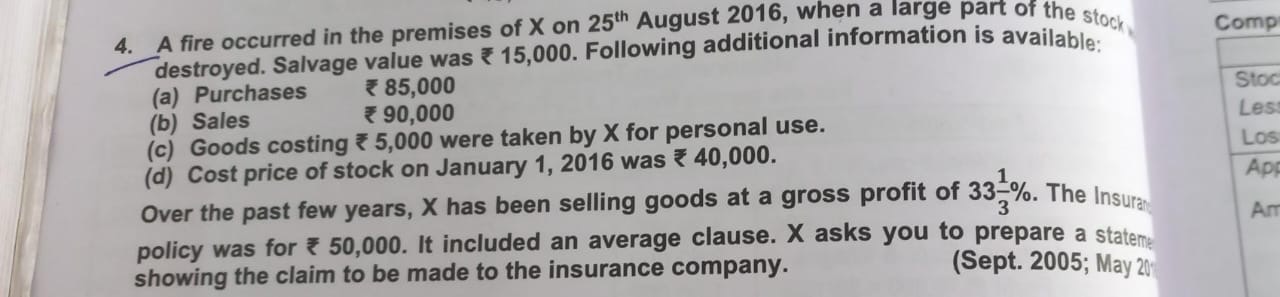

A fire occurred in the premises of X on 25th August 2016, when a large part of the stock destroyed. Salvage value was ₹ 15,000. Following additional information is available: Purch... A fire occurred in the premises of X on 25th August 2016, when a large part of the stock destroyed. Salvage value was ₹ 15,000. Following additional information is available: Purchases ₹ 85,000, Sales ₹ 90,000, Goods costing ₹ 5,000 were taken by X for personal use, Cost price of stock on January 1, 2016 was ₹ 40,000. Over the past few years, X has been selling goods at a gross profit of 33 1/3%. The Insurance policy was for ₹ 50,000. It included an average clause. X asks you to prepare a statement showing the claim to be made to the insurance company.

Understand the Problem

The question is asking us to calculate the claim to be made to the insurance company based on the given information regarding purchases, sales, stock taken for personal use, and other financial details related to a fire incident.

Answer

The claim to be made to the insurance company is ₹ 21,875.

Answer for screen readers

The claim to be made to the insurance company is ₹ 21,875.

Steps to Solve

-

Calculate the Gross Profit Rate The gross profit rate provided is 33 1/3%, which can be represented as a fraction, $ \frac{1}{3} $. This means that the cost price (CP) of goods sold can be calculated by considering that the sales price (SP) is made up of the cost price plus the profit.

-

Calculate Total Cost Price of Goods Sold (CP) Given sales of ₹ 90,000, we can calculate the cost price:

[ \text{CP} = \text{Sales} - \text{Gross Profit} ]

From the gross profit rate, the gross profit (GP) is:

[ \text{GP} = \frac{1}{3} \times \text{CP} ]

Now, since SP = CP + GP, let's denote CP as $x$:

[ 90,000 = x + \frac{1}{3}x = \frac{4}{3}x ]

To find $x$, we rearrange:

[ x = 90,000 \times \frac{3}{4} = 67,500 ]

- Determine the Total Stock on Lost Goods Calculate the stock value before the fire:

[ \text{Total stock} = \text{Opening Stock} + \text{Purchases} - \text{Personal Use} ] Substituting the values:

[ = 40,000 + 85,000 - 5,000 = 120,000 ]

- Calculate the Cost of Goods Destroyed Cost of goods destroyed in the fire can be determined as:

[ \text{Goods Destroyed} = \text{Total Stock} - \text{Closing Stock} ]

- The closing stock can be calculated as:

[ \text{Closing Stock} = \text{Total Stock} - \text{CP of Goods Sold} ] So,

[ = 120,000 - 67,500 = 52,500 ]

Now the goods destroyed (within the stock) would be:

[ = 120,000 - 52,500 = 67,500 ]

- Calculate the Claim Amount Calculate the claim amount:

[ \text{Claim Amount} = \text{Cost of Goods Destroyed} - \text{Salvage Value} ]

Substituting the values:

[ = 67,500 - 15,000 = 52,500 ]

- Consider the Average Clause Since the insurance policy was for ₹ 50,000 and included an average clause:

[ \text{Claim} = \text{Claim Amount} \times \left( \frac{\text{Insured Value}}{\text{Total Stock}} \right) ]

So,

[ = 52,500 \times \left( \frac{50,000}{120,000} \right) = \frac{52,500 \times 50,000}{120,000} = 21,875 ]

The claim to be made to the insurance company is ₹ 21,875.

More Information

This amount represents the calculated claim based on the net loss due to the fire, considering both the total stock and the average clause in the insurance policy.

Tips

- Miscalculating gross profit leading to errors in determining cost of goods sold. Always ensure to apply the formula correctly.

- Forgetting to deduct personal use items when calculating the total stock. All relevant figures must be included for an accurate net stock amount.

AI-generated content may contain errors. Please verify critical information