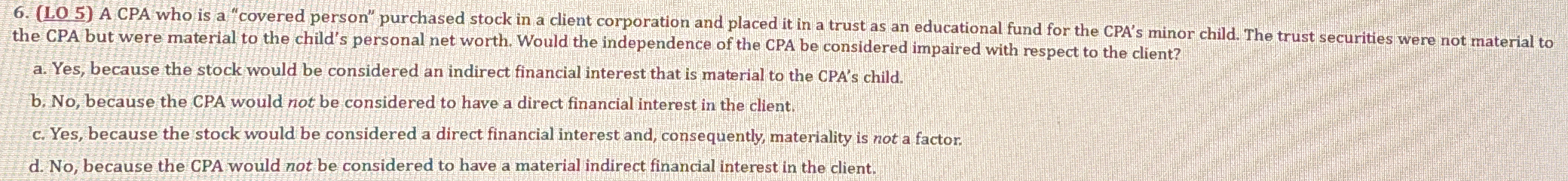

A CPA who is a 'covered person' purchased stock in a client corporation and placed it in a trust as an educational fund for the CPA's minor child. Would the independence of the CPA... A CPA who is a 'covered person' purchased stock in a client corporation and placed it in a trust as an educational fund for the CPA's minor child. Would the independence of the CPA be considered impaired with respect to the client?

Understand the Problem

The question is asking whether the independence of a CPA is impaired due to the ownership of stock held in a trust for the CPA's child. This involves assessing indirect financial interests and materiality in relation to the CPA's professional responsibilities.

Answer

Yes, because the stock is an indirect financial interest material to the child's net worth.

Yes, because the stock would be considered an indirect financial interest that is material to the CPA's child.

Answer for screen readers

Yes, because the stock would be considered an indirect financial interest that is material to the CPA's child.

More Information

The independence of a CPA is impaired if they have a direct or indirect financial interest in a client that is material. Here, the investment is considered material to the CPA's child.

Tips

A common mistake is assuming the materiality is to the CPA directly, whereas it involves the CPA's child.

Sources

- A CPA who is a “covered person” purchased stock in | Chegg.com - chegg.com

- Quizlet Flashcards - quizlet.com

AI-generated content may contain errors. Please verify critical information