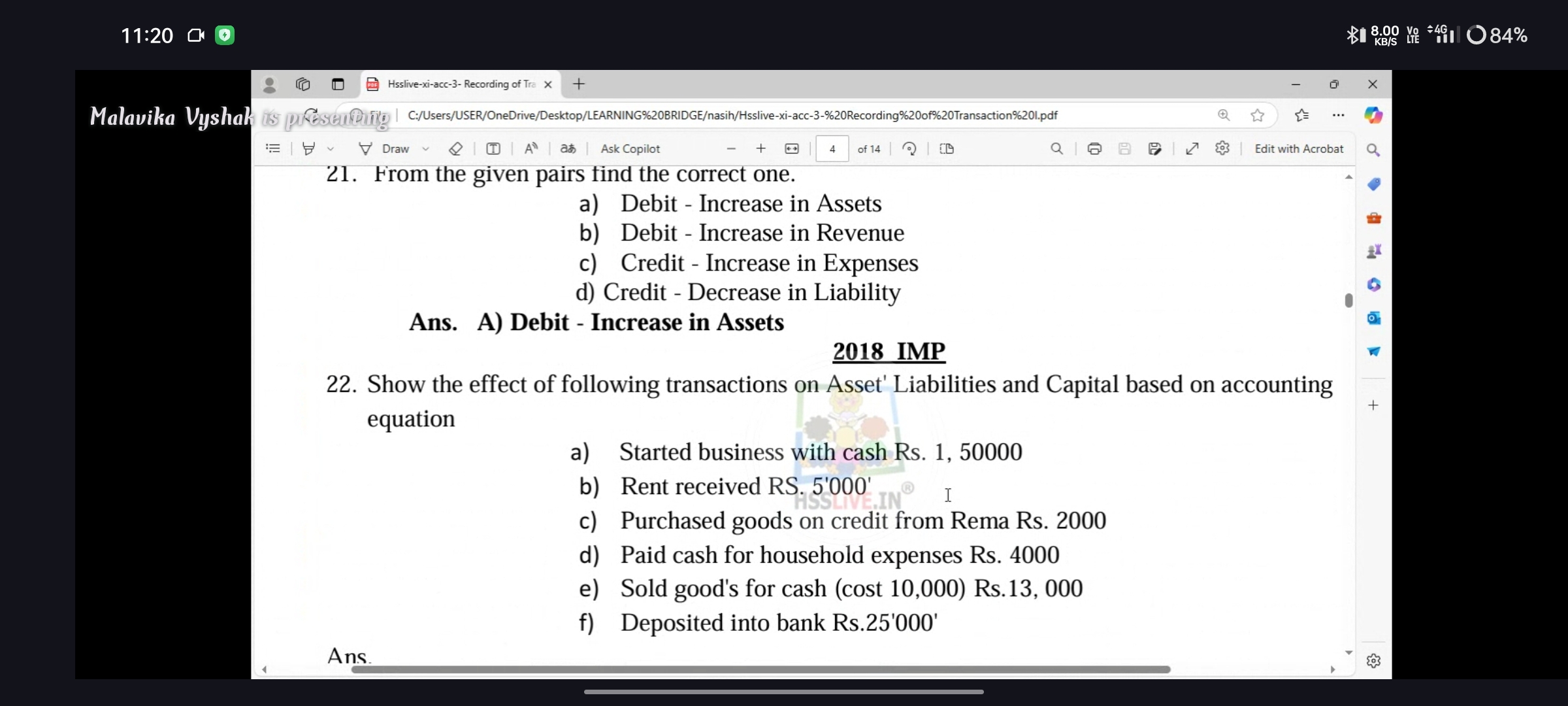

22. Show the effect of following transactions on Assets, Liabilities and Capital based on accounting equation: a) Started business with cash Rs. 1, 50000 b) Rent received RS. 5... 22. Show the effect of following transactions on Assets, Liabilities and Capital based on accounting equation: a) Started business with cash Rs. 1, 50000 b) Rent received RS. 5'000' c) Purchased goods on credit from Rema Rs. 2000 d) Paid cash for household expenses Rs. 4000 e) Sold good's for cash (cost 10,000) Rs.13, 000 f) Deposited into bank Rs.25'000'

Understand the Problem

The image presents two accounting questions. The first asks to identify the correct pairing of debit/credit with its effect on assets, revenue, expenses, or liabilities. The second requires demonstrating the impact of various transactions on assets, liabilities, and capital using the accounting equation.

Answer

21. a) Debit - Increase in Assets 22. * a) Assets + 150,000 = Liabilities + 0 + Capital + 150,000 * b) Assets + 5,000 = Liabilities + 0 + Capital + 5,000 * c) Assets + 2,000 = Liabilities + 2,000 + Capital + 0 * d) Assets - 4,000 = Liabilities + 0 + Capital - 4,000 * e) Assets + 13,000 - 10,000 = Liabilities + 0 + Capital + 3,000 * f) Assets + 25,000(Bank) - 25,000(Cash) = Liabilities + 0 + Capital + 0

Answer for screen readers

-

a) Debit - Increase in Assets

-

Here's the effect of each transaction on the accounting equation (Assets = Liabilities + Capital):

* a) Assets + 150,000 = Liabilities + 0 + Capital + 150,000

* b) Assets + 5,000 = Liabilities + 0 + Capital + 5,000

* c) Assets + 2,000 = Liabilities + 2,000 + Capital + 0

* d) Assets - 4,000 = Liabilities + 0 + Capital - 4,000

* e) Assets + 13,000 - 10,000 = Liabilities + 0 + Capital + 3,000

* f) Assets + 25,000(Bank) - 25,000(Cash) = Liabilities + 0 + Capital + 0

Steps to Solve

-

Identify the correct debit/credit pairing

- Debit increases assets and expenses, and decreases liabilities, owner's equity, and revenue.

- Credit increases liabilities, owner's equity, and revenue, and decreases assets and expenses.

- Based on these rules, the correct option is (a) Debit - Increase in Assets and (d) Credit - Decrease in Liability. The image itself says that (a) is correct, so we'll go with that for consistency.

-

Analyze transaction (a): Started business with cash Rs. 1,50,000

- Asset (Cash) increases by Rs. 1,50,000.

- Capital increases by Rs. 1,50,000.

- Accounting equation: Assets = Liabilities + Capital becomes 1,50,000 = 0 + 1,50,000

-

Analyze transaction (b): Rent received Rs. 5,000

- Asset (Cash) increases by Rs. 5,000.

- Capital (Revenue) increases by Rs. 5,000.

- Accounting equation: Assets = Liabilities + Capital becomes 5,000 = 0 + 5,000

-

Analyze transaction (c): Purchased goods on credit from Rema Rs. 2,000

- Asset (Inventory) increases by Rs. 2,000.

- Liability (Accounts Payable) increases by Rs. 2,000.

- Accounting equation: Assets = Liabilities + Capital becomes 2,000 = 2,000 + 0

-

Analyze transaction (d): Paid cash for household expenses Rs. 4,000

- Asset (Cash) decreases by Rs. 4,000.

- Capital (Drawings) decreases by Rs. 4,000.

- Accounting equation: Assets = Liabilities + Capital becomes -4,000 = 0 + (-4,000)

-

Analyze transaction (e): Sold goods for cash (cost 10,000) Rs. 13,000

- Asset (Cash) increases by Rs. 13,000.

- Asset (Inventory) decreases by Rs. 10,000.

- Capital (Profit) increases by Rs. 3,000 (13,000 - 10,000). *Accounting equation: Assets = Liabilities + Capital becomes 13,000 - 10,000 = 0 + 3,000

-

Analyze transaction (f): Deposited into bank Rs. 25,000

- Asset (Bank) increases by Rs. 25,000.

- Asset (Cash) decreases by Rs. 25,000.

- Accounting equation: Assets = Liabilities + Capital becomes 25,000 - 25,000 = 0 + 0

-

a) Debit - Increase in Assets

-

Here's the effect of each transaction on the accounting equation (Assets = Liabilities + Capital):

* a) Assets + 150,000 = Liabilities + 0 + Capital + 150,000

* b) Assets + 5,000 = Liabilities + 0 + Capital + 5,000

* c) Assets + 2,000 = Liabilities + 2,000 + Capital + 0

* d) Assets - 4,000 = Liabilities + 0 + Capital - 4,000

* e) Assets + 13,000 - 10,000 = Liabilities + 0 + Capital + 3,000

* f) Assets + 25,000(Bank) - 25,000(Cash) = Liabilities + 0 + Capital + 0

More Information

The accounting equation (Assets = Liabilities + Owner's Equity) is the foundation of double-entry bookkeeping. Every transaction affects at least two accounts to keep the equation in balance. Debits increase asset and expense accounts while decreasing liability, owner's equity, and revenue accounts. Credits do the opposite.

Tips

A common mistake is not understanding the basic accounting equation (Assets = Liabilities + Owner's Equity) and how different transactions affect each element. Another mistake is confusing the effect of debits and credits on different account types (assets, liabilities, equity, revenue, and expenses). For example, many students wrongly apply debit as always increasing and credit as always decreasing which is untrue.

AI-generated content may contain errors. Please verify critical information