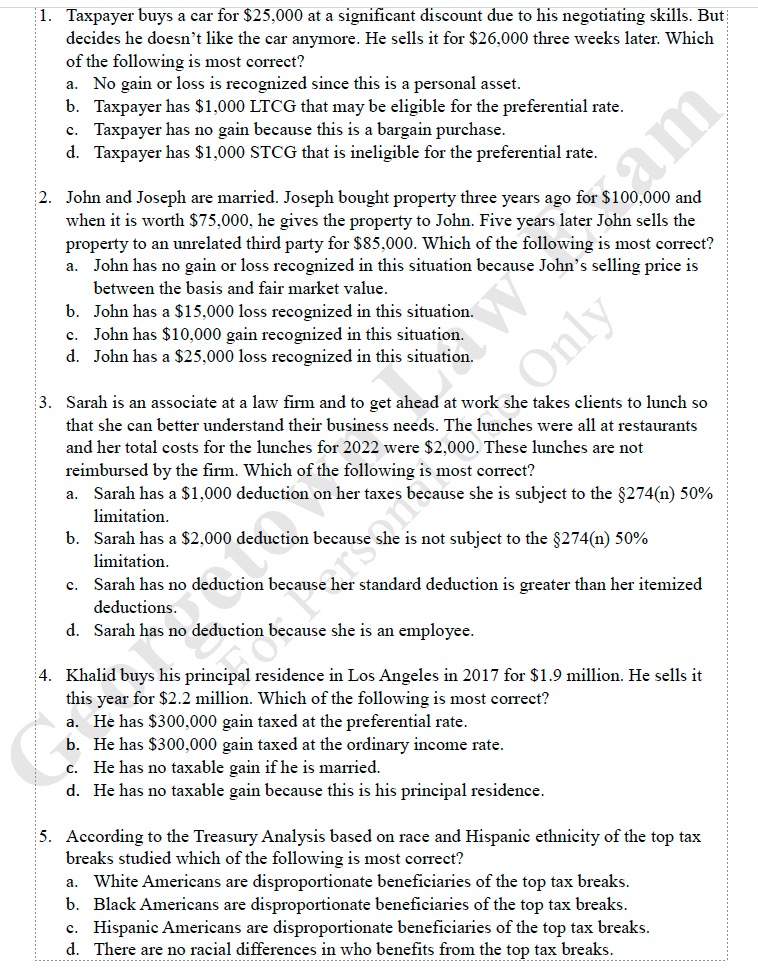

1. Taxpayer buys a car for $25,000 at a discount. Sells it for $26,000. Which is most correct? 2. John and Joseph are married. John sells property for $85,000. What is most correct... 1. Taxpayer buys a car for $25,000 at a discount. Sells it for $26,000. Which is most correct? 2. John and Joseph are married. John sells property for $85,000. What is most correct? 3. Sarah works at a law firm and takes clients to lunch. What is most correct about her deductions? 4. Khalid sells his principal residence for $2.2 million. What is most correct? 5. According to Treasury Analysis, which statement about racial/ethnic disparities in tax breaks is most correct?

Understand the Problem

The questions are asking for the most accurate answers pertaining to tax-related scenarios and regulations in various contexts, such as personal asset sales, property transactions between family members, lunch deductions for employees, principal residence sales, and racial/ethnic disparities in tax breaks.

Answer

1. d 2. c 3. a 4. b 5. c

- d

- c

- a

- b

- c

Answer for screen readers

- d

- c

- a

- b

- c

More Information

- Sales for profit from a personal asset can lead to short-term capital gains.

- The gain is the difference between sale price and the original value.

- Lunch expenses can often be deducted up to a limit.

- Gains on principal residence sales may be taxed as ordinary income.

- Hispanic Americans are often noted for disproportionate tax benefits.

Tips

Ensure to consider tax implications for personal assets, and verify current tax laws regarding deductions and residence sales.

AI-generated content may contain errors. Please verify critical information