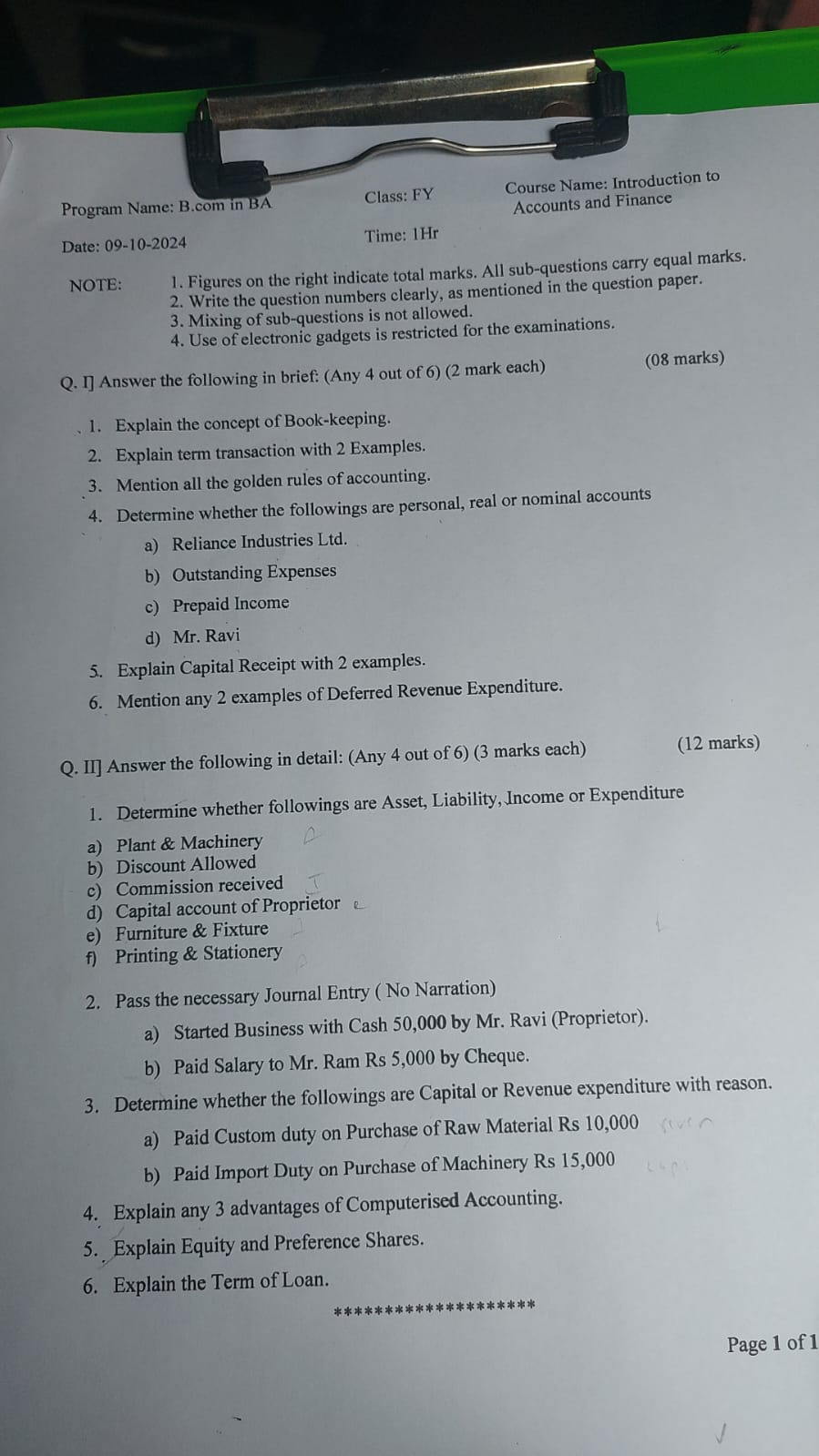

1. Explain the concept of Book-keeping. 2. Explain term transaction with 2 Examples. 3. Mention all the golden rules of accounting. 4. Determine whether the followings are personal... 1. Explain the concept of Book-keeping. 2. Explain term transaction with 2 Examples. 3. Mention all the golden rules of accounting. 4. Determine whether the followings are personal, real or nominal accounts: a) Reliance Industries Ltd. b) Outstanding Expenses c) Prepaid Income d) Mr. Ravi. 5. Explain Capital Receipt with 2 examples. 6. Mention any 2 examples of Deferred Revenue Expenditure. 7. Determine whether followings are Asset, Liability, Income or Expenditure: a) Plant & Machinery b) Discount Allowed c) Commission received d) Capital account of Proprietor e) Furniture & Fixture f) Printing & Stationery. 8. Pass the necessary Journal Entry: a) Started Business with Cash 50,000 by Mr. Ravi. b) Paid Salary to Mr. Ram Rs 5,000 by Cheque. 9. Determine whether the followings are Capital or Revenue expenditure: a) Paid Custom duty on Purchase of Raw Material Rs 10,000 b) Paid Import Duty on Purchase of Machinery Rs 15,000. 10. Explain any 3 advantages of Computerised Accounting. 11. Explain Equity and Preference Shares. 12. Explain the Term of Loan.

Understand the Problem

The question is asking for detailed explanations and definitions related to accounting and finance concepts, including bookkeeping, journal entries, and different types of accounts and expenditures. It is structured as an exam paper requiring specific knowledge of accounting principles.

Answer

1. Book-keeping records financial transactions. 2. Transaction: buying goods, paying rent. 3. Rules: Debit the receiver, etc. 4. a) Personal, b) Nominal, c) Nominal, d) Personal. 5. Capital receipts: asset sales, loans. 6. Deferred Revenue: advertising, development. 7. a) Asset, b) Expenditure, etc. 8. a) Cash, Capital; b) Salary, Bank. 9. a) Revenue, b) Capital. 10. Advantages: Speed, accuracy. 11. Equity: ownership; Preference: fixed dividends. 12. Loan: borrowed sum with interest.

- Book-keeping involves recording financial transactions systematically. 2. A transaction is any financial exchange, e.g., buying goods, paying rent. 3. Golden Rules: Debit the receiver, credit the giver; Debit what comes in, credit what goes out; Debit expenses, credit incomes. 4. a) Personal, b) Nominal, c) Nominal, d) Personal. 5. Capital receipts are non-recurring and contribute to long-term growth, e.g., selling assets, loans taken. 6. Deferred Revenue Expenditures: Development expenses, advertising campaigns. 7. a) Asset, b) Expenditure, c) Income, d) Equity, e) Asset, f) Expenditure. 8. a) Debit Cash, Credit Capital; b) Debit Salary, Credit Bank. 9. a) Revenue, b) Capital. 10. Advantages: Speed, accuracy, easy access. 11. Equity shares give ownership and voting rights; preference shares offer fixed dividends. 12. A loan is a sum borrowed with an agreement to repay with interest.

Answer for screen readers

- Book-keeping involves recording financial transactions systematically. 2. A transaction is any financial exchange, e.g., buying goods, paying rent. 3. Golden Rules: Debit the receiver, credit the giver; Debit what comes in, credit what goes out; Debit expenses, credit incomes. 4. a) Personal, b) Nominal, c) Nominal, d) Personal. 5. Capital receipts are non-recurring and contribute to long-term growth, e.g., selling assets, loans taken. 6. Deferred Revenue Expenditures: Development expenses, advertising campaigns. 7. a) Asset, b) Expenditure, c) Income, d) Equity, e) Asset, f) Expenditure. 8. a) Debit Cash, Credit Capital; b) Debit Salary, Credit Bank. 9. a) Revenue, b) Capital. 10. Advantages: Speed, accuracy, easy access. 11. Equity shares give ownership and voting rights; preference shares offer fixed dividends. 12. A loan is a sum borrowed with an agreement to repay with interest.

More Information

Book-keeping is essential for financial accuracy and compliance. Deferred revenue expenses often provide benefits over time, making them important for strategic planning.

Tips

Mixing up account types can lead to incorrect entries. Ensure you understand the nature of the account before categorizing.

Sources

- The Three Golden Rules of Accounting | Examples and More - patriotsoftware.com

- What are the 3 Golden Rules of Accounting: Types & Example - highradius.com

AI-generated content may contain errors. Please verify critical information